Central Planners Versus Contrarian Logic

Stock-Markets / Financial Markets 2016 May 05, 2016 - 04:39 PM GMTBy: Doug_Wakefield

"For every action, there is an equal and opposite reaction" - Newton's Third Law, The Physics Classroom

"For every action, there is an equal and opposite reaction" - Newton's Third Law, The Physics Classroom

Since the Great Recession, anyone following financial history and markets knows that this period of intervention and debt has surpassed everything seen in history prior to the events of 2007-2009. For every pull back in "risk on" assets, there have been actions to make sure equity markets went higher or back to previous highs, the lead example worldwide being US equity markets.

The problem with this level of central planning and intervention is that central bankers have tried to redefine the very laws of physics. Newton's third law now should read;

"For every action by the natural forces of the global economy from too much debt and assistance, more debt and assistance is applied to stop an opposite reaction."

If your personal debts skyrocket and your income stays the same or falls, you eventually expect the person to file bankruptcy, bring in more income, or restructure their debts.

If your business follows the same path, you expect the same methods in order to correct this problem.

Yet if you are a central banker, rules that apply to the public and private sectors need not apply. More debt will "always" be available to crush economic growth until we HAVE economic growth.....or so the theory goes.

As long as investors experience positive returns or are given the hope of more upside from the state's assistance, the public at large eventually is ready to punt free markets and capitalism and replace it with this form of global financial socialism.

One's experience is the measuring rod, whether investor or manager. Logic from the laws of physics and financial history are no longer needed.

Or are they?

The Big Data Picture

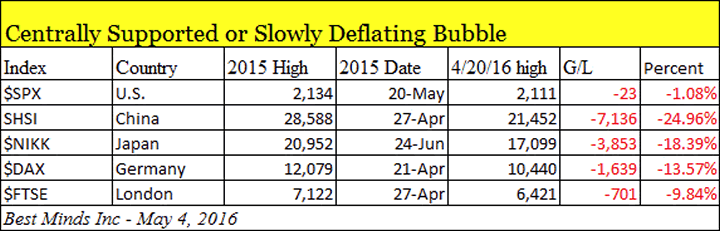

Since the February 2016 low, the cheerleaders have been looking for a future breakout in the US stock bull to produce yet another all time high. Let's examine what took place over the 10-week rally into the current April 20th top in US stock indices, and consider the S&P 500's high based on various markets and timeframes.

We can see from the chart above, that from their 2015 highs until their April 20th 2016 highs, the other four global equity markets went much lower than the S&P 500. Is the US lagging the global bear, or the rest of the global equity markets lagging the next phase of the third longest US stock bull on record?

Next we can see that the two counter rallies in the S&P 500 over the past 11 months did not managed to push it through its May 20, 2015 all time high.

Can it? Sure. But not without TRUSTING that more debt and state intervention is the way to feed the bull.

But there is more.

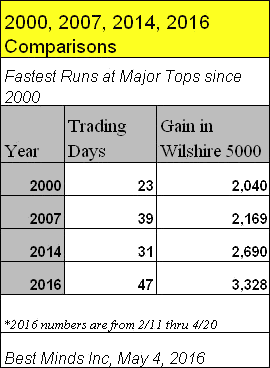

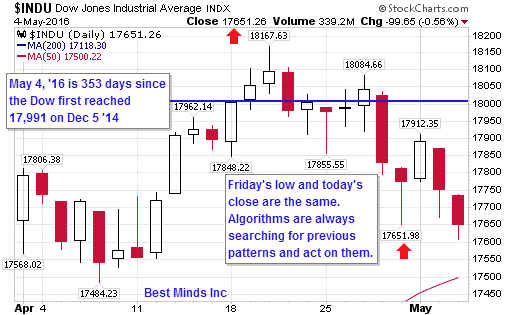

In December 2014, I produced this chart in the article, 10 Years of 'Why Sell Now?' This rare data was released with a chart of the Dow through the December 5, 2014 high (17,991). This marked the first attempt at taking out 18,000 in the Dow.

Through 2015, the record ascent in Q4 2014 held. The speed of "I must get in now", or more correctly, "hammer all shorts", produced a record never seen at an all time high. However, the second corrective wave that took us from February 11th through April 20th, ten weeks, handily broke the 2014 record.

So while the S&P 500 could still break the 2,111 level reached on April 20th, the friction in this centrally planned stock bull mania is already deep into overtime.

Do we really expect the rest of the world to suddenly ignite economic growth from negative interest rates after the Federal Reserve's 7 years of a zero interest rate policy did not do it?

Are stock bulls today considering the fact that the S&P 500 only gained 41 (1.9%) points between the 2014 high (2093, 12/29) and the 2015 high (2134, 5/20), and that took 20 weeks? What was the economic miracle or break through that ushered in a 16.6% rally in 10 weeks this spring? Was it Draghi's trillion euro scheme to buy corporate bonds after his previous 2 trillion euro schemes have failed since 2011?

We move on.

Algorithms Have Distorted Systemic Risk

When the NASDAQ 100 reached its highest level ever (4,816) on March 24, 2000 - nothing in 2015 broke this record - it began to fall sharply. 11 months later to the day it was down 60%. What the S&P 500 gained between October 2002 and October 2007 was completely wiped out in 13 months. Eleven months from the October 11, 2007 top, the world was three days from learning that Lehman brothers had filled bankruptcy.

The most powerful tool in the game of central planners today is not money but algorithms. We have seen markets soar, hang around a top, then act like they were literally struggling to decline. This is polar opposite of how humans act. The Dutch Tulip Bulb, the 1929 crash, the Japanese blow off in 1990 or dot.com meltdown, all started with a panic to get out.

Yes the central banks are seeking to prop up this game through purchasing assets from the banks that they themselves can never sell in bulk to anyone who doesn't own a printing press. But without algorithms to kick in at previous short-term bottoms over and over and over again, Newton's law would have long ago hammered this stock bubble. The stare step effect we have watched would not be part of this ongoing drama at these market highs.

But herein lies the mega problem. With every passing week, the image from this speed of light computer game is further removing the public's perception of financial and economic risks that continue to mount in the real world.

A Major Warning From Tom McClellan: "Can This Possible End Well?", Zero Hedge, April 27 '16

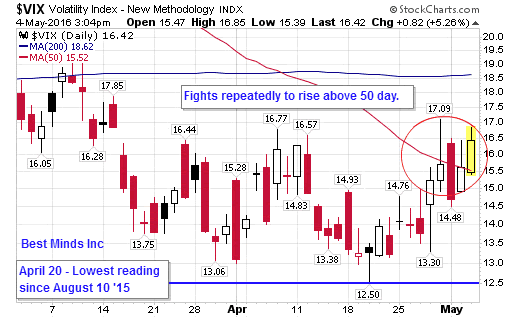

Read the post regarding Tom McClellan's comments on what has been taking place in the VXX, a VIX tracking ETN. Then look at the chart below.

Was it mere chance that the lowest reading of the VIX since August 10, 2015 (most complacent) took place on the day April options expired? Why after breaking sharply through the 50 day moving average did "the crowd" sell immediately last Friday, then Monday and Tuesday? Why on Wednesday did the VIX continue selling off at the end of the day?

Could the state (central bankers) actually front run and hammer other markets so that money flowed back into stocks based on algorithms? No way, just some sci-fi movie I must have seen.

Be a Contrarian, Not A Central Banking Dependent

Sadly, contrarian investors and traders continue giving up on our markets. They know something has been wrong for a long time, but the wild volatility and huge rallies have led them to believe that no one can win by being OPPOSITE the herd at the top of a mania.

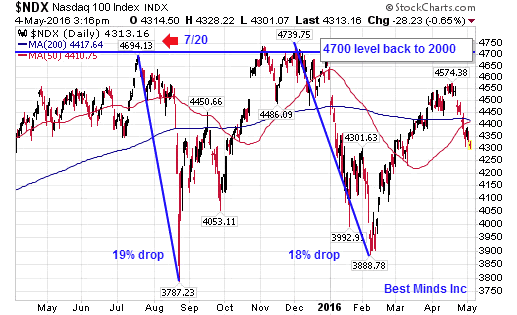

A good example of why this is not the case, is the action of the NASDAQ 100, one of the hottest markets going into its all time high not last spring, but back in 2000! On March 24, 2000, as stated earlier, it reached 4,816. The 2015 high was on Dec 2nd, when it reached 4,739, its second highest annual record.

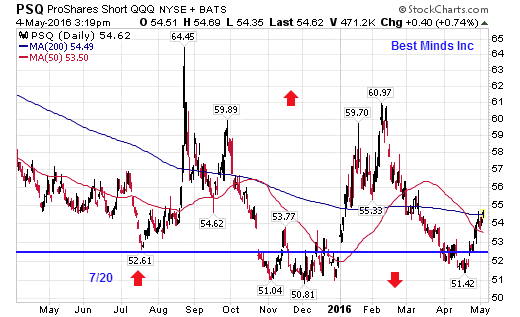

Now look at the chart of the PSQ. For disclaimers, I do work with traders with decades of experience who currently have positions in the PSQ, and I myself discuss the benefits of inverse ETFs. Why not, they worked in the 2008 collapse. In a deflationary bust these tools are designed to help investors and traders.

On July 20, 2015, the NASDAQ 100 came within 6 points of 4700. It then lost 19%.

After a major rally last fall, it closed above 4700. It managed to close above this watermark only 5 days in November and two days in December, never closing even 0.5% above this level. The only other day in the history of the index to close above 4700 was on March 27, 2000.

So while there is a plethora of speculation on the upside of markets, there is also a plethora of history behind prices across markets that reveal previous extremes. I believe this is extremely critical data, when trying to keep one's mind clear of clutter in a sea of misinformation, and constant "assistance" in markets.

Heck, even a report released last fall by the G-30 revealed that central bankers not only have limits, but years of zero interest rate policies and money printing were not enough to create economic growth.

Central Bank Calvary Can No Longer Save The World, Reuters, Oct 10 '15

"In 2008 central banks, led by the Federal Reserve, rode to the rescue of the global financial system. Seven years on and trillions of dollars later they no longer have the answers and may even represent a major risk for the global economy.

A report by the Group of Thirty, an international body led by former European Central Bank chief Jean-Claude Trichet, warned on Saturday that zero rates and money printing were not sufficient to revive economic growth and risked becoming semi-permanent measures.

'Central banks have described their actions as 'buying time' for governments to finally resolve the crisis... But time is wearing on, and (bond) purchases have had their price,' the report said."

Be a Contrarian, Remember Your History

The reason I assembled the interviews and history found in Riders on the Storm: Short Selling in Contrary Winds (Jan '06), was because it was obvious from what I was learning from the Mises Institute and the Austrian school of economics that flooding the system with trillions in ultralow interest rates was going to lead to another major bust. The ideas in this paper were put to the test in the Great Recession. If you have yet to read this research paper, it can be downloaded free from the Best Minds Inc website.

To gain access to the most up to date research, click here to start a six month subscription to The Investor's Mind. Critical thinking has never been more important for each of us, no matter what your background.

On a Personal Note

Check out the posts at my personal blog, Living2024. The latest post is Do Money Rail Lines End?

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.