US Dollar El Peso Colombiano!

Currencies / US Dollar Oct 01, 2015 - 11:46 AM GMTBy: Austin_Galt

It was the year 2001 when I first entered the country of Colombia. I crossed over the Rumichaca Bridge which separates Ecuador and Colombia and got the first bus of the day from Ipiales headed for Cali. I'd considered travelling overnight but had thought better of it having been warned about night time robberies along the way.

It was the year 2001 when I first entered the country of Colombia. I crossed over the Rumichaca Bridge which separates Ecuador and Colombia and got the first bus of the day from Ipiales headed for Cali. I'd considered travelling overnight but had thought better of it having been warned about night time robberies along the way.

It wasn't long into my Colombian adventure when things heated up. Around 3 hours into the journey, travelling in some spectacular mountain scenery between the towns of Pasto and Popayan, the bus came to a screeching halt. That was because around five men in military fatigues jumped into the middle of the Panamericana highway pointing their guns at the bus. Here we go!

One seemingly happy chap entered the bus and spotted me up the back. I was the only foreigner on the bus and a bit taller than the local folk so not that hard to spot. He zoomed up to me and asked "De donde eres?". That's "where are you from?" in Spanish. "Soy Australiano" I replied, heart palpitating more than normal. He liked that answer and welcomed me to his country. But these were no friendly folk. These were FARC guerrillas. Put simply, communist drug traffickers with a penchant for kidnapping for ransom. Had I answered Americano things may have turned sour pronto.

But the jefe or boss of this unit was not satisfied and ordered me off the bus where he proceeded to interrogate me for around 15 minutes as the rest of the passengers watched on. His unfriendly manner had me on edge and I thought this could well be where my Colombian adventure ends. It wasn't and I'm hazarding a guess that my Aussie passport saved the day!

I've had many more interesting experiences during my time in the country but perhaps they are for another day. However, throughout this journey there has been one constant - the Colombian peso. I've watched the fluctuations of the Colombian currency for many years. Now it's time to analyse it. Let's get down to business using the daily chart.

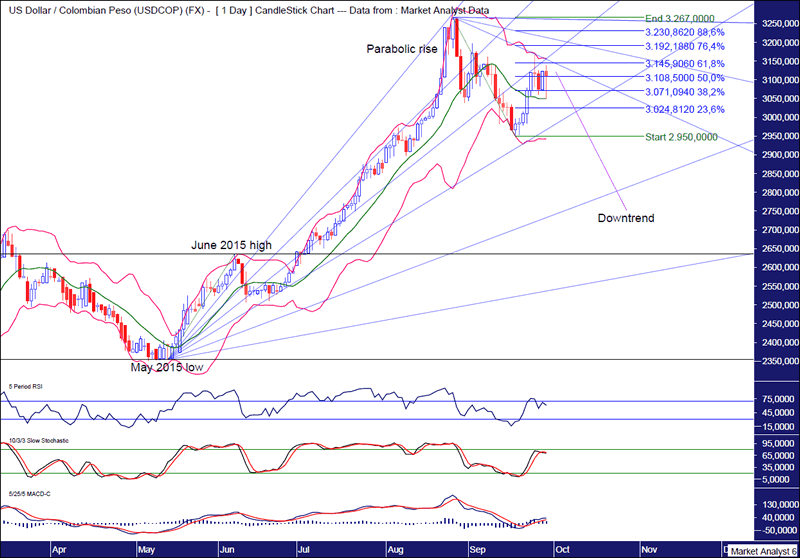

USDCOP Daily Chart

The Colombian peso has been smashed this year. The currency pair USDCOP shows the US dollar giving the peso a spanking. Bien azotado!

We can see the recent move into high at 3.267,0000 was parabolic in nature. Bull trends often end with a parabolic rise and that is my expectation here.

I have drawn a Fibonacci Fan from the May 2015 to the first high after that which was set in June 2015. We can see price trending up generally between the 61.8% and 38.2% angles before the final parabolic move up ended with a top that was right at resistance from the 23.6% angle. Nice.

Since then price has begun to trend down making its way back through the angles. The recent low was just above support from the 61.8% angle while the recent high a few days ago was around resistance from the 50% angle.

I have also added two angles, being the 76.4% and 88.6%, from a bearish fan drawn from the top. The recent high was right at resistance from the 76.4% angle and that looks to be it. If price were to rally a bit higher, then the 88.6% angle would come into contention.

I have added Fibonacci retracement levels of the move down from high to recent low and price has so far clipped the 61.8% level and that could well be it. If not then the 76.4% level at 3,192.0000 would be an area to target.

The Bollinger Bands show price has just bounced up from the lower band to the upper band and I expect the resistance at this upper band to be solid.

The RSI did not show any bearish divergences at the high but that is often the case when a parabolic rise has just occurred.

The Stochastic indicator has a bearish bias while the MACD indicator is currently bullish but that is coming after a solid move down.

So, where is price likely to go now?

I have drawn two horizontal lines. The upper line denotes the June 2015 high at 2.635,2000 and that is my absolute minimum expectation. However, taking into consideration the parabolic rise into top, I expect price to break below the previous swing low which is denoted by the lower horizontal line denoting the May 2015 low of 2.390,4157.

The Colombian economy is heavily reliant on exports of oil and the price of this commodity has been smacked although there does appear to be some promise there going forward. Any rise in the oil price should help the Colombian peso and see the USDCOP pair head down.

And perhaps the peace deal just reached between the FARC and the Colombian government will help tourism and in turn the Colombian peso. Now it's just the FARC's smaller cousin, the ELN, to deal with. Oh, and the Bacrim (criminal bands) as well. Hmm, the journey continues regardless...

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2015 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.