That Makes TWO Central Bankers Ringing Bells At Market Top

Stock-Markets / Financial Markets 2016 Mar 02, 2016 - 03:53 PM GMTBy: Graham_Summers

In the last month, we’ve had two major confessions from Central Bankers.

We’ve already detailed the first, which came from the Head of the Bank of Japan, Haruhiko Kuroda.

The second major confession from a Central Banker came from ECB President Mario Draghi. A few days ago, Draghi gave a speech in which he said:

Very low inflation complicates the adjustment process within countries, leading to higher unemployment. It delays the rebalancing process across countries, hindering those that lost competitiveness prior to the crisis from regaining it. And if low inflation is unexpected, it raises real debt burdens making it harder for the economy to grow out of debt.

On the surface this seems like a statement of the obvious: low inflation or deflation makes your debts more difficult to pay off.

However, it is only when you take this a step further and realize that he is in fact talking about the bond bubble in Europe that you realize just why he is terrified.

Remember:

- Europe’s entire banking system is leveraged at 26 to 1. At these levels even a 4% drop in asset values (read BONDS) renders the banks insolvent.

- Due to their massive welfare programs, most EU countries have real debt to GDP ratios well north of 300%. Even Germany is above 200%!

- No major bank or country has used the post-crisis period (2012 to present) or lower yields to deal with their structural debt problems.

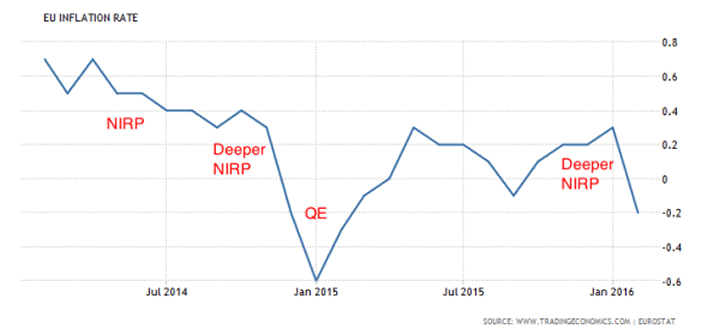

Moreover, as Draghi has found, despite three NIRP cuts and €1 trillion in QE, unexpected low inflation continues to be a REAL problem for the EU. Indeed, it just broke into negative territory again!

This is why Dragh is so concerned with “unexpected” low inflation… because he EXPECTED inflation to explode higher due to his monetary policies and instead it’s barely flatlining!

Thus, in the last two weeks, we have had TWO major Central Bank heads confess their deepest fears… namely that they do not have the monetary tools to fix their respective financial systems’ problems.

Again, the markets have yet to fully realize this. But this is as close as you can get to a Central Banker ringing a bell at the TOP.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.