Gold and Gold Stocks Bull Trap or Bottom in?

Commodities / Gold and Silver Stocks 2015 Sep 19, 2015 - 12:24 PM GMTBy: Jordan_Roy_Byrne

As we know, Gold and gold mining stocks have been trapped in a bear market that has been severe in both price and duration. It is seemingly a "forever" bear market as rebounds and recoveries have been followed by lower prices and more devastation. The Fed-induced strength of this week is giving bulls some hope. For the bulls, this strength needs to be duplicated in the weeks ahead or it would be another false alarm. While a new bull market is inevitable, we do not see it as imminent.

As we know, Gold and gold mining stocks have been trapped in a bear market that has been severe in both price and duration. It is seemingly a "forever" bear market as rebounds and recoveries have been followed by lower prices and more devastation. The Fed-induced strength of this week is giving bulls some hope. For the bulls, this strength needs to be duplicated in the weeks ahead or it would be another false alarm. While a new bull market is inevitable, we do not see it as imminent.

First I will start with the miners. We plot a weekly candle chart of GDXJ as it is the strongest and figures to lead the eventual recovery. GDXJ is reversing today. That is bearish though it is not entirely reflected in the weekly chart. GDXJ, trading around $21 faces a confluence of major resistance around $23 to $24. Multiple lines of resistance and the 200-day moving average converge there. While GDXJ has formed a good base, its potential recovery will remain questionable or doubtful unless it can make a weekly close above $23 to $24 within the next few weeks. Bulls need to see GDXJ explode through that resistance or it could roll over again.

The prognosis for Gold is even simpler. Its key resistance and pivot point over the past 12 months is $1155 to $1160. For the bulls, Gold needs to break above that barrier with a few strong weekly closes. If it cannot, then the strength of the past few days will be another false alarm.

The recent recovery in global equities may have ended yesterday (Thursday). The S&P 500 rebounded back above its 400-day moving average (2003) to 2020 before reversing to close below its 400-day moving average. It remained below its 50-day moving average the entire time. It is down another 1.3% today. Other markets such as the Nasdaq, Emerging Markets (EEM) and Russell 2000 made the same reversal and at their 50-day moving averages. They are down more than 1% today.

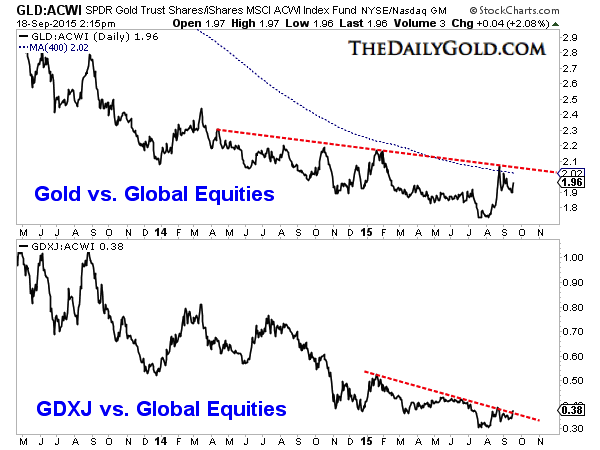

Further weakness in global equity markets should be bullish for precious metals in the sense that it could act as a catalyst for the start of the next bull market. In the chart below we plot Gold and gold miners (GDXJ) against the all country weighted index (ACWI). It is important to note, the precious metals complex remains in a downtrend against equities. It has not broken out yet but figures to have a good chance to do so in the months ahead.

If Gold and gold miners have bottomed then they should explode through upside resistance over the next few weeks. Gold would need to push above $1160 and more importantly, GDXJ would close above resistance at $23-$24. While I do not expect this to occur, it is a scenario we should keep in mind.

The other scenario is this Fed-induced rebound in precious metals fizzles out and precious metals join global equity markets in a selloff. Although that is bearish, it would be bullish to see Gold decline less than global equity markets. That scenario, given how Gold fared relative to equities in the August selloff, is plausible. Gold traders and investors need to be careful here and put their portfolios in position to take advantage of the next buying opportunity, which could mark the end of the bear.

As we navigate the end of this bear market, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.