Stock Market Pivot Day

Stock-Markets / Stock Markets 2016 Feb 22, 2016 - 03:03 PM GMT It appears that SPX Premarket has risen to the range of 1937.00 this morning. That means the Wave structure has morphed into a Minor wave C. The target for this wave [Where Wave (v) equals (i)] is 1945.48. An expanded flat Wave (2) would terminate in the range of the Wave A high at 1947.20. The Broadening formation trendline appears to be near 1952.00, so this gives us a range of outcomes for today.

It appears that SPX Premarket has risen to the range of 1937.00 this morning. That means the Wave structure has morphed into a Minor wave C. The target for this wave [Where Wave (v) equals (i)] is 1945.48. An expanded flat Wave (2) would terminate in the range of the Wave A high at 1947.20. The Broadening formation trendline appears to be near 1952.00, so this gives us a range of outcomes for today.

Tomorrow is a Trading Cycle Pivot, but there are two lesser Pivots today. The rally may spend 40.5 hours, which would place it near the 13:00 hour today. The next option is 43 hours, which places the top near the end of the day.

The global slowdown in revealing itself throughout the world this morning.

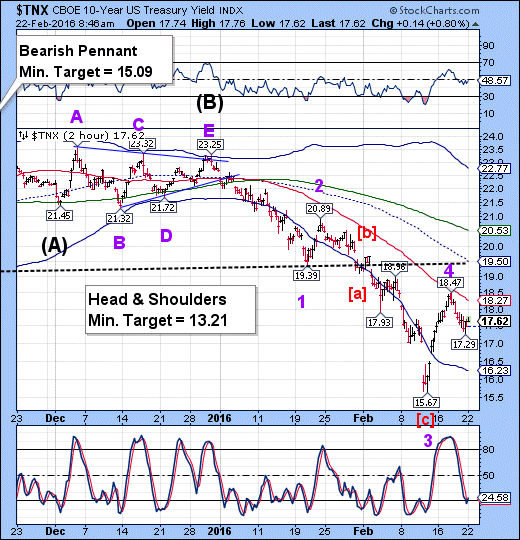

TNX is bouncing ever so slightly, which leads me to take another look at the Treasury Bond history. The 30-year bond indeed had a high yield of 15.2% on September 29, 1981, but it had a marginally higher yield at 15.21 (which I missed in my original research) on October 26, 1981. If you line up October 26, 1981 (1981.819) and add 34.4 years, you come to a high on March 21, 2016 (2016.219).

This lines up with the next Master Cycle low in equities also on March 21, 2016. The outcome of this is that the change in timing would have led us to a tradable bounce at 1810.10 rather than expecting the decline to resume more quickly.

In any event, the next decline for equities into the March 21 low will be a monster.

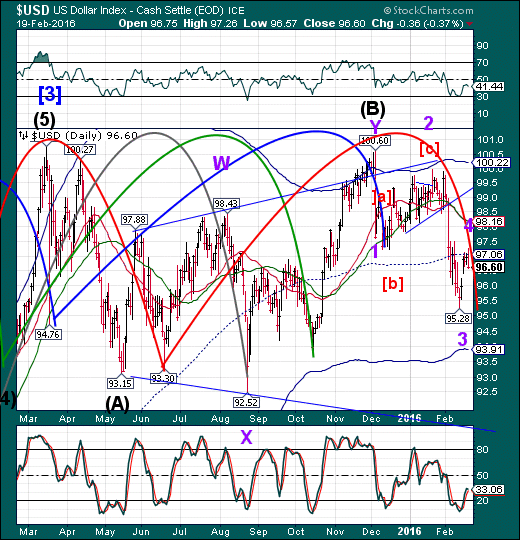

The USD futures are taking a final swing higher at 97.61 this morning before the Wave 5 decline. The minimum decline appears to be 93.81, while the stretched version appears to take it to 91.80.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.