Enough Americans Have Already Voted – Stock Market Chaos Is Coming!

Stock-Markets / Stock Markets 2016 Apr 03, 2016 - 05:58 PM GMTBy: Chris_Vermeulen

Once the majority of Americans have made up their mind and voted it will be almost impossible to change the direction of the outcome and change their minds. Unfortunately, the majority has voted and are in agreement with the next major event that will catch most people off guard. While this may sound bad and negative, I feel it is an opportunity of a lifetime.

Once the majority of Americans have made up their mind and voted it will be almost impossible to change the direction of the outcome and change their minds. Unfortunately, the majority has voted and are in agreement with the next major event that will catch most people off guard. While this may sound bad and negative, I feel it is an opportunity of a lifetime.

You may be thinking I’m talking about who will be the next president but that is not it. Although the same theory applies to that as well.

Hear me out because this is equally important in terms of your financial future. This video is a great example of how you can benefit from this next major event unfolding – Bear Market in US Stocks, continue reading to fully understand my reasoning.

How do you read these data points?

Everyone reads data very differently than each other and I think that is one of the reasons why I can navigate the market so well. I look at data and try to figure out who are the individual generating the data within the information presented. For example in this article, I want to show you how I perceive Google trends and what it’s telling us.

Typically traders look at mass market sentiment leaning in one direction to be a contrarian indicator. Meaning if everyone is bearish on the market then we are likely to see a new bull market start sooner than later. While I do agree with this theory/strategy you must take into account what type of data you are using in order to come to that conclusion.

To me, there is a big difference between the average investor being bearish on the market which we typically see right at the end of a bear market when trillions have been lost because of falling stock prices. But, compared to those who are searching the keyword phrase in Google “bear market” at any given time I look at it as a leading indicator.

You see, I think people searching on Google for specific topics specifically ”bear market” are not the average Joe investor who does nothing but ride the emotional and account value roller coaster as markets fluctuate and don’t even know what a bear market is or even think to search it.

Instead, I feel those searching Google are the educated and active investors and trader who are the ones who create market trends and significant turning points in the market. These are people being proactive learning and adjusting their portfolios to avoid losing money and/or to profit generously during market downturns just as I do.

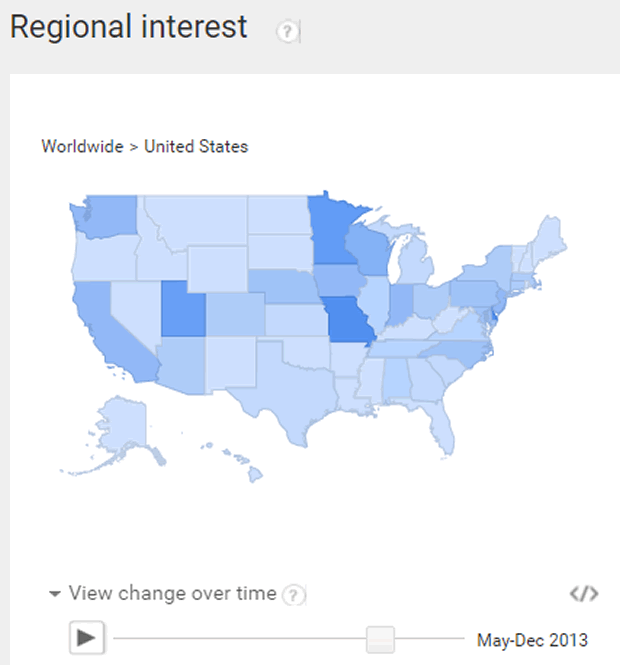

Stocks Are In A Bull Market When Google Tend Looks Like This:

The graph below shows different shades of blue. The lighter blue colors mean fewer searches for the term “bear market”. This is when the educated traders are bullish on the market and continually buying more shares, thus supporting the market trend. The dark shaded states are where specific regions of people are more bearish than the rest of the states. When the chart looks like this (light blue) we expect higher prices in the stock market.

Stocks ENTERING A NEW BEAR MARKET If Google Tend Looks Like This:

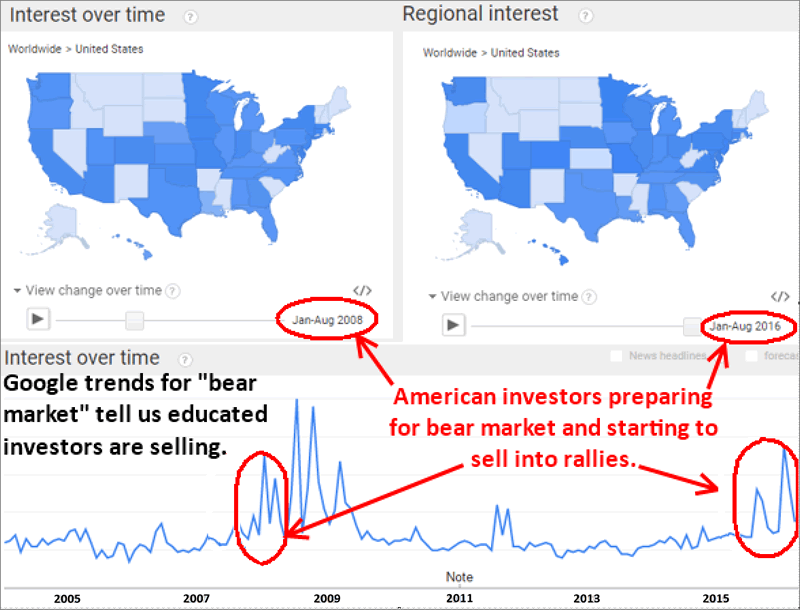

Take a look at the two charts and graphs below. Both of these look very similar to each other. The one on the left shows us what the educated investor was thinking and doing with their money just before the bear market of 2008 and the final washout low in 2009.

Now, if you look at today’s Google trend which is the image of the US on the right-hand side you will see both look very similar to each other. To add more depth to this analysis if we were to compare the market breadth and internals for the US stock market they are also very similar in nature. Both of these types of analysis combined paint a clear bearish picture for stocks looking forward 6 to 12 months from now.

Just look how much darker blue both of these charts are compared to that during a bull market when investors are putting new money into stocks, which is the first graph explained above.

Now let’s look at the bottom of this image where you see the interest over time line chart for the number of searches on “bear market ”in the USA. From what this data is telling us, we are days or weeks away from a significant market top in stocks and the start of something that will wipe-out most individuals life savings once again… This will be my third time experiencing this type of event as a trader – 2001 tech crash, 2008 financial crisis, and now the 2016 economic crash.

Concluding Thoughts:

In short, I feel the US stock market specifically the large-cap stocks are going to provide a huge opportunity for investors who understand what is happening and how to take advantage of it.

Google has provided us with some excellent information to help identify and time major market turning points for long-term investors and short-term active traders like you and me.

In 2008, we had a very similar situation set up in the market and I was able to generate life-changing returns from these moves, I should note there are two major plays here, not just one.

These incredible trade setups are a once in a decade opportunity and more money can be made during some of the roughest times in the stock market and economy if you know which simple trades to place and when to buy and sell.

Learn more at my ETF Trading Newsletter Website

Join my pre-market video newsletter and start your day with a hot cup of coffee and my market forecast video: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.