SPX Rally Met by Triple Resistance

Stock-Markets / Stock Markets 2016 Feb 26, 2016 - 05:21 PM GMT SPX did not make its Fibonacci 50% retracement at 1963.29. Instead, it declined back beneath its Cycle Top resistance at 1959.81 and Broadening formation trendline at 1956.00. A confirmation and sell signal comes beneath the 50-day Moving Average at 1943.49.

SPX did not make its Fibonacci 50% retracement at 1963.29. Instead, it declined back beneath its Cycle Top resistance at 1959.81 and Broadening formation trendline at 1956.00. A confirmation and sell signal comes beneath the 50-day Moving Average at 1943.49.

The peak came at 09:32 hours, only two minutes after the open. This may also be a confirmation of yesterday’s expected Pivot. We may yet see a retest of either the trendline at 1956.00 or the Cycle Top resistance now at 1961.70.

ZeroHedge reports, “With the S&P retesting its stubborn support level of 1,812 as recently as a week ago, many have continued to predict that failures to breach said level would result in violent bear market rallies, most recently JPM which however "should be faded", as it noted three weeks ago, looked at earnings and said that "16x and $120 create a firm ceiling at ~1950 and thus moves toward that level should be faded."

Others such as BofA's Michael Harnett, and overnight Citi, went so far as saying that unless the G-20 comes out with a big stimulative surprise, it would open the path for the market's next leg lower, below this critical support.”

VIX did bounce off its 2-hour Cycle Bottom currently at 18.22. This also corresponds with the VIX daily mid-cycle support, momentarily breached at 18.81. The subsequent action suggests that VIX may be complete on the downside.

Interestingly, a Trading Cycle low was due for the VIX yesterday, which strengthened my resolve that a top was near. It took an uncomfortable overnight session to confirm the reversal.

ZeroHedge comments, “VIX mini 'flash-crashed' this morning to test its 200-day-moving-average to the lowest level since Dec 31st 2015. For now, it appears to have marked a low...”

You can see that the Elliott Wave appears to be an inverse copy of SPX.

WTIC did an abrupt about-face at 34.65 and is now trading at 33.53. I would still like to see crude fall beneath its Head & Shoulders neckline at 33.00 before taking a short position.

Another sharp decline ahead…

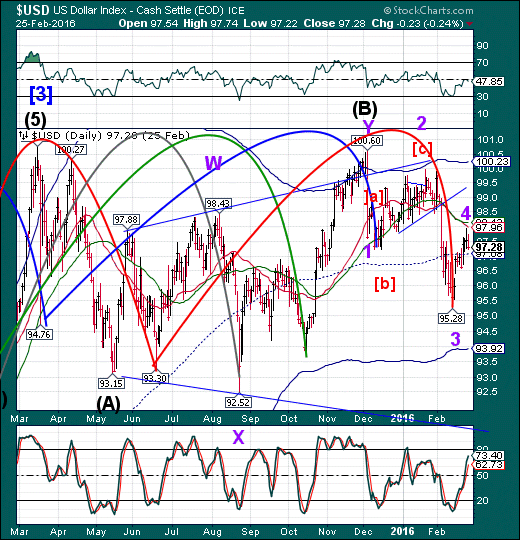

USD made a sharp spike to 98.02 before reversing down this morning. This provided the fuel (Yen carry trade) to finance the final push in SPX. This may also be the expected reversal in the dollar, which was also due yesterday.

After these experiences, I am sure that the market can be manipulated to briefly change or postpone an outcome. However, the manipulators cannot stop it. This is where false breakouts can fool many investors into being trapped the wrong way.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.