Stock Market Crash: Is the Dow headed for a Repeat of 2008

Stock-Markets / Stock Market Crash Jan 27, 2016 - 06:09 PM GMTBy: Sol_Palha

Do not wait for ideal circumstances nor for the best opportunities; they will never come. Anonymous

Do not wait for ideal circumstances nor for the best opportunities; they will never come. Anonymous

We could not help ourselves and put the word stock market crash in the title because every Tom, Dick and Harry is now chanting this tune. Take a look at some of the recent headlines:

Is the stock market headed for a repeat of 2008?, On marketwatch.com

A stock-market crash of 50%+ would not be a surprise — or the worst-case scenario on Yahoo Finance

Stock Market Crash 2016: This Is The Worst Start To A Year For Stocks Ever on rightsidenews.com

And the list goes on and on.

The Naysayers are busy listing several factors that in their opinion does not bode well for the market

- Ultra low oil prices: we are told that low oil prices are bad for the economy. Hold on, was it not too long ago they were telling us that high oil prices were bad for the economy, so which one is it. Many oil companies will go bankrupt, but the ones that are left will emerge strong and be ready for the next bullish phase. It is because oil prices are low that car sales jumped and set a record last year; 17.5 million vehicles were sold and many consumers started purchasing Gas guzzlers they were avoiding before due to high gas prices. Ultra low oil prices are the equivalent of central bankers injecting roughly $1 trillion dollars into the global financial system, as that is how much the global economy will save at these rates.

The China factor; China’s economy is slowing down, and so the fear is that this could have a significant impact on our economy.- A big deal is being made over China’s slowing economy; this growth is something every developed economy can only dream off. U.S. Corporations export roughly $500 billion year worth of Goods to China. We have an $18 trillion economy, so this is a drop in the bucket and nothing to panic over.

- Uncertainty after the Fed’s raised rates. For crying out loud, the Fed only raised rates by a paltry 0.25%, and they can immediately turn around and reverse their position if they wanted. However, in our opinion, even another 2-3 rates will do nothing to derail this economy as rates are being raised from ultra-low levels.

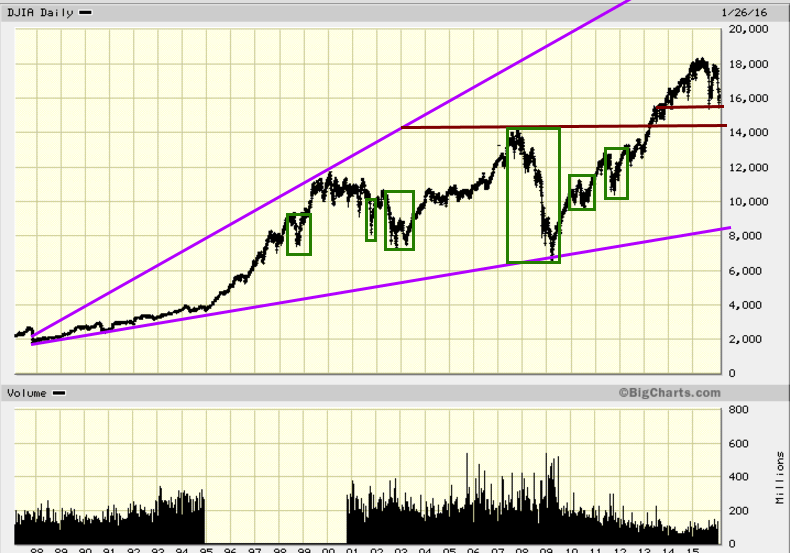

Let us take a pause and think about the current situation. Have we not seen this before? The theme is always the same, something bad is going to happen a stock market crash is imminent, take cover and run for the hills. Sure, in the short-term the markets have experienced some violent moves, but fast forward, in every case, the markets recouped and traded higher. People will mention Japan as an example of a market that is still trying to play catch up decades later. Well, what happened in Japan happened in a different era? We are now in the era of devaluing or die, in other words, every nation is hell-bent on debasing its currency or it is being forced to because major players have jumped on the bandwagon. In such an environment, normal rules, do not apply, and central bankers usually respond by flooding the markets with money. Regardless of this issue, look at this long-term chart of the Dow and it clearly illustrates that every so-called disaster was nothing but a buying opportunity.

We have never advocated buying right at the top; our theme was to view strong pullbacks as buying opportunities to open new positions. Has the situation changed so much since last year? Are we also going to join the pack of naysayers? Before we answer that question, let’s examine the issue of volatility. Last year we emphasized several times that volatility was going to be a major issue as our Volatility Indicator had soared into record territory. In fact, in early Jan, we republished comments that we had sent out to our subscribers in Dec 2015, listed below

Our V indicator has surged to yet another high, so extreme volatility is here to stay. In fact, 2016 will probably be remembered as the most volatile year on record.

Volatility is a two-way street; this means that one should expect large price swings on both ends of the scale. Given the run up the markets have experienced over the past seven years, the current correction while strong is nothing to panic over.

Technical outlook

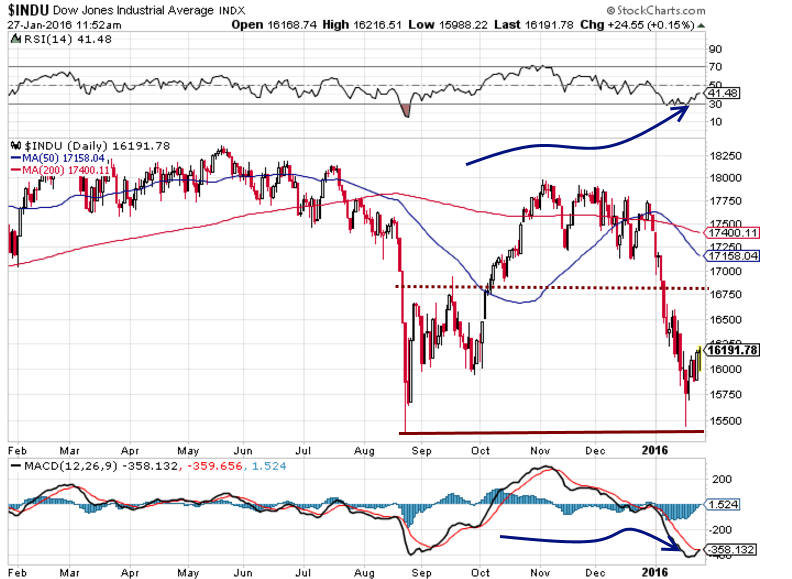

It goes without saying, that the traders are panicking, and that market psychology in the short term has taken a beating. However, the short-term and long-term is not the same. Last week we noted that the volume on most down days was significantly lower than the volume on up days. It appears someone is stepping in and buying; could this be the smart money in action? Time will tell.

On the short term timelines, the markets are oversold so a relief rally could take hold anytime. Both the MACD’s and Relative strength indicator are trading in the oversold ranges. The MACDS are about to make a bullish crossover. Given the strength of the correction, there is a good chance that we have not seen the lows as yet. The Dow is likely to rally to the 16700-16900 ranges before pulling back and trading below the current lows. The drop to below the August lows should drive out all the bears setting up the bedrock for a bottom and a move to higher prices. As we stated in several of our past updates, expect 2016 to be the most volatile year on record to date. Now is the time to build up a nice list of stocks that you always wanted to own but felt were too expensive to buy. History indicates that the stronger the markets deviate from the norm, the better the buying opportunity.

Here is a small list of stocks that have held up remarkably well during the current sell-off; PBY, IGLD, PRMW, MCD, JNJ, etc.

The paranoiac is the exact image of the ruler. The only difference is their position in the world. One might even think the paranoiac the more impressive of the two because he is sufficient unto himself and cannot be shaken by failure. |

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.