US Dollar, Oil and Bonds Three-way Dance...

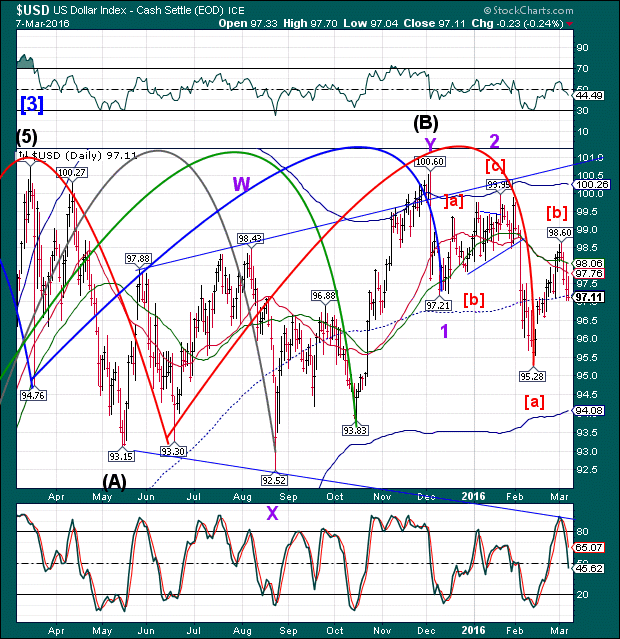

Stock-Markets / Financial Markets 2016 Mar 08, 2016 - 02:26 PM GMT The USD closed at the bottom of its trading range today, beneath mid-Cycle support/resistance at 97.17. The Cycles Model suggests the USD may continue its decline through March 25 and possibly longer.

The USD closed at the bottom of its trading range today, beneath mid-Cycle support/resistance at 97.17. The Cycles Model suggests the USD may continue its decline through March 25 and possibly longer.

ZeroHedge comments, “Two weeks ago, JPM's Marko Kolanovic put out a very interesting observation, according to which further gains in the S&P500 are capped to the upside due to one very popular reason: the US Dollar. What he said, in a nutshell, is that while a weaker dollar is beneficial for energy (clearly) and multinational stocks, it is a stronger dollar that has been driving the broader S&P 500 higher (which correlates ~30% with the USD) due to the dominant influence of Momentum and Low Volatility stocks in the index.

In other words, as the dollar weakens, it supports the most beaten down, energy, sector (which has now undergoing a record short squeeze), but it ultimately will pressure the broader market lower through Tech and Momo. As Kolanovic called it: "a market trapped by the USD."

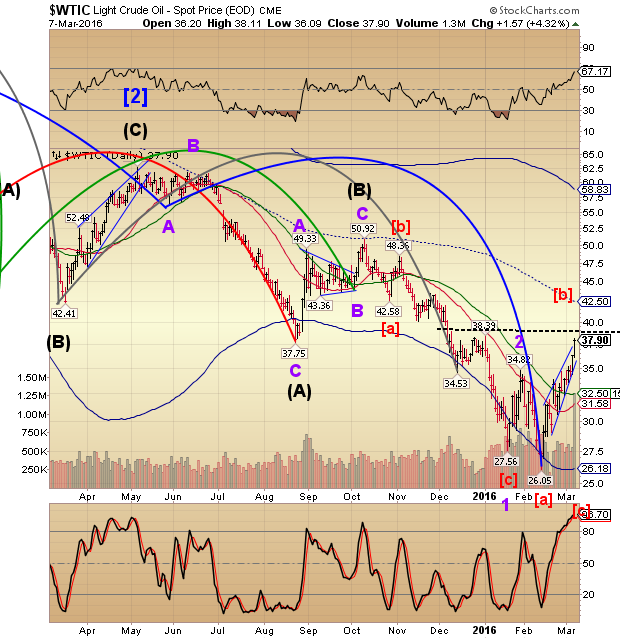

True to form, West Texas Intermediate Crude is rallying hard. But the relationship to the USD may not last, as deflation reasserts its influence. It appears that crude may peak on Wednesday, as that is a Primary Pivot day. A probable target appears to be 38.50, near the top of its Wave (iv) of [c].

Whether it goes higher than that, I cannot say.

ZeroHedge comments, “So did the G-20 decide that coordinated buying of crude oil was "unequivocally good" for the world's (economy) stock markets?

Tick-for-Tick...”

There are too many players (banks) that want to exit this trade to make it last much longer.

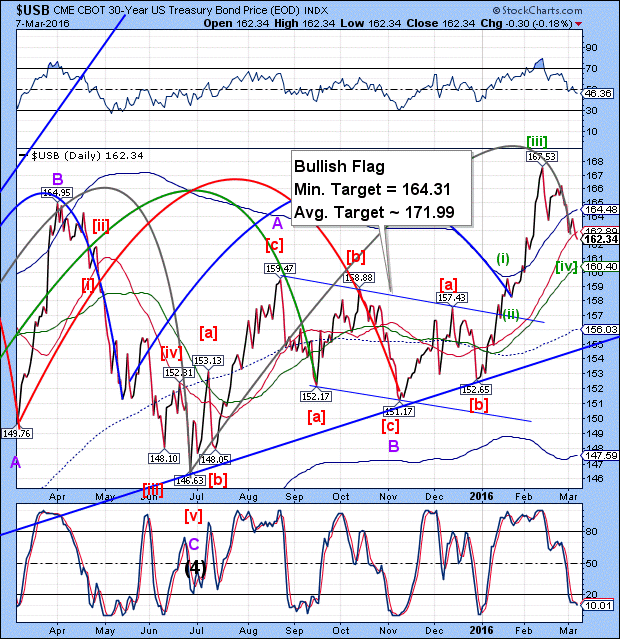

The tool of choice to accomplish the above move appears to be shorting/selling USB and UST. ZeroHedge reports that the players that are shorting Treasuries are big. Possibly China and/or Russia may be at work, with China having the largest store of Treasuries to sell or short.

Tomorrow is a potential Trading cycle low. Thursday offers another potential turn. Coupled with that is a Master Cycle low that is due imminently.

We shall see the reversal very soon.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.