Shanghai Stock Market First... Are we Next?

Stock-Markets / Stock Markets 2016 Feb 25, 2016 - 02:33 PM GMT Good Morning!

Good Morning!

Yesterday’s call that the Shanghai Index had topped must have been prescient. Overnight it dropped 187.65, or 6.41%. This puts the index just above a potential Cup with Handle formation whose target exceeds the Head & Shoulders formation target.

ZeroHedge reports, “After a burst of volatility in the developed market over the past month, one odd outlier was China, where after a surge of gut-wrenching moves in both its currency and equity markets (recall that it was China's troubles with marketwide circuit breakers at the start of January that may have catalyzed the global volatility wave), Chinese stocks remained relatively quiet and resilient, levitating quietly day after day. That all changed overnight when the Shanghai Composite plunged by 6.4% with the drop accelerating into the close. This was the biggest drop in over a month and was big enough to almost wipe out the entire 10% rebound from the January lows in one session.”

The EuroStoxx 50 and the Nikkei both rallied overnight, but don’t believe that there won’t be any consequences from the Shanghai decline. Euronext has already declared a suspension of trading this morning.

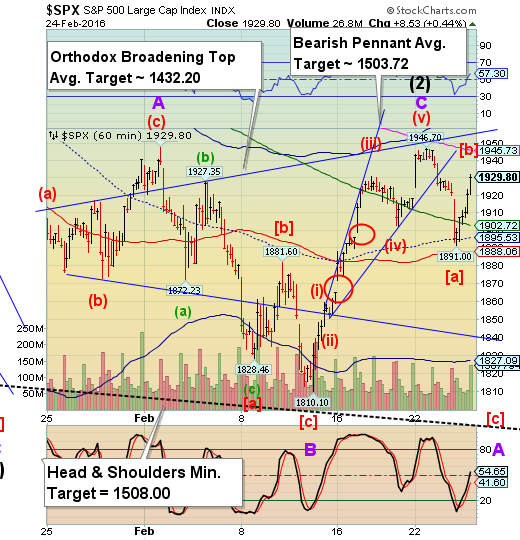

SPX futures made two attempts at driving the market higher in overnight trading. However, the Premarket is flat at this time.

The NYSE also broke at 7:00 am allowing the algos to push the markets higher for a while. However, that did not last.

Initial jobless claims fell to 42-year lows, but one wonders how much of that was seasonal adjustments?

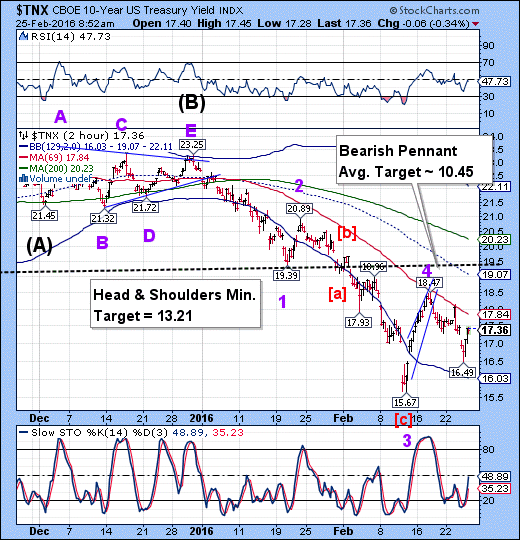

TNX is flat this morning, as is the SPX.

One wonders what surprises await us at the open?

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.