Stock Market SPX May Gap Down

Stock-Markets / Stock Markets 2016 Mar 24, 2016 - 03:04 PM GMT Good Morning!

Good Morning!

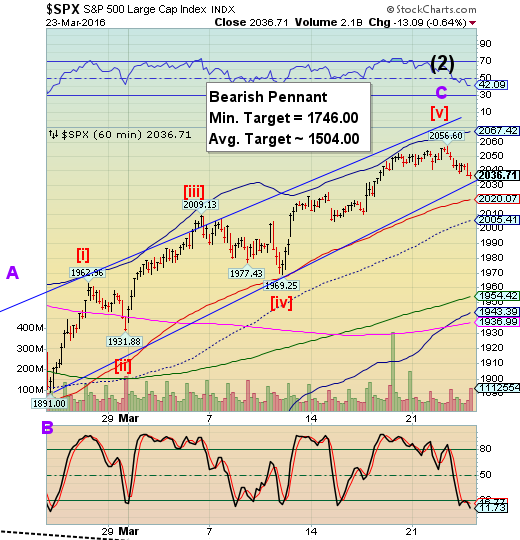

SPX crossed another short-term trendline in the Premarket and appears to be challenging its Short-term support at 2020.07. Should SPX gap beneath that level at the open, we may be in for a fast ride to Intermediate-term support at 1854.42. It is my opinion that 2040.00 was the most important support of the rally.

ZeroHedge writes, “Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all global risk assets.”

VIX futures now appear to be challenging the upper trendline of the Bullish Pennant. Once above that level, the VIX is on a buy signal.

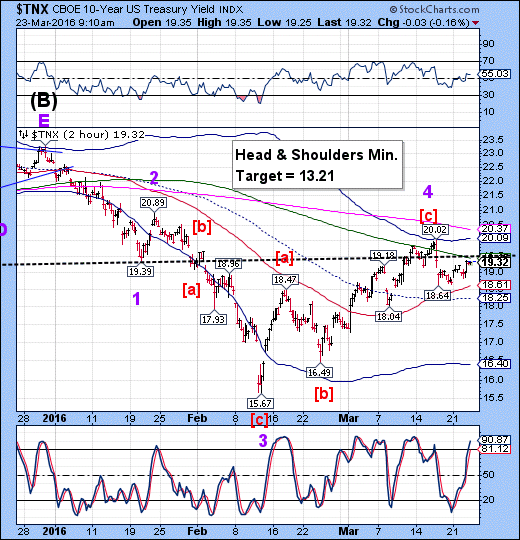

TNX is easing down, but not significantly, yet. It is on a sell signal already, but having the decline pick up momentum would be the best indicator of funds escaping risk assets.

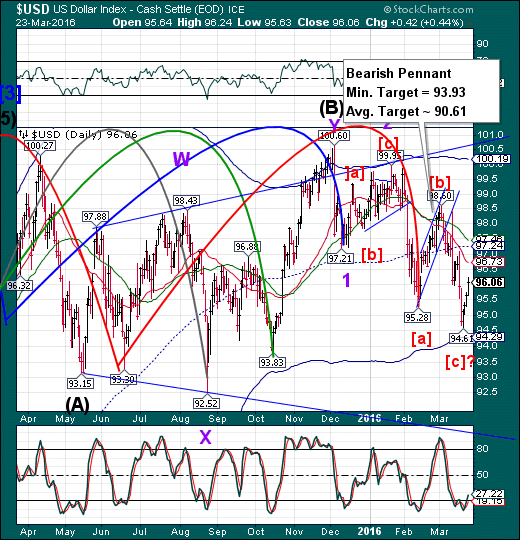

USD may finally be turning down after a morning high of 96.38 in the futures. This has been a jagged move for a Wave [c] and appears likely to extend to make up for the overlap. The Cycles Model calls for a deeper low over the next two weeks which support that thesis. In addition, the next Master Cycle low is not due until early May.

The Chinese are also voicing concern over the (recently) stronger dollar. ZeroHedge reports, “

With the USD Index stretching to its longest winning streak of the year, jawboned by numerous Fed speakers explaining how April is 'live' (and everyone misunderstood the dovishness of Yellen), it appears that The PBOC wanted to send a message to The Fed - Raise rates and we will unleash turmoil on your 'wealth creation' plan. Large unexpected Yuan drops have rippled through markets in recent months spoiling the party for many and tonight, by devaluing the Yuan fix by the most since January 7th, China made it clear that it really does not want The Fed to hike rates and cause a liquidity suck-out again.”

By the way, devaluing the Yuan is not good for risk assets, as we found out last August.

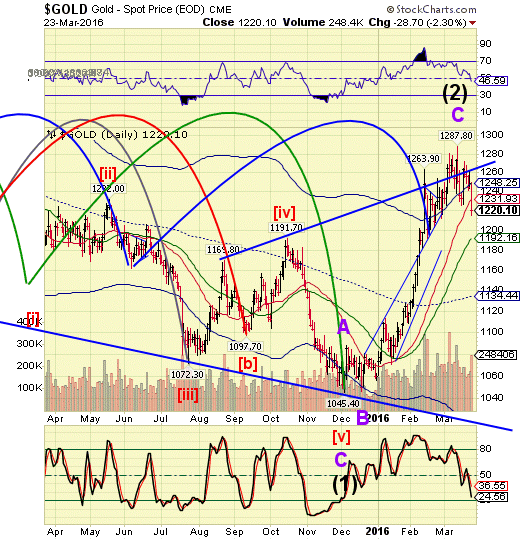

Those who went short at gold’s failure to hold 1260.00 are in good shape by now. The decline may go as low as mid-cycle support at 1134.44 before the next sizable bounce.

Crude tumbled hard in the overnight session, but appears to be capable of a bounce at this time. The bounce may challenge mid-Cycle resistance at 41.17 where an excellent short entry may be made. There is the prospect that the bounce may not go that high, so use your best judgement and leave a little room for error.

Initial jobless claims are still hovering near 43-year lows, which leaves a mystery - why is the ISM's composite manufacturing and services employment index collapsing to 6 year lows?

ZeroHedge also writes, “Durable Goods New Orders (Ex-Transports) or so-called "Core" durable goods dropped 0.5% YoY, extending its losing streak to 13 months. This is the longest streak in the history of the series with no recession. All segments of the durable goods report saw negative MoM moves with headline down 2.8% (small beat) but prior data was revised dramatically lower, Capital goods orders were drastically revised lower but still fell more than expected (-1.8% MoM) and finally shipments ex-aircraft dropped 1.1% MoM (missing the expected rise of 0.3% notable) with significant downward revisions once again.”

The bean counters are at it again.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.