Imminent Stocks Bear Market Signaled by Dow Theory ...

Stock-Markets / Stocks Bear Market May 27, 2015 - 04:36 PM GMTBy: Clive_Maund

Don't be fooled by the new highs in the flagship US stock indices that are being trumpeted on Wall St as a sign of strength - the internals of the market are terrible and getting worse, and one big sign of impending trouble is the Dow Theory non-confirmation of these new highs by other key indices.

Don't be fooled by the new highs in the flagship US stock indices that are being trumpeted on Wall St as a sign of strength - the internals of the market are terrible and getting worse, and one big sign of impending trouble is the Dow Theory non-confirmation of these new highs by other key indices.

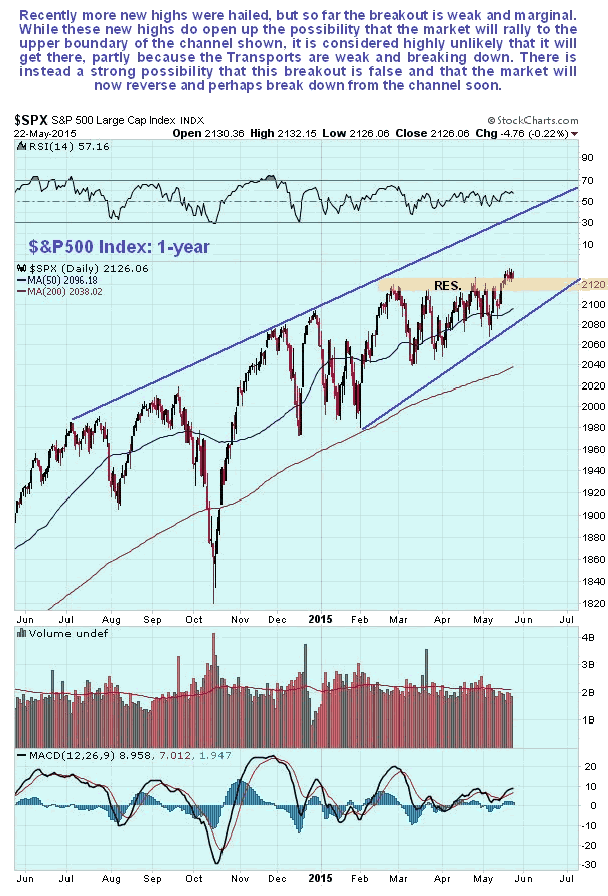

First we will see how the S&P500 looks on its charts before moving on to consideration of other key indices. On the 1-year chart for the S&P500 index we can readily see that the breakout to new highs was marginal, on weak volume, and that the index has made very little progress since late last year - it appears to be rounding over and weakening within an uptrend that is converging, which has bearish implications. The fact that it has made new highs has theoretically opened up the possibility of a run to the upper boundary of the uptrend, which is quite some way above, but other factors that we will come to shortly suggest that it will fall way short of that, and they further suggest that this breakout could be false and be followed by a reversal to the downside anytime now.

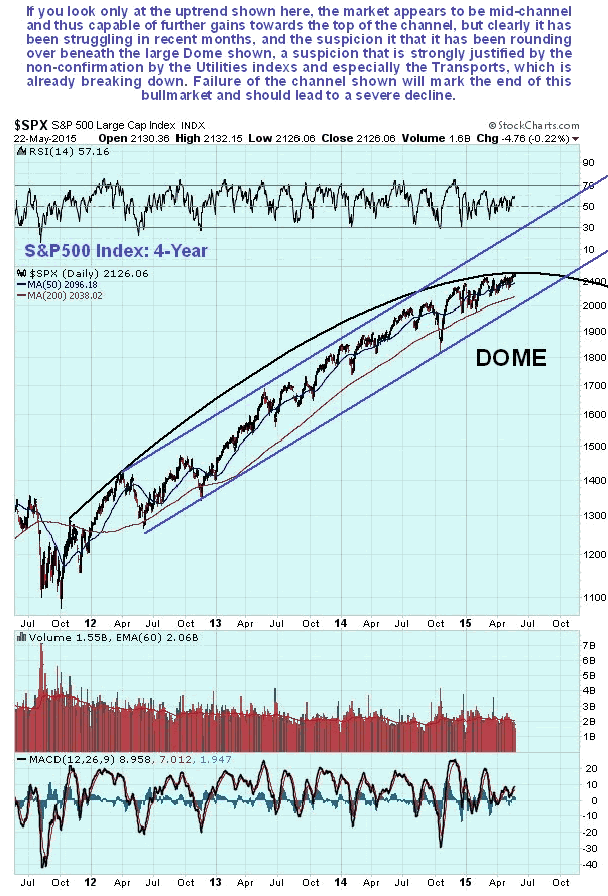

We can get a clearer idea of the big picture on the 4-year chart for the S&P500 index. At first glance the market appears to be in the middle of a parallel channel in force from early 2012 with scope for significant further gains towards the upper boundary of the channel, but in recent months action has been increasingly choppy and it appears to be flagging and rounding over. It is thus very interesting to find that if we draw a parabolic Dome from the start of the uptrend, the index is at the apex of this Dome right now, and if it doesn't negate it soon by breaking clear above it, it will be forced lower by the Dome into a downtrend. That is what Dow Theory and various other indicators suggest is going to happen, and once it breaks down below the lower boundary of the uptrend shown, a severe decline could be in prospect.

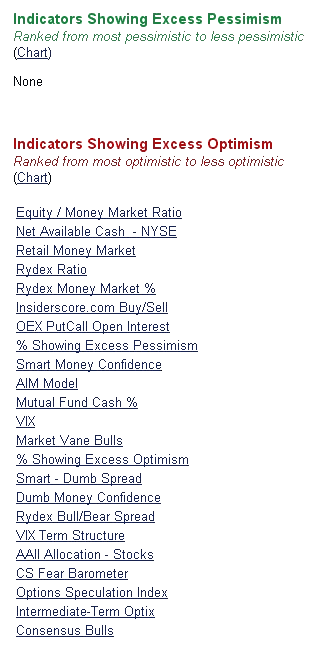

It should thus come as no surprise that all indicators are bearish now...

Table courtesy of www.sentimentrader.com

Now, what about the other major indices that are weak and not confirming the Dow and S&P500 breakout, and thus, according to Dow Theory, calling for an imminent end to this bullmarket?

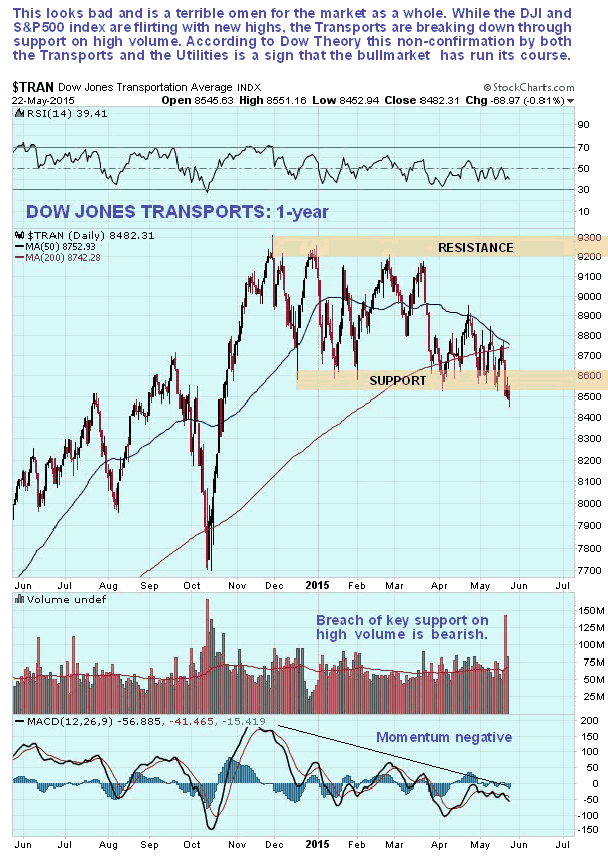

We will start with the Dow Transports, which looks dire. After going into a trading range from late November, it broke down from this range just last week on the highest volume this year, which was a bearish development that calls for it to drop further, and thus for the other flagship indices to follow suit. Momentum for the Transports is weak and swinging negative, as shown by the MACD indicator at the bottom of the chart, and we are about to see a bearish moving average cross, the somewhat luridly named "Death Cross" - this is hardly the stuff of roaring bullmarkets. The Transports are now in position to plunge - and to take the entire market down with it.

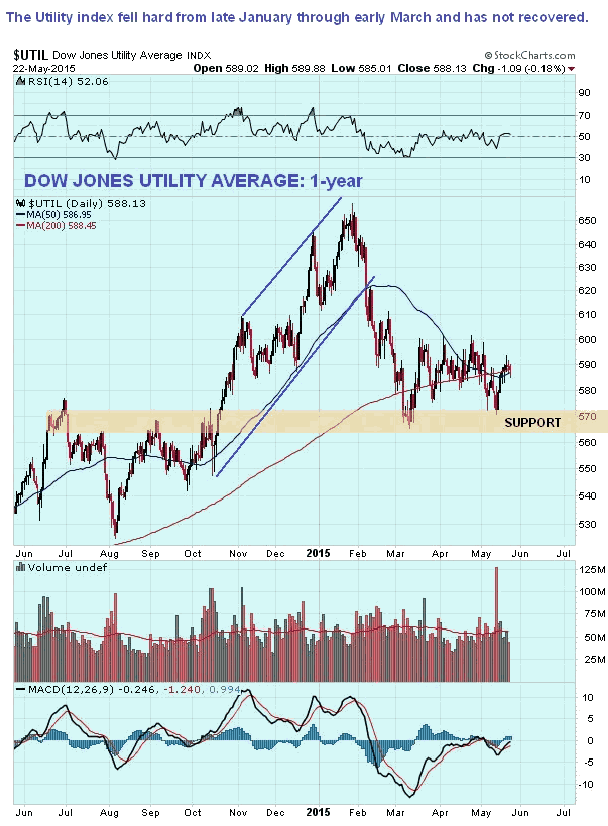

The Dow Jones Utility average is also giving a clear non-confirmation of the new highs in the Dow Jones Industrials and the S&P500 index. It dropped back hard from late February to early March and has not recovered. It has found support in the recent past in the vicinity of its highs in the middle of last year, which has allowed its oversold condition to unwind, but this support looks likely to fail going forward, leading to another steep drop.

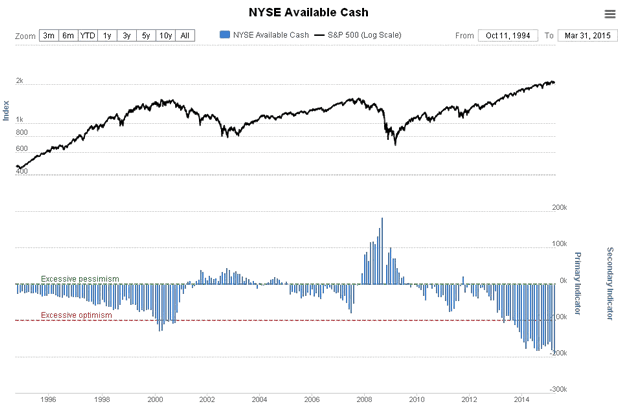

If you ever wanted proof that investors don't learn from history, take a look at the following, which presents the starkest warning possible that we getting very close to something very nasty happening to this market. Don't waste your time telling people who are heavily committed to the market and strongly bullish about this - they don't want to know and will simply ignore you, or attempt to counter with some vacuous "this time it's different" tale. Look after Number One and let these fools learn the hard way...

Chart courtesy of www.sentimentrader.com

Several points to note regarding this chart. The data is reported late and so is a little out of date - so it could be even worse now. Extreme readings tend to precede major reversal by a few months. The situation is far more extreme than it was before the 2008 crash.

Conclusion: according to Dow Theory the bullmarket in US stocks has run its course and it won't be long before it breaks down into a bearmarket, that is likely to be severe. A catalyst for this could be a collapse in the bond markets. There is no logical reason for investors to hold bonds - they yield nothing and carry an increasing risk of severe capital depreciation, because most governments are either insolvent or fast heading in that direction, which means that they can't and won't honor their debts. If we see a collective realization of this reality by bond holders, which could happen at any time, we could quickly witness an ugly stampede for the exits leading to a dramatic spike in interest rates and a global market crash. We have already seen a convulsion in the bond markets in recent weeks, which is viewed as "a shot across the bows" - a warning of much worse to come.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.