Janet Yellen Responds as a Central Banker Would

Interest-Rates / US Federal Reserve Bank Nov 24, 2015 - 12:23 PM GMTBy: Gary_Tanashian

Let's try to untangle the web of Fed-speak going on here. "Reality" for our purposes is defined as my opinion, obviously.

Let's try to untangle the web of Fed-speak going on here. "Reality" for our purposes is defined as my opinion, obviously.

Yellen Defends Seven Years of Low Interest Rates in Letter to Nader

Fed-Speak:

Warning that "an overly aggressive increase in rates would at most benefit savers only temporarily," she argued in the letter released Monday in Washington that the Fed's seven-year era of zero rates had sheltered American savers from dramatic declines in the value of their homes and retirement accounts.

Reality:

It was a thing called deflation, which is a natural corrective to man-made, currency-compromising monetary policy that leverages the 'value' inherent in official 'money' in service to asset appreciation. Periodically, this 'money' becomes valued as liquidity as the monetized economy deleverages from the official Fed-sponsored inflation (in this case, Alan Greenspan's commercial credit bubble). In other words, the "value of their homes" was a false economic signal to begin with. So what she is saying is that the Fed's seven-year era of zero rates have been a tool employed to forestall, you guessed it... reality.

Fed-Speak:

"Many of these savers undoubtedly would have lost their jobs or pensions (or faced increased burdens from supporting unemployed children and grandchildren)," if the Fed had not acted with such force, she wrote.

Reality:

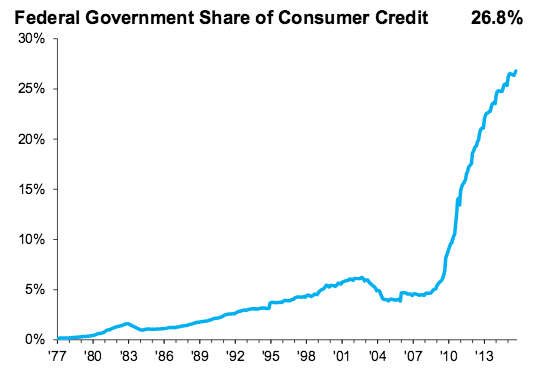

Yes indeed, they would have. That would have been due to the fallout from from the last time the Fed acted to delay an economic deleveraging. So what you are saying Ms. Yellen, is that you have employed a different flavor (government vs. commercial credit) of the same solution that was in actuality, the cause of the problem to begin with. See? The consumer is now hopped up on government credit instead of mortgage products on this cycle. From FloatingPath ...

Fed-speak:

Repeating that she and most of her colleagues expect the pace of policy tightening to be gradual after liftoff, Yellen said "overly aggressive" rate hikes could also undercut the economic expansion and force the Fed to reverse course back to zero, drawing a parallel with Japan, where rates have been stuck near zero for the past 25 years.

Reality:

It's a Kabuki Dance.

Fed-Speak:

Yellen's letter responded to a plea from a "group of humble savers" that included consumer advocate Ralph Nader frustrated by low returns gained from traditional bank deposits and money-market accounts.

"We want to know why the Federal Reserve, funded and heavily run by the banks, is keeping interest rates so low that we receive virtually no income for our hard-earned savings while the Fed lets the big banks borrow money for virtually no interest," it read. "It doesn't seem fair to put the burden of your Federal Reserve's monetary policies on the backs of those Americans who are the least positioned to demand fair play."

Yellen told the group that lower borrowing costs helped make large purchases more affordable for American consumers, supporting the economy and creating "millions of jobs."

Reality:

I didn't know Ralph Nader was still around. I remember him from when I was a kid, and I am pretty old. To answer your question Ralph, the Fed has been keeping rates so low in order to make sure that enough of the economy deleverages from previous Fed-induced moral hazards. The Fed has held savers in suspended animation in an effort to make powerful and abusive interests whole again. It is these interests that matter to the Fed, not regular people.

As to the last paragraph, the average American consumer cannot make large purchases without ample credit (see graph above). Households are no doubt better off today than they were in 2009 but again, we are talking about the cure being the disease. Yellen is justifying a new flavor of the policy that created the "Great Recession" as the media came to call it. It was not a great recession, it was a deflationary episode that unwound the Greenspan Fed's excesses, and then deflation was kicked down road by the Bernanke/Yellen Feds as if it were just an empty can of Budweiser.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.