Stock Market Maybe This Time is Different?

Stock-Markets / Stock Markets 2016 Mar 26, 2016 - 05:24 PM GMTBy: Tony_Caldaro

The week started at SPX 2050. After a somewhat choppy move higher to SPX 2057 by Tuesday, the market pulled back to SPX 2022 on Thursday. Then it rose for the rest of the day to close at SPX 2036. For the week the SPX/DOW lost 0.6%, the NDX/NAZ lost 0.3%, and the DJ World lost 1.3%. On the economic front reports finally came in on the positive side. On the uptick: FHFA housing, new homes sales, Q4 GDP and the WLEI. On the downtick: existing home sales, durable goods, and Q1 GDPN. Next week, a busy one, is highlighted by Payrolls, the Chicago PMI, and the PCE.

The week started at SPX 2050. After a somewhat choppy move higher to SPX 2057 by Tuesday, the market pulled back to SPX 2022 on Thursday. Then it rose for the rest of the day to close at SPX 2036. For the week the SPX/DOW lost 0.6%, the NDX/NAZ lost 0.3%, and the DJ World lost 1.3%. On the economic front reports finally came in on the positive side. On the uptick: FHFA housing, new homes sales, Q4 GDP and the WLEI. On the downtick: existing home sales, durable goods, and Q1 GDPN. Next week, a busy one, is highlighted by Payrolls, the Chicago PMI, and the PCE.

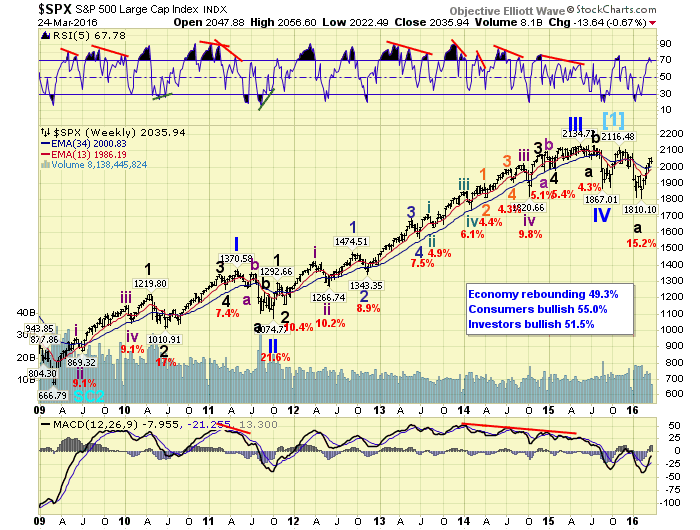

LONG TERM: bear market

The recent six week uptrend has rekindled the bullish spirits. After each of the two 15% selloffs since May the market has responded with two quite impressive rallies. During this uptrend breadth has been strong, commodities have rebounded, credit spreads have narrowed, and many are expecting a resumption of the bull market. If this does occur, it would be a first in the entire 120+ year history of the DOW in OEW terms. Maybe this time is different.

Historically there have only been five bull markets that have lasted five years or more, or gained more than 150%. This is the sixth. It lasted six years, gained 184%, and a new bear was confirmed by OEW in January 2016. The previous five bull markets were followed by some of the nastiest bear markets in the history of the DOW. The bear market that followed the 1921-1929 bull market lost 89%, the 1932-1937 bull was followed by a 52% market loss, the 1984-1987 bull was followed by a 41% stock market crash, the 1987-2000 bull was followed by a 39% market loss, and the 2002-2007 bull was followed by a 54% market loss. Maybe this time is different.

We continue to label the 2009-2015 bull market as having completed in December. We were expecting five Primary waves for this Cycle [1] bull market, and have labeled them in the chart above. Primary waves I and II completed in 2011, and Primary waves III, IV and V completed in 2015. When OEW confirmed a long term downtrend in January we were certain a Cycle wave [2] bear market was underway and the count, as posted, fit that scenario. Cycle wave [2] bear markets can be quite severe. The previous ones on record had a minimum market loss of 47%.

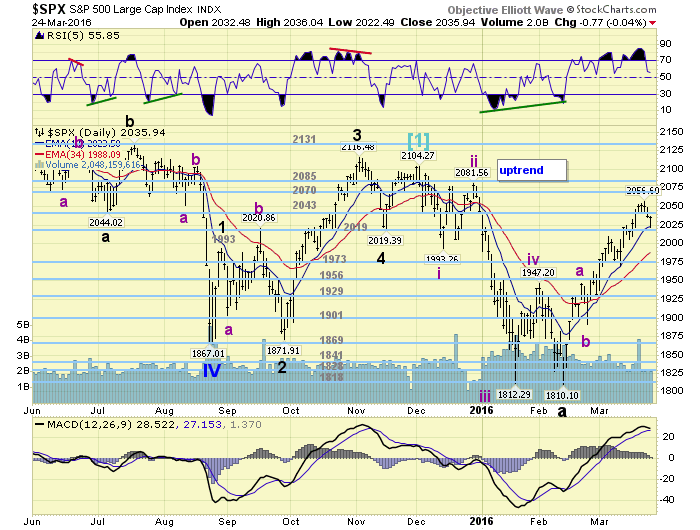

MEDIUM TERM: uptrend may have topped

At the beginning of this uptrend in mid-February we thought it would only last about 3-4 weeks and top out between the 1956 and 1973 pivots, with possibly a maximum upside to the 2019 pivot. It proved us wrong, as it has rallied even beyond the 2043 pivot to SPX 2057 just this week. This market has proven to be quite accommodating to the bulls and the bears over the past ten months. Big swings of 250+ SPX points in both directions.

As noted in the previous section we have labeled the bull market ending in Q4 2015. The first downtrend, which bottomed at SPX 1810 in February we labeled Major wave A. The current uptrend we are labeling as a three Intermediate wave Major wave B. Intermediate wave A hit SPX 1947, Int. B SPX 1891, and Int. C SPX 2057 thus far.

At this week’s high, the weekly RSI hit overbought. The last weekly RSI overbought during a bear market rally was also a B wave in 2008. The daily RSI hit its highest overbought condition since Q4 2014, and has started to decline. The daily MACD is now nearly as high as its peak during Primary wave V. Lots of upside momentum to create the current pundit bullish bias in the market. Medium term support is at the 2019 and 1973 pivots, with resistance at the 2043 and 2070 pivots.

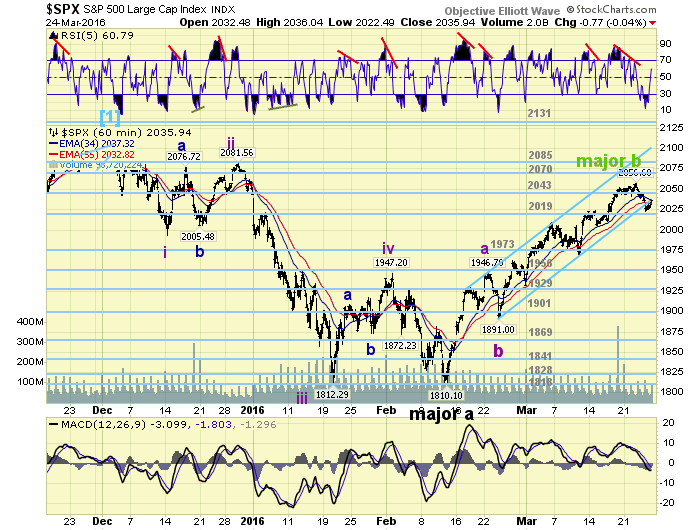

SHORT TERM

As noted in the previous section we are labeling this uptrend as a three Int. wave Major B advance SPX: 1947-1891-2057. Int. wave A was a bit sloppy but we settled on a 5 wave structure, followed by the largest pullback of the uptrend for Int. B. Intermediate wave C is a clear five wave structure: 1963-1932-2009-1969-2057. During the Int. wave C advance it had created a nice rising channel, as noted on the hourly chart, which was broken to the downside only on Thursday.

We had noted in the daily updates that we were looking for four signals that the uptrend may have ended: 1. a break of the OEW 2043 pivot, 2. a break of the lower rising trend line of the channel, 3. a drop below SPX 2009, and 4. a drop below SPX 1969. Thus far two events have already occurred. Should the next event occur before the uptrend makes new highs, evidence will be building for a new downtrend underway. Short term support is at the 2019 and 1970 pivots, with resistance at the 2043 and 2070 pivots. Short term momentum hit quite oversold on Friday, after several negative divergences, then ended the week above neutral. Best to your trading the upcoming busy week!

FOREIGN MARKETS

Asian markets were mixed on the week for a net loss of 0.5%.

European markets were mostly lower for a loss of 1.5%.

The Commodity equity group were all lower for a 2.6% loss.

The DJ World index is still in an uptrend but lost 1.3%.

COMMODITIES

Bonds remain in a downtrend and lost 0.4%.

Crude is in a weakening uptrend and lost 3.7%.

Gold is also in a weakening uptrend and lost 3.1%.

The USD is trying to uptrend and gained 1.1%.

NEXT WEEK

Monday: Personal income/spending and the PCE at 8:30, then Pending home sales at 10am. Tuesday: Case-Shiller, Consumer confidence, and a speech from FED chair Yellen. Wednesday: the ADP index. Thursday: weekly Jobless claims and the Chicago PMI. Friday: monthly Payrolls, Construction spending, ISM manufacturing, Consume sentiment and Auto sales. Best to your holiday weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2016 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.