Why Emerging Markets Are So Volatile

Stock-Markets / Emerging Markets Jun 22, 2008 - 04:20 PM GMTBy: Richard_Shaw

We are sometimes asked why emerging markets are so much more volatile than developed markets. The answer is that, due to their relative size , money flows between them cause most of the volatility effect.

We are sometimes asked why emerging markets are so much more volatile than developed markets. The answer is that, due to their relative size , money flows between them cause most of the volatility effect.

Consider a real world situation that most of us have seen — a stream emptying in to a pond and another stream at the the other end of the pond draining the overflow.

Think of the streams as the emerging markets and the pond as the developed markets. Think of the water as money.

The water in the stream feeding the pond moves quickly. When the water enters the pond, it slows as it spreads out in the breadth and depth of the pond. When the water enters the stream draining the pond overflow, it moves quickly again.

The streams are narrow and shallow by comparison to the pond, which is broad and deep. Any fixed amount of water moving through the streams must move more quickly than the same amount of water moving through the pond between the two streams.

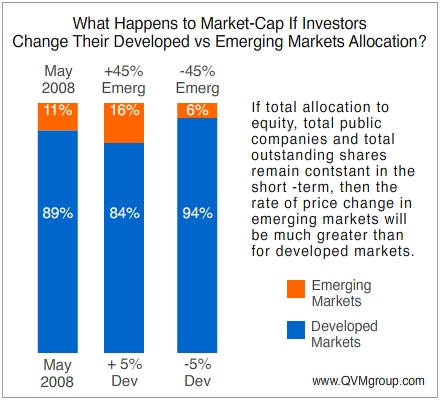

Today, the developed markets free-float (represented collectively by VTI, EWC and EFA) is about nine times the size of the emerging markets free-float (represented by VWO). Within the total equity allocation of all investors, an increase or decrease in the developed markets allocation will show up as a magnified opposite change in the emerging markets allocation.

If investors decreased their current 89% developed markets allocation to an 88% allocation (a minimal change), the emerging markets would change from 11% to 12% (a substantial change). The inverse changes are similarly minimal for developed markets and substantial for emerging markets.

The comparatively minimal nature of the developed markets changes create only minimal supply-demand pressure between money and shares, whereas the comparatively substantial nature of the corresponding emerging market changes create substantial supply-demand pressure between money and shares.

The greater the supply-demand pressure, the greater the degree of price change.

Considering the current 9:1 developed-to-emerging markets ratio, if the current bear market causes collective investors to become more risk averse and to significantly reduce their emerging markets exposure in favor of developed markets, the emerging markets would be crushed.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.