The Stocks Bear Market Everyone Saw Coming

Stock-Markets / Stocks Bear Market Sep 04, 2015 - 01:11 PM GMTBy: Gary_Tanashian

The title lets you know where this article is going. For such a routine correction in the US stock market, the Psych/Sentiment backdrop has gotten way out of whack. Do some analysis on Rydex Bull/Bear fund allocations among investors and you will find a historic knee jerk reaction into bear funds over bull funds (by those who still use Rydex funds).

The title lets you know where this article is going. For such a routine correction in the US stock market, the Psych/Sentiment backdrop has gotten way out of whack. Do some analysis on Rydex Bull/Bear fund allocations among investors and you will find a historic knee jerk reaction into bear funds over bull funds (by those who still use Rydex funds).

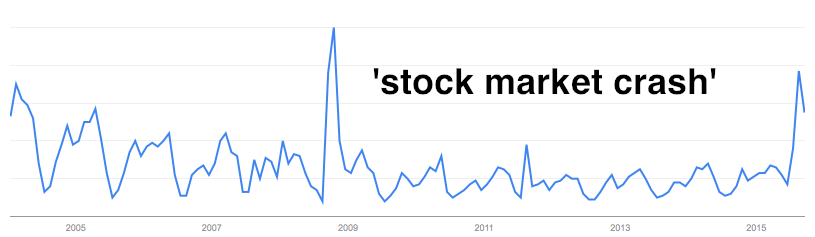

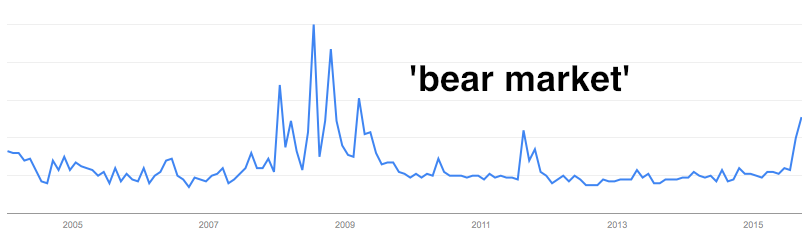

Go do a Google Trends search on ‘stock market crash’ or ‘bear market’ and you get the following results, showing a big rise in interest among the public.

By way of Bespoke, we have the Drudge indicator and it is contrarian bullish for the market, as the stock market’s routine correction has made front page news.

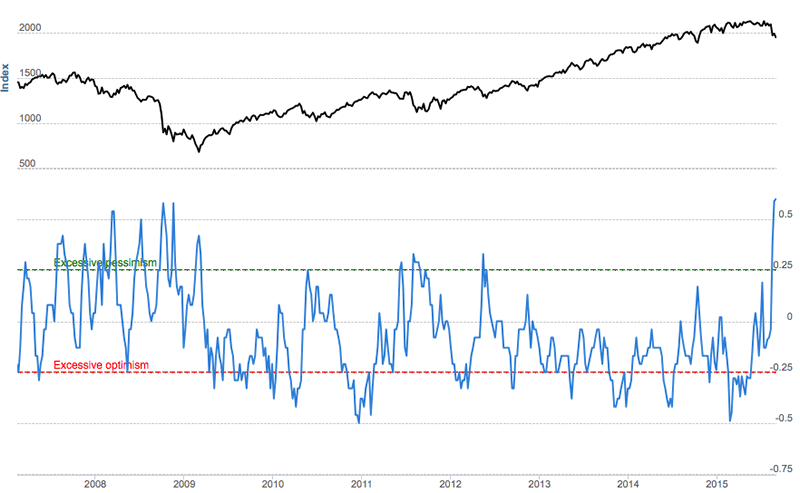

Finally, from Sentimentrader.com, where I get my best sentiment data on a weekly basis, have a look at the spread between what is normally thought to be ‘smart’ money and ‘dumb’ money. This is unsustainable bearishness for such routine market correction.

In NFTRH‘s proprietary updates we are managing this correction with no need to define whether it is just a correction or something more. It has already registered our ‘healthy’ correction parameters, although a retest of the lows is very possible if not likely.

We have been operating to a plan, which is playing out well. Using the S&P 500 as the example index, we anticipated a breakout (likely down) from the nose of a Diamond consolidation pattern and a loss of the daily MA’s 50 and 200. Check.

We then noted the first support level at around 1975, from which a bounce could occur before an eventual new decline to test the October lows. Well, the market had other ideas and took the express elevator right to that test.

We then planned for a bullish bounce with an A-B-C upward correction ‘bounce’ plan. The first target was back to 1975 (former support). Check. From there we were very open to a further rise to resistance at 2040, pending ‘B’ down, which may have occurred earlier this week. Now, considering the sentiment backdrop, the case for a continued bounce is only strengthened.

Yet from the correction’s beginning we have refused to call it anything other than just that, a correction, because while cycles and our own indicators (like the Gold-CRB and Palladium-Gold ratios) have called for a cyclical turn, the market was still in an uptrend (higher major highs and lows) and that is the ultimate decider on bull or bear markets. Hence, the October lows are critical.

It is entirely possible that cyclical indicator Palladium-Gold for example, foresaw the down cycle from a global view, focusing on China. It and its fellow indicators (Equity Pull/Call trends chief among them) certainly had us well prepared for the current market disturbance.

Yet here we are, with the services-heavy US economy still okay (with certain non-services areas, like Machine Tools struggling), its stock stock market in correction and everybody on the bearish side of the boat. Were these indicators simply forecasting a big bearish sentiment lurch that could ultimately reset the bull market?

The current backdrop reminds me of the day in late 2012 when my brother in law, a financial adviser, told me that the “best and brightest” fund managers were raising cash in anticipation of a December crash that would be induced by the fallout from the Congressional Fiscal Cliff squabble. My in-eloquent but to the point response? “Bullish”.

It is beyond the scope of this article to lay out detailed road maps for what I think is in play. We do that routinely in the weekly report and in-week by updates. It is also beyond the scope of this article to speculate about what the bullish acceleratant could be if indeed this contrarian setup plays out for a bull market resumption.

But it is within the scope of this article to ask you to have an open mind because a hell of a lot of people do not right now. They are very closed minded to the bull side of the boat and this is a crew that is not usually correct in such situations.

None of this precludes further bear activity beyond the current market bounce. These are the markets after all, and they do not get where they are going in a straight line. What we can state is that the sentiment backdrop supports the bulls, not the bears at this time.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.