Energy Sector Strong Bullish Trends Due to Demand Growth Fundamentals

Commodities / Energy Resources Jun 18, 2008 - 12:59 PM GMTBy: Joseph_Dancy

The price of crude oil hovered around $100 a barrel last month, while natural gas futures pushed toward $10 per thousand cubic feet. Both are impressive due to the fact we are in ‘shoulder season' – a time when moderating weather tends to weaken prices. Long term demand and supply trends remain powerfully bullish. Last month the following events occurred in the energy sector:

The price of crude oil hovered around $100 a barrel last month, while natural gas futures pushed toward $10 per thousand cubic feet. Both are impressive due to the fact we are in ‘shoulder season' – a time when moderating weather tends to weaken prices. Long term demand and supply trends remain powerfully bullish. Last month the following events occurred in the energy sector:

- The International Energy Agency updated their 2008 energy forecast. They project world oil demand would grow by 1.7 million barrels per day (b/d), up from 0.9 million b/d in 2007. The IEA projected demand would average 87.5 million b/d in 2008 – a record. The agency noted that transport fuel demand in China remained “very strong”. Year-on-year imports of crude oil to China increased more than 12% in 2007, and the trend continues into 2008. (Financial Times)

- A UBS report compiled a roster of major crude oil projects – those with expected production of more than 100,000 barrels a day – due to come on stream through 2015. With rising demand, plus declining production from existing fields, the industry needs to add at least 4.5 million barrels a day of new supply each year. But relying on major projects won't meet that target according to UBS. In the current year the analysts estimate new supply sources will produce 4.4 million barrels a day, but that figure drops to 2.9 million in 2009 and a paltry 1.7 million in 2010.

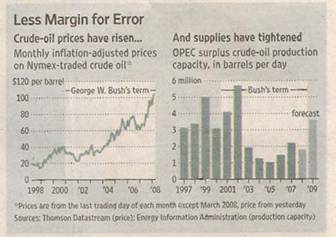

•  The Wall Street Journal had an interesting chart last month which illustrated the trends in excess crude oil production capacity from the OPEC countries. As demand rockets upward – demand is estimated to increase 1.7 million barrels per day in 2008 – the excess productive capacity has fallen to around 1.8 million barrels per day. The lack of excess capacity supports the higher global oil prices we have seen the last few years. (see chart above)

The Wall Street Journal had an interesting chart last month which illustrated the trends in excess crude oil production capacity from the OPEC countries. As demand rockets upward – demand is estimated to increase 1.7 million barrels per day in 2008 – the excess productive capacity has fallen to around 1.8 million barrels per day. The lack of excess capacity supports the higher global oil prices we have seen the last few years. (see chart above)

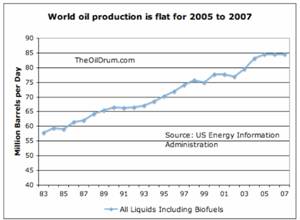

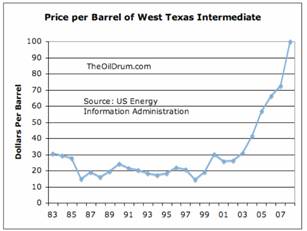

•  Two interesting charts were published by Gail Tverberg on the OilDrum.com last month. They illustrate the trend in crude oil prices to much higher levels – while at the same time global production seems to have leveled off. If production does not increase, expect prices to continue to trend upward.

Two interesting charts were published by Gail Tverberg on the OilDrum.com last month. They illustrate the trend in crude oil prices to much higher levels – while at the same time global production seems to have leveled off. If production does not increase, expect prices to continue to trend upward.

- Oil and natural gas discoveries in the Gulf of Mexico hit a 10-year low in 2007. According to Wood Mackenzie, a research firm, companies found the equivalent of 553 million barrels of oil in the Gulf last year, half as much as in 2006 and the lowest figure in a decade. The number of exploration wells drilled in 2007 was also down and close to the 10-year-low. The Gulf of Mexico will continue to be a huge source of energy as it accounts for 25 percent of U.S. oil production and 15 percent of natural gas production. ( Houston Chronicle)

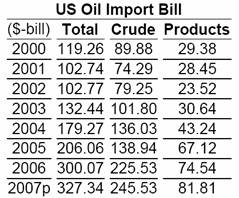

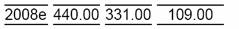

- The oil import bill for the U.S. has skyrocketed 300% since 2002. The oil import bill in 2007 was $327 billion. It should easily top $440 billion this year. The projected increase for 2008 is based on an average $90 per barrel. In 2002, before the current bull market for oil began, U.S. oil imports cost less than $103 billion. (Petroleum Intelligence Weekly)

• The recent run-up in U.S. natural gas prices can be partially attributed to the low level of liquefied natural gas (LNG) imports into the Lower 48 States according to the U.S. Energy Information Administration (EIA). LNG cargoes have been heading to Europe and Asia , where buyers continue to purchase LNG at much higher prices than have prevailed in U.S. markets. The reduction in imports to the U.S. reflects changes in global demand for LNG. Japan , the world's largest LNG importer, is relying more on LNG as a fuel for electric power generation. Some countries in Asia and Europe rely on LNG imports as a primary source of natural gas.

- China 's only LNG facility may double purchases of individual liquefied natural gas in 2008 according to official sources. The terminal bought seven individual cargoes for immediate delivery last year. The company is in talks to buy additional LNG on multiyear terms as it increases import terminal capacity. Utilities in Japan and South Korea paid as much as $20 per million British thermal units this winter, more than double the U.S. benchmark price at Henry Hub, Louisiana .

- Ocean shipping regulators and industry participants are debating how to reduce harmful sulfur dioxide emissions from their ships. Part of the industry, led by an independent tanker owners' organization, advocates a total ban on high-sulfur marine fuels in favor of lower sulfur diesel fuels. The International Maritime Organization (IMO), the UN agency responsible for preventing pollution from ships, will consider the controversial fuel proposal. The switch to diesel at sea would increase global demand for that fuel by the equivalent of one-and-a-half times the annual automotive diesel consumption in Europe .

- China 's fast-growing economy adds one coal generating plant a week. With raw-materials prices rising and the global economy slowing, what has surprised some analysts is how insatiable the appetite for energy is—and the implications that has for the rest of the world. China 's nuclear power sector is also growing faster than expected. The Chinese government is now shooting for 50% more nuclear power than originally planned, with generation capacity coming very close to the output of France . In France this level of generation equates to 80% of the nation's electricity supply; the same amount in China would meet roughly 4% of demand. What this demand will do to global uranium prices, which have already gone vertical in the last five years, is anybody's guess.

- China 's leaders are facing renewed pressure over shortfalls in diesel and gasoline, with lines growing at filling stations in major cities as the gap widens between international crude oil values and centrally controlled fuel prices. The shortages, first reported in southern and inland China , appeared to be spreading to the wealthier coastal areas as filling stations struggled to get shipments from refiners. More imports might be required to address these shortages.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.