OECD Suggests BrExit Would Cut Net Migration by 1.2 Million by 2030

ElectionOracle / EU_Referendum Apr 28, 2016 - 07:06 AM GMTBy: Nadeem_Walayat

The mostly funded by EU member states OECD's Pro-Remain report appears to have badly backfired is its analysis concludes that if the people of Britain voted for BrExit then that would result in 1.2 million FEWER migrants into Britain as average net migration into Britain would fall by 84k per annum and also slow house price inflation. So apparently according to a blundering OECD the people of Britain should vote to REMAIN so that Britain can be flooded by 1.2 million EXTRA migrants (+4.6 million total)!

The mostly funded by EU member states OECD's Pro-Remain report appears to have badly backfired is its analysis concludes that if the people of Britain voted for BrExit then that would result in 1.2 million FEWER migrants into Britain as average net migration into Britain would fall by 84k per annum and also slow house price inflation. So apparently according to a blundering OECD the people of Britain should vote to REMAIN so that Britain can be flooded by 1.2 million EXTRA migrants (+4.6 million total)!

Given that Britain faces a housing affordability crisis primarily as a result of 15 years of out of control immigration (see video) then clearly according to the OECD a BrExit WILL succeed in SIGNFICNATLY reducing net migration.

Youtube 26 Mins - https://youtu.be/yQJIB7AuqRQ

The OECD whilst not as blatant in its propaganda as the government's recent reports and leaflets have been, however, being an EU funded institution only goes part of the way towards revealing the truth for according to the OECD net migration would fall to about 200k per annum under BrExit, as opposed to 300k if Britain voted to REMAIN in the EU. Whereas my consistent analysis has warned that net migration is not only at a high 330k but the trend is rising, and likely to eclipse 400k within a few short years. Even if this did not come to pass and by some miracle net migration stabilises at current levels following a REMAIN vote, then that would STILL result in net migration of +4.6 million people by 2030!

26 Feb 2016 - UK Out of Control Immigration Crisis Continues, Tax Credits, EU Referendum and BrExit

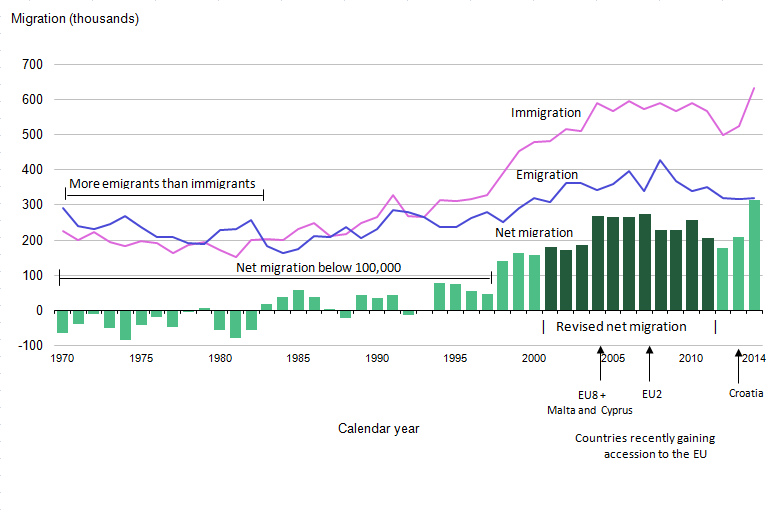

The Conservative governments failures to control immigration for the past 6 years is just a continuation of the Labour immigration catastrophe that set in motion a 17 year long immigration mega-trend for importation of over 8 million people (total immigration) where approx 90% of the adults were expected to vote Labour (at least 90% on benefits such as tax credits) as the following graph illustrates.

"Overall, net immigration would be kept in the tens of thousands, rather than the current rate of hundreds of thousands”. - David Cameron 2010

When David Cameron took power in 2010 he promised that he would cut net immigration by 2015 to the tens of thousands from the then disastrous annual figure of 205,000, instead the latest data from the ONS shows that net immigration remains OUT OF CONTROL at levels far higher level than 2010 disastrous figure that today stands well above 300k and trending towards 400k per annum.

The bottom line is that the UK government demonstrably has NO CONTROL over Britain's borders which means that out of control immigration WILL CONTINUE TO PERSIST and the trend for which is EXPONENTIAL.

Whilst a BrExit would likely see net migration fall to approx 100k per annum which converts into net migration of about 1.4 million, whilst still painful, i.e. these extra mouths to feed would need about 1/2 million EXTRA homes to be built to house them, nevertheless is less than 1/3rd the catastrophe that a vote to REMAIN would herald.

For more on the deconstruction of the REMAIN camps propaganda see the following on Chancellor George Osborne's UK Government (Treasury) report that concludes that leaving the EU would cost the UK potential future GDP growth of 6.2% (Canada model) per annum by 2030 in relative terms, whilst probability instead favor's the exact opposite would happen.

And also see my facts check of the Conservative Governments propaganda leaflet.

Ensure you are subscribed to my always free newsletter (only requirement is an email address) for new analysis and forecasts including for the following :

- US Dollar Trend Forecast

- UK Housing Market Trend Forecasts

- US Stock Market Forecasts

- US House Prices Detailed Multi-Year Trend Forecast

- Gold and Silver Price Forecast

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.