The Gig Economy Is the New Normal

Economics / Employment Nov 17, 2015 - 10:22 AM GMTBy: John_Mauldin

An already-confusing employment environment grew even more complicated this past week. Many readers responded to my “Crime in the Jobs Report” letter with their own stories. Some confirmed what I wrote, while others disputed it. Some of the stories I read from readers who are stuck far from where they want to be in this job market were very moving. I think everyone agrees the labor outlook is uncertain. I sense a lot of nervousness, even from those who have secure jobs that pay well. In today’s letter, I’m going to respond to some of the observations and data that came in this week on employment.

An already-confusing employment environment grew even more complicated this past week. Many readers responded to my “Crime in the Jobs Report” letter with their own stories. Some confirmed what I wrote, while others disputed it. Some of the stories I read from readers who are stuck far from where they want to be in this job market were very moving. I think everyone agrees the labor outlook is uncertain. I sense a lot of nervousness, even from those who have secure jobs that pay well. In today’s letter, I’m going to respond to some of the observations and data that came in this week on employment.

As we will see, we have a right to be nervous. Big changes in the employment world are happening, and we don’t yet know how they will affect us individually. Analysts like me can say we’ll muddle through, but we must remember that not everyone will muddle at the same pace.

We will also take a look today at a growing new phenomenon: the gig economy. (I should note that today’s letter is a little shorter. I am trying to reduce the word length of Thoughts from the Frontline.)

We talked last week about employers’ reluctance to hire older workers. Reader Steve Lange from Denver pointed me to a ZeroHedge article that questions this premise.

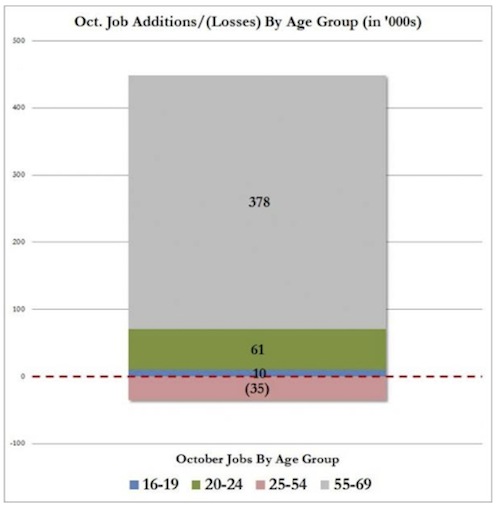

If you look at the BLS age breakdown for new jobs (Table A-9), you’ll see that workers aged 55 and over accounted for virtually all of October’s strong gains. That group added 378,000 jobs last month.

Meanwhile, the number of workers aged 25-54 actually declined by 35,000. That’s supposed to be “prime working age,” so any decline should ring alarm bells. And the numbers are more alarming if you are male: men aged 25-54 lost 119,000 jobs in October.

This pattern isn’t new, either. I’ve written about this ongoing anomaly in previous letters. Since December 2007, workers aged 55 and older have gained over 7.5 million jobs, while those under 55 have lost a cumulative 4.6 million jobs. Older workers are simply taking employment market share from younger workers.

What would cause this trend? Partly it’s demographic. The population is aging as the Baby Boomer bulge grows older and Millennials postpone parenthood. Nevertheless, it does look as though Baby Boomers are not exiting the labor force as fast as we thought.

Some Boomers may delay retirement simply because they enjoy working and are healthier than previous generations were in their late 60s. I’m in that category myself. More ominously, it seems that millions of Boomers are reaching retirement age without much in the way of retirement assets. They don't retire because they can’t afford to do so.

Tyler Durden, the pseudonymous ZeroHedge writer, connects this pattern to the unimpressive wage growth we’ve seen in this recovery.

Little wonder then why there is no wage growth as employers continue hiring mostly those toward the twilight of their careers: the workers who have little leverage to demand wage hikes now and in the future, something employers are well aware of.

Do older workers really have “little leverage to demand wage hikes?” I think it probably depends on the worker and the job. For relatively unskilled, repetitive work, employers will hire whoever is most productive and reliable for the price they want to pay. They’ll pay what it takes to keep those workers aboard and still make a profit. No offense to the younger generation, but the older generation doesn’t stay out and party and shows up ready to work.

I am sure you have had something like the following experience. I walked up to the busy checkout line at the local Barnes & Noble, where a clearly elderly gentleman proceeded to check out the rather complex combination of books, gift cards, and electronic transfers I wanted to buy. He proceeded flawlessly, and I finally had the temerity to ask, “How old are you?” “Eighty-four,” came back the answer; “I like to stay active, and I get to meet a lot of interesting people.” We had a quick conversation about how much more common people like him are today, and I moved on. I got the definite impression that he could live without the income but preferred working. I also recalled my 17-year-old daughter checking me out at Barnes & Noble 20 years ago. So I walked around and sized up the present-day staff and found an age range decidedly skewed from what I remembered 20 years earlier.

Older people may simply be willing to work for less money, although I don’t think Barnes & Noble is paying high salaries to any of its retail clerks. Some have other income sources, such as Social Security. Those over 65 have Medicare, which reduces the employer’s benefit headache. Younger workers have neither advantage.

Nonetheless, I’m still surprised to see younger workers losing so much ground. I hope it’s because they’re busy learning new skills. That’s what we really need.

The Gig Economy Is the New Normal

But there may be something else happening to skew the work force age distribution. There is growing awareness of what is being called the “gig economy.” My hedge fund friend Murat Koprulu has been busy researching and documenting this phenomenon and regularly regales me with what he finds. He goes and spends evening and weekends with young gig workers, trying to figure out what it is they really do and how they make ends meet in New York City. It turns out they need a lot less to support their lifestyle than you might imagine, and they prefer working intermittent gigs, being able to do what they want, and having no boss.

A close look at the data indicates that the gig economy is indeed large and growing. Pushing this growth are Generation Xers, who typically prefer more flexible work arrangements, and Millennials, who often have no other choice. The gig economy is rapidly changing the country’s economic landscape – for better or worse.

It’s not just Uber driving or AirBnB. There are literally scores of websites and apps where you can advertise your services, get temporary or part-time work, and do so from anywhere you happen to be. Some “gigs” actually pay pretty good money, but they are for people with specialized skills who prefer to live a somewhat different lifestyle than the typical 9-to-5’er does.

There is a great deal of debate among economists about how big the gig economy really is. It doesn’t seem to show up clearly in the BLS employment data. Typically, we would expect those working in the gig economy to appear in the self-employed category, but that category is actually drifting downward in numbers, relatively speaking. So the Wall Street Journal recently published an article pooh-poohing the concept of the gig economy.

Not so fast, say Harvard economist Larry Katz and Princeton’s Alan Krueger. They are currently working on research to document the rise of the gig economy America. From a story at fusion.net:

Katz said two pieces of evidence suggest current measures of self-employment and multiple-job holding are “missing a large part of the gig economy.”

The first is that the share of the employed (and of the adult population) filing a 1099 form, the tax document “gig economy” workers must file, increased in the 2000s, even as standard measures of self-employment declined in the 2000s.

Likewise, the share of individuals filing Schedule C tax forms to report profits and losses for their homegrown businesses is up “substantially” in the 2000s, “even though survey measure of self-employment are down.”

“These discrepancies suggest a growth of ‘gig’ and ‘share’ economy workers who receive 1099 income, file Schedule C forms on their taxes, but don’t answer the standard [government] question as indicating they are self-employed and don’t say they are a multiple job holder,” Katz said.

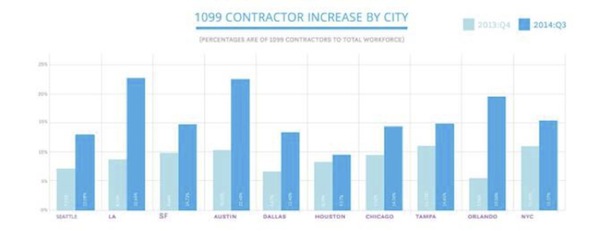

Other groups have confirmed this: Zen Payroll, a site that tracks the sharing economy, found increases in the share of 1099 workers across many major U.S. metros.

Source: Zen Payroll via Small Business Labs

And data from research group EconomicModeling.com show the share of traditional, 9-to-5 workers in the labor force has declined…

Source: Fusion, data via EconomicModeling.com

…while those who categorize themselves as “miscellaneous proprietors” is climbing.

Source: Fusion, data via EconomicModeling.com

Meanwhile, in preliminary interviews with “gig economy” workers, Katz said he and Krueger have confirmed that a majority of those who have regular, non-“gig” employment don’t answer that they have “multiple jobs” when asked the standard multiple-jobs question, “even in many cases where they have significant on-line and other non-traditional job income.”

They do answer about their share, gig, and freelance economy activities when specifically asked about other specific ways they made income,” Katz said. “But many of them do not seem to consider such activities as ‘regular jobs.’”

Indeed, a recent survey found 60 percent of such workers get at least 25 percent of their income from gig economy work.

This report absolutely squares with what Murat’s research is showing. He is starting to write a book on the gig economy. I’ve read the outline. I don’t think my age peers will quite understand what’s happening. Their reaction may be akin to how my parents felt about their children in the ’60s and ’70s.

As Steve Hill writes at the Huffington Post:

The gig economy is just one sub domain of what is happening more broadly to the workforce, including just-in-time scheduling and other disruptions to the labor markets, whether as a result of the gig economy, automation and robots, artificial intelligence and other factors. Fortune columnist Jeffrey Pfeffer writes, “What is not in dispute is that the proportion of contractors, freelancers, and part-time, contingent workers in the U.S. has been increasing and has been for a long time.”

What I notice with some of my own children and many of their friends is that the gig economy, and the independent contractor world in general, is almost completely divorced from anything that looks like a social safety network. Healthcare? 401(k)s? Retirement programs? Extra help for single moms? Forget about it.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.