Will Stocks Just Correct or Collapse in 2015?

Stock-Markets / Financial Crash Apr 02, 2015 - 05:15 PM GMTBy: Chris_Vermeulen

The question on everybody's mind for 2015 is when will the stock market start to correct in value and will it turn into a 50+% collapse?

The question on everybody's mind for 2015 is when will the stock market start to correct in value and will it turn into a 50+% collapse?

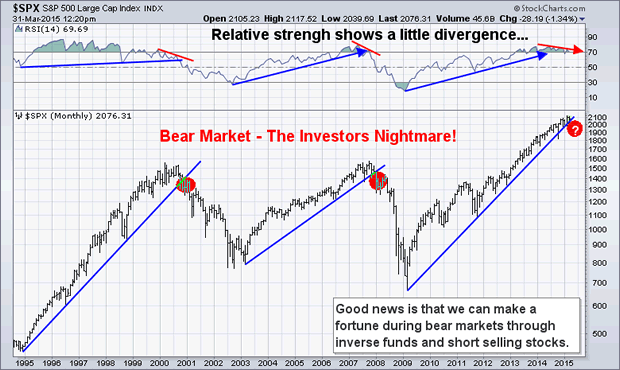

Over the last 15 years investors has been through a lot in terms of market volatility. From the 2000 tech bubble bear market and the 2008 financial crisis bear market investors are far from having their investment psyche scars healing and is for good reason. Many sustained 50+% loss in their portfolio value more than once and are not willing to do it for a third time.

A large group of investors exited the stock market and has never returned. Unfortunately those who exited have missed the seven-year bull market rally to all-time highs. Those who remain in the market are in constant fear that a new bear market will emerge.

The stock market has a tendency to move in a 6 to 8 years cycle. With the current bull market now lasting seven years and was several indicators signaling weakness within the equities market it makes logic sense that a bear market is about to emerge.

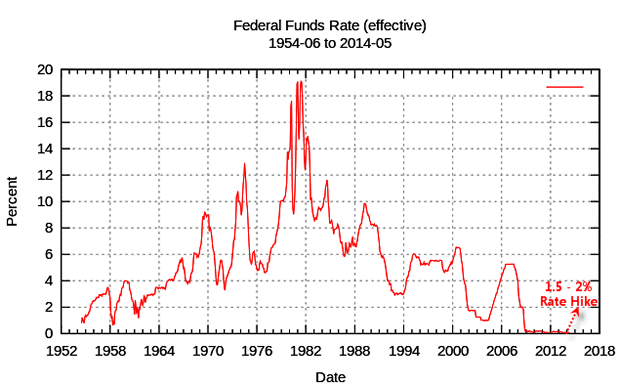

The stock market cycle and technical indicators are not the only causes the trigger a bear market. A rising Fed funds rate can cause weakness in the equities market and if you know what to look for you can escape the next bear market and profit from falling prices.

Question: if you could put your money in a guaranteed investment not to lose any principle and receive a 1% per annum return on investment or receive potentially 7% per year but with no guarantee on your principle, which would you choose?

Most people would choose the 7% return option because they understand financial rewards almost always require some risk. Over the last 90 years the stock market has on average returned 7% annualized gains.

Obviously not all years will have a positive gain, but when averaged over many years, it is reasonable to expect an annual return of 7% from the stock market.

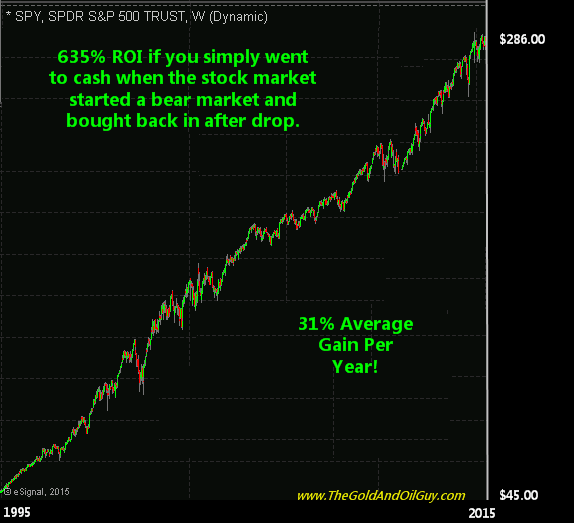

What if I told you there is a way to improve on this? For example, if you simply moved your equity investments to a large cash position at the start of each bear market?

The chart below showing the gain from your would have has from 1995 to 2015 by selling all stock holdings when the US stock market topped during 2000 and 2007 avoiding the last two bear markets.

100% cash position during bear markets would have generated 635% ROI, which is a 31% average annual return. The numbers are staggering to say the least. But obviously you cannot pick the exact top and bottom, but even if your timing was way off and you only pocketed half of those gains you would still be way ahead of game.

You may be asking yourself: How do I avoid a bear market?

I believe for investors this is not that difficult because a major trend change takes time and because the moves are so large you don't need to be perfect with your timing.

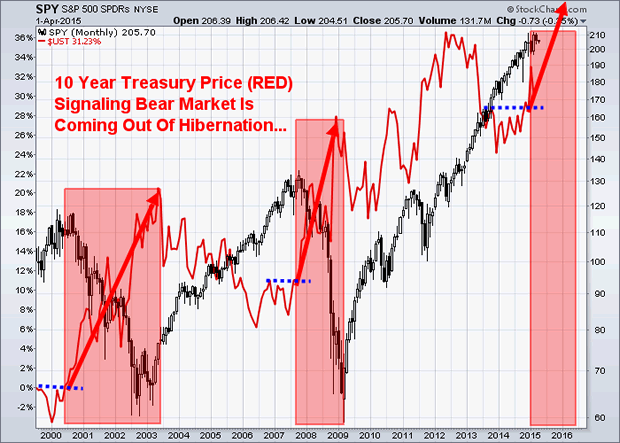

Take a look at my analysis charts below. The first one shows the 10 year treasury price which is broken its short term resistance levels and is rocketing higher. We have seen this happen 6-12 months before the last two bear markets started.

Let's take a look at the Fed rates. Not every rate rise turned into a recession, but nearly everyone has. Rising rates will lead to a market downturn.

Could the next bear market/recession occur when rates start to climb? After analyzing economic data provided by Brad Matheny I have a max rate at 2% over the next couple years.

That combination of technical indicators, analysis above couple with the rising fed rate hikes had created the perfect storm for a bear market to emerge which I expect to last 1-2 years.

Bottom line, we are still in a bull market but only months away from a bear market. Do not ignore these warning signals.

Keep your eye on the 2 year treasury rates instead because they usually lead Fed funds, and will provide an earlier warning signal as to the markets down turn.

When rates start to rise, we may only be weeks, instead of months, before the stock market starts to collapse.

Get My Trade and Investment Alerts Today: www.TheGoldAndOilGuy.com - Limited Time Offer!

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.