Stock Market Premarket is Down

Stock-Markets / Stock Markets 2016 Apr 18, 2016 - 02:14 PM GMT Good Morning!

Good Morning!

SPX futures declined to short-term support at 2062.36 in the overnight session. The Premarket is down, but partially recovered from its earlier plunge. The overnight bounce at Short-term support indicates the probability that it may not hold the second time. The rally trendline and mid-Cycle support at 2056.35 may be the next challenge later today.

Crude plunged nearly 7% to challenge its daily Intermediate-term support at 38.62. ZeroHedge reports, “Following yesterday's OPEC "production freeze" meeting in Doha which ended in total failure, where in a seemingly last minute change of heart Saudi Arabia and specifically its deputy crown prince bin Salman revised the terms of the agreement demanding Iran participate in the freeze after all knowing well it won't, oil crashed and with it so did the strategy of jawboning for the past 2 months had been exposed for what it was: a desperate attempt to keep oil prices stable and "crush shorts" while global demand slowly picked up.”

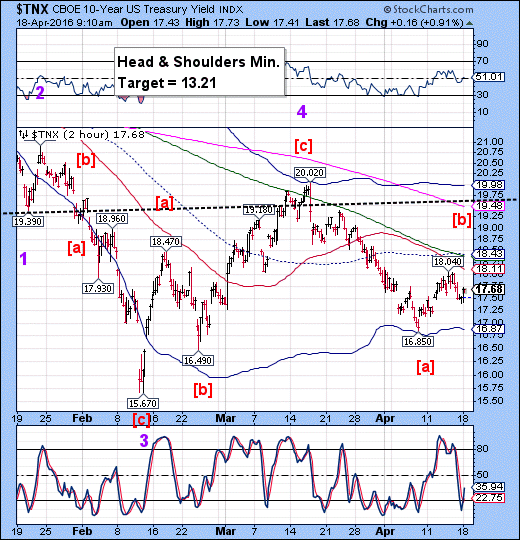

TNX appears to have some indications that it may exceed the 18.04 high in an effort to reach mid-Cycle resistance at 18.49. If so, the Cycles Model suggests that the next 24-48 hours may be the high point before the larger decline begins.

The threat that the Saudis may sell off some of their vast US Treasury reserves if Congress probes its role in the 9-11 attacks appears to be weighing heavily on the Treasury market. Right now, it’s just a threat. At some time in the future, it may be real.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.