It's Stock Market Panic Time!

Stock-Markets / Stock Markets 2016 Feb 09, 2016 - 02:12 PM GMT The Nikkei 225 Index is in the news this morning. It declines to 16085.44 in their overnight session. That’s right. It is down 918.86 points. This puts it just above its Head & Shoulders neckline. There’s a lot more to come should the neckline be broken.

The Nikkei 225 Index is in the news this morning. It declines to 16085.44 in their overnight session. That’s right. It is down 918.86 points. This puts it just above its Head & Shoulders neckline. There’s a lot more to come should the neckline be broken.

The futures are down 1129.50, or 15871.50. ZeroHedge reports, “With China offline for the rest of the week, global markets have found a new Asian bogeyman in the face of Japan which as reported last night saw its markets crash, and the Yen soar, showing that less than 2 weeks after the BOJ unveiled NIRP, yet another central bank has lost control.”

Meanwhile Japanese 10-year notes are trading at 0% this morning as the Nikkei crashes.

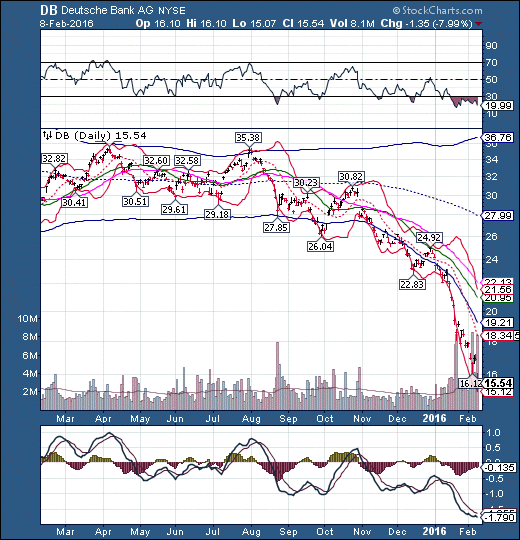

Deutsche Bank is in deep trouble. Selling has resumed this morning in an already beleaguered stock. ZeroHedge comments, “Yesterday's desperate scramble by Deutsche Bank to comfort markets about its liquidity position worked, for about three hours. And then, the bank which really should just keep its mouth shut, did the opposite and reminded an already panicked market just how "serious" things are, in the parlance of Jean-Claude Junkcer, when in an internal memo, the CEO assured his workers that:

DEUTSCHE BANK CEO: CAP STRENGTH, RISK POSITIONS ’ROCK SOLID’

That was the good news. The bad news:

DEUTSCHE BANK TO INFORM STAFF IN COMING WEEKS ABOUT COST CUTS”

In the meantime, Deutsche Bank is crashing to a record low.

Of course, this has brought the EuroStoxx 50 to a new low point, as well. It is now down to 2719.15, below the Head & Shoulders neckline. If the formation target is correct, Stoxx has a long way to decline in a very short period of time.

That’s not all. European Sovereign risk has soared as well. Banks own a large portion of the Euroland sovereign debt.

The SPX Premarket has declined nearly to yesterday’s low at 1828.46.

Reuters reports, “U.S. stock indexes were set to open lower on Tuesday, as cautious investors doubled down on safer assets amid increasing concerns of a sustained slowdown in global economic growth.

Gold prices XAU= steadied near seven-month highs, while yields on Japan's 10-year government bond slipped into negative territory for the first time ever.”

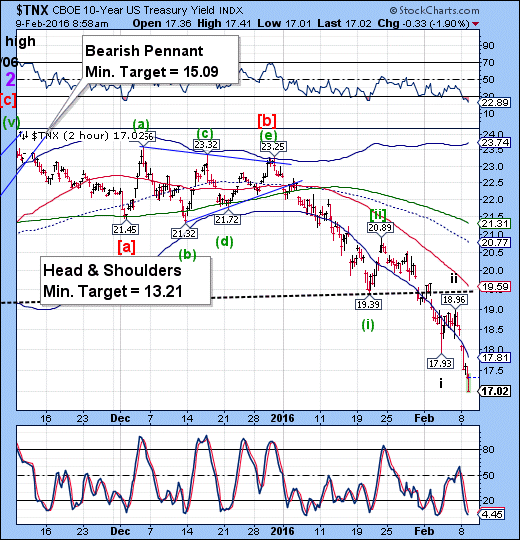

TNX continues its slide, foretelling what the US markets may look like at the open.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.