US Economy Nearing Recession, Dollar Falling Hard

Economics / Recession 2015 May 14, 2015 - 10:47 AM GMTBy: John_Rubino

The dollar soars by a record amount versus the euro and the yen in 2014. And economists predict strong growth in 2015. Really? If a country can have a rapidly-appreciating currency with all the benefits that that confers, and strong economic growth with all the obvious advantages that that confers, why wouldn't everyone be going for powerhouse currencies?

The dollar soars by a record amount versus the euro and the yen in 2014. And economists predict strong growth in 2015. Really? If a country can have a rapidly-appreciating currency with all the benefits that that confers, and strong economic growth with all the obvious advantages that that confers, why wouldn't everyone be going for powerhouse currencies?

Because the two things, a strong currency and accelerating growth, tend to be mutually exclusive in the short run, with a strong currency acting like rising interest rates, slowing growth and making debts harder to service.

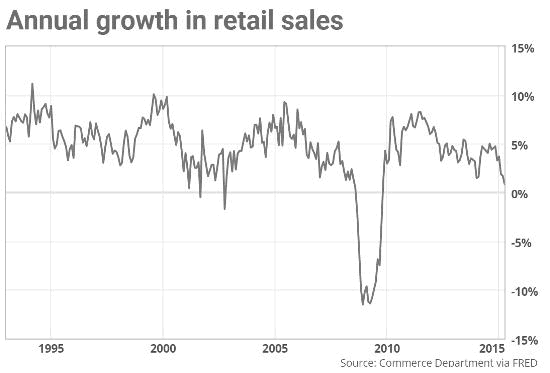

So it shouldn't be a surprise that the latest batch of US numbers are somewhere between disappointing and catastrophic. First-quarter GDP was flat and is about to be revised negative. Retail sales were flat in April, the first month of the second quarter, with business inventories and import prices pointing in the same grind-to-a-halt direction.

The US is now looking at zero growth for the entire first half of 2015. Six years into a recovery, with record low interest rates and a recent doubling of govern ment debt, that's a bit of a dilemma. Especially given the Fed's threat to raise interest rates in the next few months.

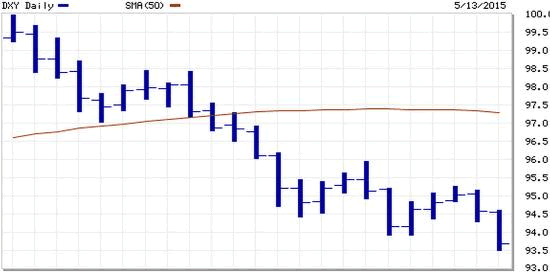

Rates clearly are not going to be raised, at least not on purpose. On the contrary, slow growth always and everywhere leads panicked governments to break out the stimulus. And the dollar is reacting to this prospect exactly as one would expect, by falling like a stone in the past month.

Gold, meanwhile, is acting like the reciprocal of the dollar, adding $30 an ounce in the past two days.

At the risk of excess repetition, the US is obviously losing the currency war and will soon be forced into a new offensive. Negative interest rates, here we come.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.