Dow Stocks Bear Market Underway

Stock-Markets / Stocks Bear Market Jul 06, 2015 - 05:48 PM GMTBy: Austin_Galt

The final high to the Dow's bull market was put in on the 20th May 2015 at 18351. This was outlined in client analysis the following day titled Dow Final High. For those following the continuous intraday charts, there was a clear bearish double top around 18350. It is my expectation that a bear market is now underway. I don't wait for any mainstream nonsense that requires a 20% fall. I leave that stuff for the fools.

The final high to the Dow's bull market was put in on the 20th May 2015 at 18351. This was outlined in client analysis the following day titled Dow Final High. For those following the continuous intraday charts, there was a clear bearish double top around 18350. It is my expectation that a bear market is now underway. I don't wait for any mainstream nonsense that requires a 20% fall. I leave that stuff for the fools.

In client analysis last Friday, titled Dow Weak Weekly Close, I suggested the Greeks would vote NO in their referendum as my view of the technicals led me to believe there would be some follow through to the downside based on the weak weekly close. Bollocks, some may say! Well, it ain't the first time I've predicted what a fundamental announcement will be based on my view of the technicals.

So, while I believe the bear market is underway, there should be one last chance to get short or close longs. Let's take a look at that using the daily and weekly charts.

Firstly let's look at the daily chart to see the topping pattern we were following and what the expectations are going forward.

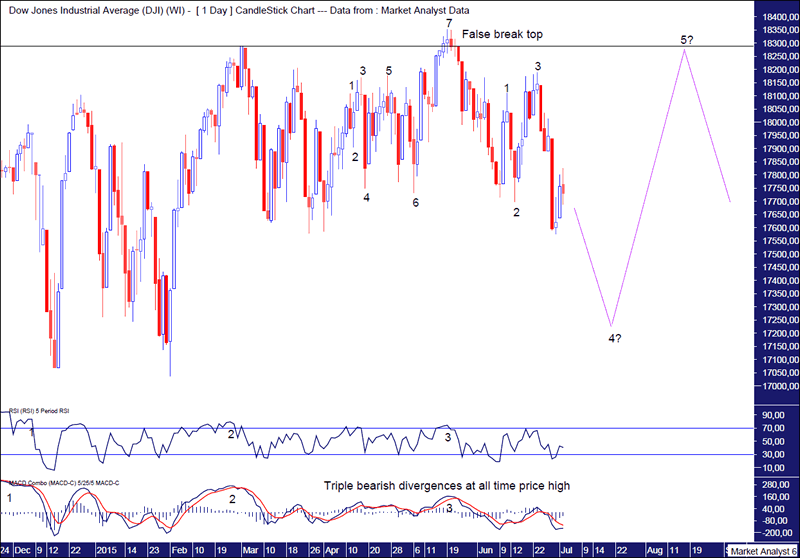

Dow Daily Chart

We can see there was a 7 point broadening top that brought in the final high denoted by the numbers 1 to 7. We were following this right from the start. No need for confusing Elliott Wave nonsense here - just an understanding of market psychology which helps to identify the pattern.

I have drawn a horizontal line denoting the previous swing high set in March 2015 high. We can see the all time high clipped this level before turning back down impulsively and creating the false break top.

The all time high was accompanied by triple bearish divergences in both the RSI and MACD indicator. I always like to see at least one bearish divergence at important highs and a triple often leads to a significant decline.

Going forward I still believe there is a major secondary high still to be seen. While a 7 point broadening top brought in the all time high, it is my belief that a 5 point broadening top will bring in the secondary high. Price looks to still be tracing out its way to the point 4 low. I expect the point 5 and major secondary high to be back up near the March 2015 high.

To get a better grip on the price action going forward, let's move on to the weekly chart.

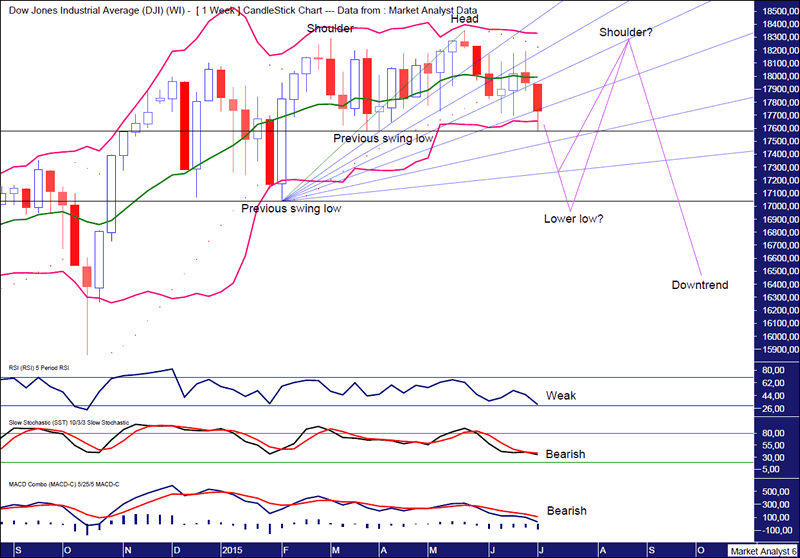

Dow Weekly Chart

This analysis is from last Friday's article, titled Dow Weak Weekly Close, which does not include today's trading which is still unfinished. But the outlook remains the same. Let's run through it.

The PSAR indicator is bearish with the dots above price.

The Bollinger Bands show price is back at the lower band. Price bounced somewhat off this support but looking at the weekly candle it doesn't look very solid. I think price can now head a bit lower as it clings to the lower band.

I was looking for the weekly candle to be much less bearish and even positive. This didn't happen and when things don't play out as expected I go back to the chart to reanalyse the situation.

Upon reanalysing the technicals, the first thing that stood out were the lower indicators which are all looking decidedly negative. The RSI is trending down and looking weak while both the Stochastic and MACD indicators are bearish.

Taking this all into consideration, I now believe price is headed further down before rallying back up.

I have drawn two horizontal lines denoting previous swing lows at 17579 and 17037.I now expect the next low to be well below the upper horizontal line and perhaps even below the lower horizontal line.

I have drawn a Fibonacci Fan from the lower swing low to all time high and one possibility si price finds support at the 88.6% level.

I still expect a rally back up to at least 18250 and this may well set up a head and shoulders top with the March 2015 high at 18288 the first shoulder and the all time high at 18351 the head.

As for some timing, there is often a period of accumulation and distribution after a major high lasting around 3 months. The all time high occurred on the 19th May 2015 so a potential timing target for secondary high would be mid to late August 2015.

Summing up, I believe the Dow's bear market to be underway with a major secondary high still to come.

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2015 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.