US Treasury Curve Steepening Bet Blows Sky High

Interest-Rates / US Bonds Jun 10, 2008 - 01:49 AM GMTBy: Mike_Shedlock

Treasury spreads between the 2 year treasury and the 30 year long bond exploded today. This in and of itself is not unusual. However, the way that it happened today was indeed very unusual.

Treasury spreads between the 2 year treasury and the 30 year long bond exploded today. This in and of itself is not unusual. However, the way that it happened today was indeed very unusual.

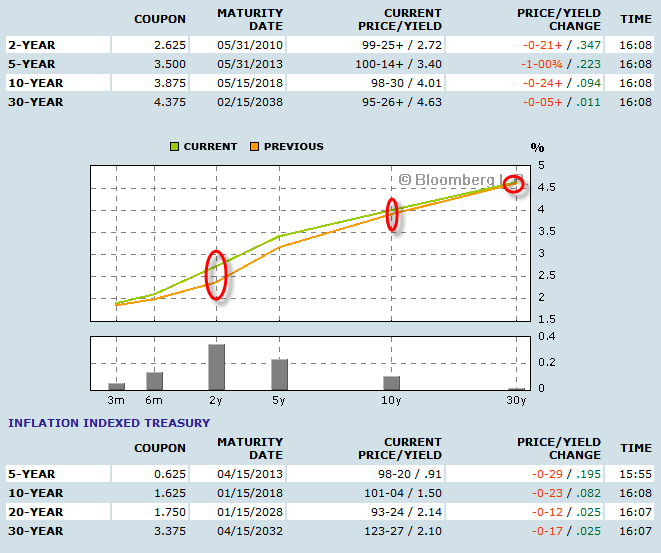

Let's take a look starting with this chart courtesy of Bloomberg .

2's 30's Getting Crunched

Minyanville professor Bennett Sedacca had these comments today.

Perhaps the reason for financials acting like such 'doodoo' is the fact that the 2-year/30-year spread has inverted by 35 basis points today. Not only is the 2 year/30 year spread getting crunched but the same is occurring in 2's/10's which are now 25 basis points on the day.

This is an enormous move.

These types of flattening trades are rare and may mean trouble for banks that borrow short and lend long as if banks need any other troubles. But there could be a hedge fund or two or three off sides as everyone seems to have on the steepener.

Fed funds futures are now pricing in a 41% chance for a 25 basis point hike by October and a 33% chance of a 50 basis point hike.

Just what an over-leveraged economy needs... higher rates.

By " everyone seems to have on the steepener " Sedacca means that in his belief funds were betting that treasury yields would rise more on the long end than the short end. Today, yields on the long bond did not budge and the effect is the yield curve flattened as opposed to steepened.

How Big Was This Move?

Minyanville Professor Jason Goepfert writes:

How big is it? It's in the top 0.5% of all daily moves since 1975. Put another way, it's a four standard deviation event.

Are we going to now be hearing about funds going under that had put on leveraged curve steepeners?

I have strong doubts the Fed is going to hike given that any hikes will add to the wreckage in housing. However, if the Fed does hike, it will be for one reason only: It was forced to by the markets. It sure won't be because of a strengthening economy.

One day does not necessarily prove much, but the fact that there was no selloff in the long bond today in spite of a massive move in the 2's may be telling.

Whatever inflation scare is happening, the long bond sure did not see it today.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.