EU Referendum - Assessing Britain's Ties to the Europe Union

ElectionOracle / EU_Referendum Sep 08, 2015 - 10:17 AM GMTBy: STRATFOR

Mark Fleming-Williams writes: At some point in the next two years, British voters will decide whether to remain a part of the European Union. This will be the first time Britons have been consulted on the subject since 1975, when 67 percent voted to stay in. If it does decide to leave, the United Kingdom will become the first country to leave the European Union since it was created as the European Community in 1957. The repercussions would be felt not just in Britain, but also across the Continent and indeed across the world. To predict the eventual result of the vote, it is first important to understand the factors that have kept the United Kingdom in the union this long.

Mark Fleming-Williams writes: At some point in the next two years, British voters will decide whether to remain a part of the European Union. This will be the first time Britons have been consulted on the subject since 1975, when 67 percent voted to stay in. If it does decide to leave, the United Kingdom will become the first country to leave the European Union since it was created as the European Community in 1957. The repercussions would be felt not just in Britain, but also across the Continent and indeed across the world. To predict the eventual result of the vote, it is first important to understand the factors that have kept the United Kingdom in the union this long.

The story starts with geography. Britain is a relatively small island situated off a large but historically divided continent. It is narrow, with navigable rivers, natural resources and fertile land. These factors have various implications for the country's development. As an island with narrow dimensions, the coast is always nearby, making a large portion of the population maritime. Add an ample supply of wood, and conditions are ripe for the construction of a strong navy. The fertile soil allows for a stable population, while resources such as coal, metals and sheep (for wool), along with navigable rivers, provide propitious circumstances for international trade. From the United Kingdom's perspective, the divisions in the Continent both reduced its threats — limiting Continental powers' ability to build a navy strong enough to invade — and increased its opportunities as British traders found ways to insert themselves between countries that were often at war. Thus, once the island's basic needs of safety and nourishment were satisfied, Britain's geography enabled it to flourish as a maritime trading power.

Changing British Fortunes

The 19th-century historian John Seeley described Britain as having acquired its empire in a "fit of absence of mind." Britain's merchants led it to conquer the world. Thriving wool trade was eventually superseded by the arrival of cotton, and it became important for Britain's textiles industry to have sources of the material in warmer climes. This need, along with the promise of other exotic trade goods, drove it to establish trading posts and colonies in the Caribbean and North America. The ever-strengthening navy provided more opportunities further afield, and trading stations in India and Asia also grew, feeding an ever more rapacious British consumer. The British had to counter threats from local groups or competing European powers, and ultimately it became more economically viable for Britain to just take control of whole countries to protect trade. This expansion repeated again and again, and by the start of the 20th century the British Empire covered 22 percent of the world's land mass. Control, of course, also enabled the United Kingdom to keep trade weighted in its favor — a factor that undermined its industrial competitiveness. But the twin requirements inherent in Britain's geography led to the empire's ultimate demise; when Germany threatened to unite the European continent and develop an empire of its own, British interests were endangered both at home and abroad. The result was two world wars that exhausted the trading empire and effectively ceded global domination to the up-and-coming United States.

The United Kingdom that emerged in 1945 was a shadow of its former self. The remains of its empire dropped off in the following decades, and it found it was unable to keep up its former trading prowess. In fact, the amount of sterling held around the world by its former colonies was a great burden on the faded British economy, depreciating the currency strongly. The United Kingdom had to institute exchange controls in 1947. Manufacturing in northern England was now exposed as uncompetitive in the global market, as were the great shipbuilding cities on the coasts. Moreover, the population had grown so much in the previous 150 years that the island now needed to import half of its food. Doing so was affordable in the days of empire, but now the United Kingdom struggled to pay with its depleted finances.

Meanwhile, Europe was suppressing its divisions and uniting under Franco-German leadership, with the only consolation for the United Kingdom being that the new bloc did not appear hostile. Confronted with the danger of losing all influence on the Continent, and with abundant French and Italian food supplies offering an answer to many problems, Britain joined up in 1973, in the process erecting trade barriers against the rest of the world, including all of its former colonies. London's slow realization of its new circumstances and France's veto of two British applications in the 1960s — mainly because of uncertainty over whether the United Kingdom would be a productive member — delayed Britain from joining sooner.

The Financial Advantages of Membership

Being a part of the European Union (originally the European Community) was always a challenge for the United Kingdom. Not having joined at the bloc's creation, London found the rules weighted against it. French and Italian agriculture benefitted from the subsidies of the Common Agricultural Policy, and Germany's industrial efficiency challenged Britain's waning manufacturing industries. It was not until the 1980s, when Britain traded in its veto power for the creation of a single market in financial services, and achieved a rebate for its excess payments, that the economic advantages truly emerged.

London, the epicenter of British finance, had been suffering like the rest of the country after the war. It fell far behind New York on the global stage with the U.S. dollar's ascension as the global reserve currency at the expense of the British pound. But a massive liberalization program in the 1980s, partly touched off by the removal of exchange controls in 1979, complemented investment access to the European market. It allowed London to reclaim its place as the home of international finance in the following decades (a large portion of New York's transactions are domestic), even after the United Kingdom chose to stay out of the eurozone in 1992.

London currently generates 22 percent of the United Kingdom's gross domestic product with just 13 percent of the country's population. In the services trade, of which financial and business services make up 55 percent, the United Kingdom is now second only to the United States, and with its goods trade so depleted, the entire country now relies on the sector as its source of foreign capital. The British navy is no longer an influential force in the world, but the country's trading instincts persist, facilitating transactions from the comfort of its own home.

The Benefits of Remaining an EU Member

The financial services sector, then, is the life raft that emerged from the sinking empire. These are the interests that the United Kingdom must protect if it is to preserve any semblance of its great power status. Knowing this, it is now possible to approach the broader question of whether the United Kingdom's interests are better served by staying in the European Union or by leaving it.

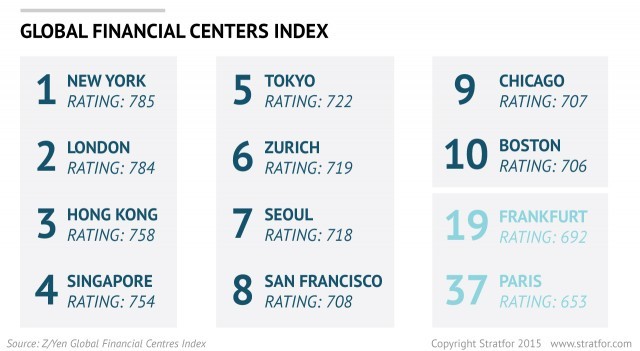

A recent episode provides a clue. In March, the United Kingdom won a court case against the European Central Bank at the European Court of Justice. The ECB had been attempting to move the clearing function for eurozone transactions within the monetary union itself. The move would have excluded London and made Paris and Frankfurt significantly more attractive as financial centers, endangering London's position in Europe's financial services sector. The court case victory was an example of the benefits of retaining influence in the European Union. In 2013, 41 percent of Britain's financial services exports went to EU countries. If the United Kingdom were to leave the European Union, it seems likely that tariffs would be raised and actions taken to encourage this trade to move back into the bloc.

Of course, opportunities do exist outside the European Union. London has been pursuing the nascent Islamic finance market, in which it is the number one Western trading location, and it also plays host to two-thirds of all yuan transactions that take place outside Hong Kong and China. Historical links, similar legal systems and language similarities will all play their part in creating opportunities for the United Kingdom in former colonies — many of which are projected to be among the world's fastest-growing economies — in the decades to come. However, in Asia, British inevitably will confront the strong hubs of Hong Kong and Singapore, while in the Americas, New York will continue to be a strong adversary. Europe represents a domestic market, which gives the United Kingdom global clout — and not only in financial services. Thus the risks of departure are stark, and the opportunities do not outweigh them.

In the coming months, British Prime Minister David Cameron will attempt to negotiate more favorable terms for the United Kingdom in Europe. His wish list will include restrictions of future immigration, attempts to regain some of the sovereignty Britain has given up, exemptions from the trajectory leading toward the United Kingdom losing its independence and assurances over Britain's continuing access to the single market in financial services. Europe does not want to see Britain leave either. Britain gives Europe military depth and direct access to the United States, and serves as a balance between Germany and France. So Cameron will have some bargaining power and may be able to make some progress in achieving these goals, or he may return with cosmetic results as did Prime Minister Harold Wilson in 1975. The British public could welcome any gains that are achieved, or disapprove of a perceived lack of results, but it will not affect the United Kingdom's final decision. Britain is a trading nation that has always been led by its economic considerations, and right now, remaining in the European Union fits with Britain's interests.

"Britain's Status as a Trading Nation Ties It to Europe is republished with permission of Stratfor."

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2015 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.