SPX Rolling Over

Stock-Markets / Stock Markets 2016 Feb 16, 2016 - 03:01 PM GMT SPX went on a low volume ramp over the extended weekend, topping out near 1895.00, the 61.8% Fibonacci retracement level at midnight. Since then it has eased down near Short-term resistance at 1884.20. Today is a double Pivot Day in the Cycles Model, suggesting a strong reversal may be happening.

SPX went on a low volume ramp over the extended weekend, topping out near 1895.00, the 61.8% Fibonacci retracement level at midnight. Since then it has eased down near Short-term resistance at 1884.20. Today is a double Pivot Day in the Cycles Model, suggesting a strong reversal may be happening.

ZeroHedge reports, “One day after markets saw a violent return of optimism, which sent stocks around the globe and US equity futures soaring (the US was closed for President's Day) driven by terrible Japanese and Chinese economic data which in turn hinted at more central bank easing, animal spirits have cooled off despite some truly unprecedented Chinese credit numbers.”

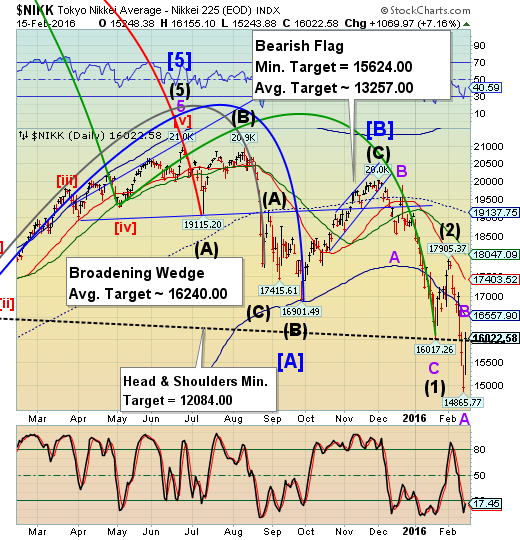

The Nikkei challenged the neckline of its Head & Shoulders formation. It closed above it in its Tuesday session, but the futures show a solid decline beneath it in after hours.

The Shanghai Index had a solid advance in overnight trading. The index appears to be on a delayed fuse as it returns from a week-long holiday. Wednesday appears to be a strong Pivot day for the Shanghai.

ZeroHedge comments, “The world let out a collective gasp of shock last night when the PBOC announced that in January, China had created an absolutely gargantuan CNY3.4 trillion in new total debt (Total Social Financing) - or about $520 billion - more than 50% higher than expected, of which CNY2.1 trillion was in the form of new loans.”

The EuroStoxx 50 Index had its Pivot in the overnight markets. It ramped up to 2858.00 near its open, then reversed back down. It is now back beneath its Head & Shoulders neckline. The reversal back beneath it is the trigger for this formation.

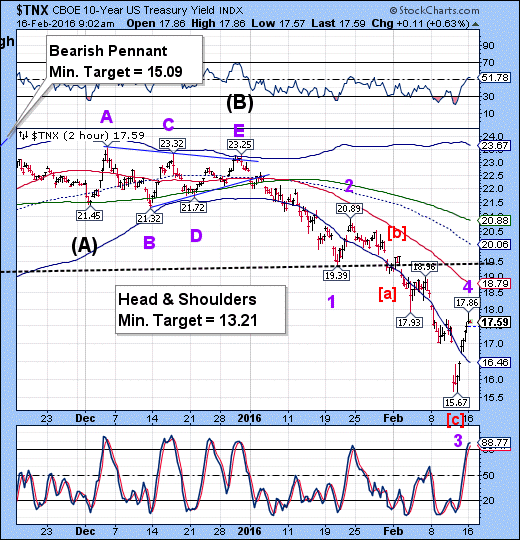

TNX appears to have capped off its Minor Wave 4 this morning. Wave 5 of (C) of [5] of V of (V) has begun. The minimum target is well within reach. In fact, it may extend all the way to 10.81! No guarantees on that one, but should it happen, this will bring in the most money ever into the long bond at the precise top in price and bottom in yields..

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.