Is It Finally Time to Buy Energy Stocks?

Companies / Energy Resources Apr 07, 2015 - 04:45 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: "Why You Can't Buy Oil Stocks – Yet." That was the DailyWealth headline on January 6.

Dr. Steve Sjuggerud writes: "Why You Can't Buy Oil Stocks – Yet." That was the DailyWealth headline on January 6.

I wrote that 90 days ago... Has the picture changed yet for oil stocks?

Is it finally time to buy energy companies yet?

Back in early January, EVERYONE was buying oil companies. Everyone, that is, except me. Here's why I wasn't buying back then:

I hate to disappoint you... but I am NOT buying oil companies – yet.

The reason is simple. Oil stocks are not hated enough – yet.

For the bottom to be here in oil stocks, investors have to give up on them. You want to be a buyer of oil stocks AFTER everyone has given up on them.

The problem is, the opposite is happening... Investors are getting extremely bullish on energy stocks.

So where are we today? Have investors given up? Is it time to buy yet?

In short, we are not there yet... but we are getting close.

Oil is no longer the big story in the financial media (finally!). And investors are finally giving up on oil companies – a bit.

Let me show you one (unique) way to make my point...

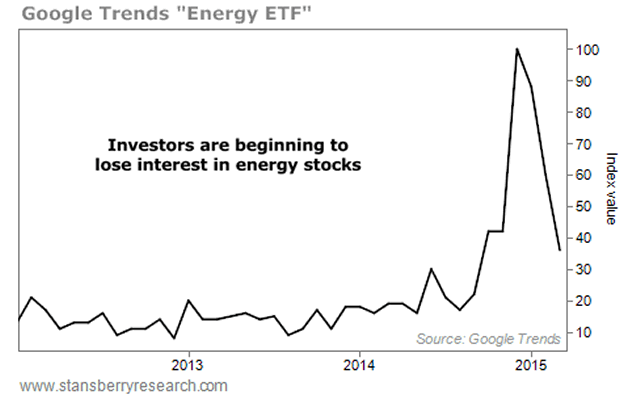

Let's look at the "Google Trends" search results of the term "energy exchange-traded fund (ETF)." (You can see how popular an investment theme is by looking at its Google Trends results.)

In December, Americans searched on Google for the term "energy ETF" more than any time, by far, since the financial crisis. Take a look:

You can also see that interest in energy ETFs has fallen off dramatically since December.

In short, I think that investors have stopped buying energy stocks... but they haven't fully given up on them yet...

Investors haven't sold yet. (One way to see this is to look at the "shares outstanding" of the main energy-stock ETF... The shares outstanding have stopped going up... but they're not going down – yet.)

I look forward to buying energy companies at some point...

There are plenty of positives here... Energy stocks are one of the cheaper sectors in the stock market today. Both oil and oil companies crashed in price, and they may have bottomed. I do like some of what I see.

I am just not a buyer – yet. We haven't seen investors give up enough yet.

When the time comes to buy, I will let you know...

Good investing,

Steve

Editor's note: If you'd like more insight and actionable advice from Dr. Steve Sjuggerud, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the five must-read books on investing. This report will show you several of the DailyWealth team's "must read" books, which will help you become a better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.