The U.S. Dollar's 2014-2015 Rally: Wave 3 in Action

Currencies / US Dollar Jul 03, 2015 - 02:36 PM GMTBy: EWI

An excerpt from our free 14-page report shows you how the Elliott Wave Principle can "Boost Your Forex Success"

I always say trading forex markets is like riding a bike -- except that said bike has one flat tire and the ground beneath it is covered in ice.

So why are they so popular, you might ask? In fact, forex is the most liquid market on earth, where trillions of dollars change millions of hands every day.

The reason people are so willing to ride that bike -- so to speak -- is because if you can stay on, the rewards are often unmatched. The trick, of course, is staying on.

There's no such thing as a fool-proof strategy. Slips and scrapes are bound to happen. But as the title of Elliott Wave International's chief currency strategist Jim Martens' go-to guide reveals, there is definitely a way "The Elliott Wave Principle Can Boost Your Forex Success."

Here below, you can read an exclusive excerpt from Chapter 1:

Chapter 1: A Useful Trading Methodology

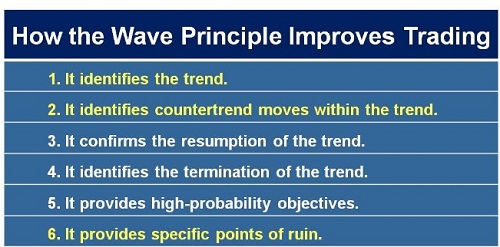

Of the many ways the Wave Principle can improve trading success, for me, points 1, 2, and 6 are the most important. I like to trade with the trend, and the Wave Principle allows me to identify that trend...

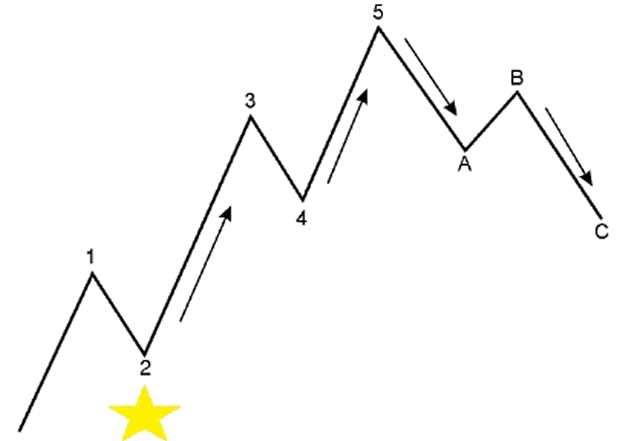

The setup waves -- the waves we're trying to identify in order to prepare for the trading opportunities -- are wave (2), wave (4), and wave (B)...

Let's concentrate on trading wave (3), since it is usually the strongest and longest wave, and its trend is clear. That means that we want to identify the wave (2) that will lead into a strong third wave.

Now, let's jump off the page and into the real world where you can see exactly how Jim used this one simple lesson to identify a major turning point in euro/dollar (EURUSD).

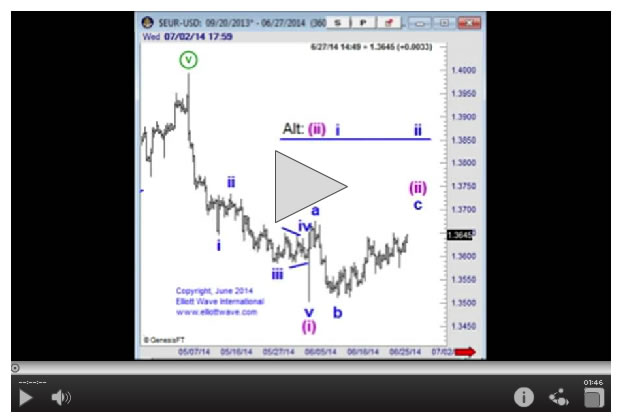

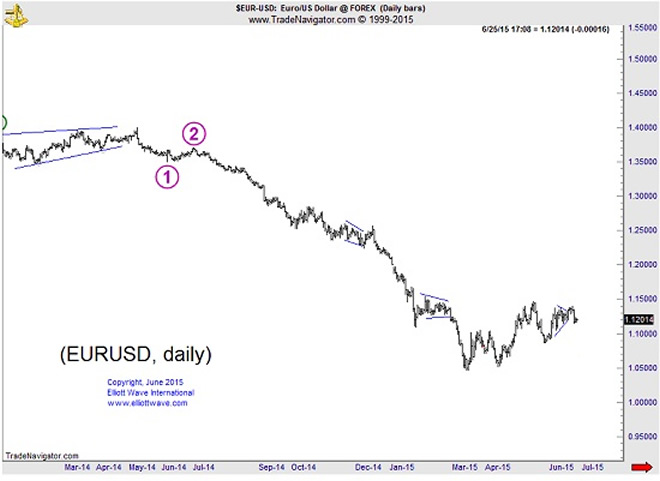

The time was mid-2014. The euro was orbiting a 2-and-1/2 year high against the U.S. dollar. But, as early as mid-May, Elliott wave patterns already showed cracks in the euro's bullish case. And on June 27, Jim recorded an urgent video for his Currency Pro Service subscribers in which he warned the buck's luck was about to change.

You can listen to a clip from Jim's June 27, 2014 Currency Pro Service video right here. Note the basis for Jim's dramatic forecast -- an imminent third wave.

Soon after, the EURUSD followed its Elliott wave script. The third wave initiated the market's largest annual decline since 2005 and pushed the U.S. dollar to its highest level in 12 years.

Riding forex "bike" isn't easy. But right now, you can utilize the "training wheels" of Jim Martens' enduring classic "How to Use the Wave Principle to Boost Your Forex Success" -- free. With 14-pages of original analysis, detailed charts, and timeless trading examples, this report is a must-have for every serious trader in not just currencies, but every single financial market.

The best part is, the entire report is available at the incredible discount price of $0.00! Yes, you read that right. Jim's "How to Use the Wave Principle to Boost Your Forex Success" is ready to view as soon as you become a free Club EWI member, a 325,000 member-strong online community of your fellow Elliott wave fans.

For newbies, click here and follow the fast steps to joining the rapidly-growing Club EWI.

If you're already a Club EWI member, click here to instantly download your copy of Jim Martens' "How to Use the Wave Principle to Boost Your Forex Success" (.pdf)

This article was syndicated by Elliott Wave International and was originally published under the headline The U.S. Dollar's 2014-2015 Rally: Wave 3 in Action. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.