SPX is at Strong Resistance

Stock-Markets / Stock Markets 2016 May 25, 2016 - 12:57 PM GMT Today’s Premarket shows us why there is always an alternate view of the Wave patterns. The decline to 2025.91 was too shallow and overlapping to be an impulse, although it could have been easily mistaken for one.

Today’s Premarket shows us why there is always an alternate view of the Wave patterns. The decline to 2025.91 was too shallow and overlapping to be an impulse, although it could have been easily mistaken for one.

I have put in a “line in the sand” at 2084.87. The SPX rally may not stop precisely on it, but it may provide serious resistance to going much further.

ZeroHedge comments, “The single biggest event overnight was the PBOC's devaluation of the Yuan to the lowest since March 2011, setting the fixing at 6.5693, the highest in over 5 years and in direct response to a stronger dollar, which however if one looks at the DXY remains well below the recent highs in the 100 range, suggesting for China this is only just beginning.”

You may recall that China had been devaluing its Yen for about two weeks before the August 24 flash crash. The Yuan appears to be probing new lows which may add danger the risk-off scenario.

Jeff Gundlach comments, “In his latest contrarian comments to Reuters, Jeff Gundlach focused on the recent flipflopping by the Fed and its various speakers who are now positioning the market for an imminent rate hike despite the US economy still treading water, and said that while many Fed officials are "dying to raise rates," but all that matters is Janet Yellen's opinion, a glimpse of which we will get as soon as this Friday when she speaks at Harvard. "All that matters is Yellen. She is still there."

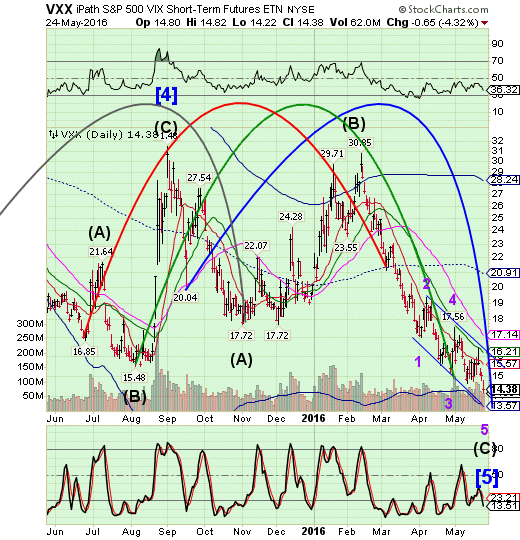

Instead of showing VIX this morning, I have decided to show VXX, ,which is approaching its Master Cycle low (VIX is not). Today is day 251 of the current Master Cycle, so I suspect that the decline may last through the end of the week. It has a technical support at 13.79 that may bring this decline to a close even sooner, should the decline continue at this pace.

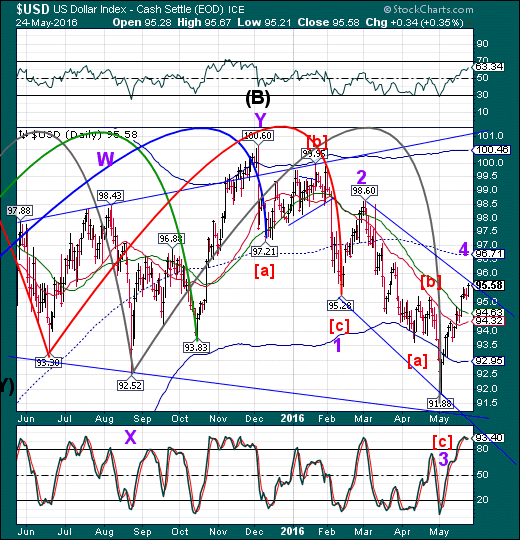

USD nudged a little higher this morning, but appears ready for its next decline. The Cycles Model suggests a decline through the month of June to reach its targeted low at 90.50.

While the euro is declining precipitously, the Yen is still in its rising trading channel. It appears that there may be some confusion in the currency markets until the USD finds its final support.

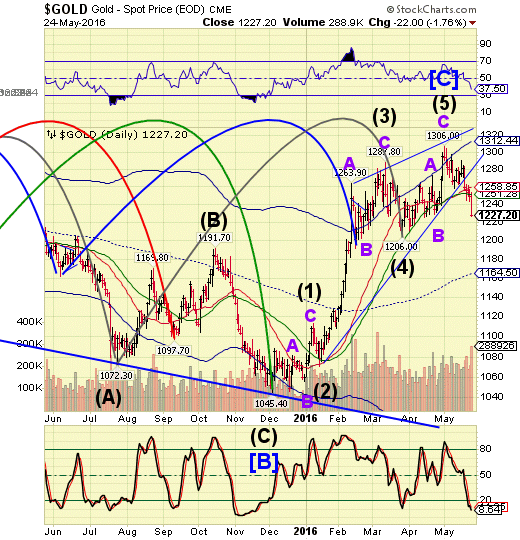

Gold reached a new low of 1220.50 this morning, but as I had previously commented, it is due for a Master Cycle low by Friday. We may see a bounce at any time, since today is day 257 of the current Master Cycle.

There may be a better short entry in the next 2-3 weeks.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.