SPX Still Working on Final Wave?

Stock-Markets / Stock Markets 2016 Jun 06, 2016 - 03:11 PM GMT SPX is challenging its Thursday afternoon high at 2105.26. It appears that it is still working on Wave 5. This may be the final thrust ending near 2110.00. If so, it may not change the wave structure illustrated in the chart.

SPX is challenging its Thursday afternoon high at 2105.26. It appears that it is still working on Wave 5. This may be the final thrust ending near 2110.00. If so, it may not change the wave structure illustrated in the chart.

Earlier this morning, ZeroHedge reported, “Every ugly jobs report has a silver lining, and sure enough following Friday's disastrous jobs report, global mining and energy companies rallied alongside commodities after the jobs data crushed speculation the Fed would raise interest rates this month. “The disappointing U.S. jobs report on Friday means that a summer Fed rate hike is off the table,” said Jens Pedersen, a commodities analyst at Danske Bank. “That has reversed the upwards trend in the dollar, supporting commodities on a broader basis. The market will look for confirmation in Yellen’s speech later today.” While commodities benefited from USD weakness, the pound slumped following polls that showed Britons favor exiting the European Union. European stocks and U.S. stock index futures are little changed. Asian stocks rise.”

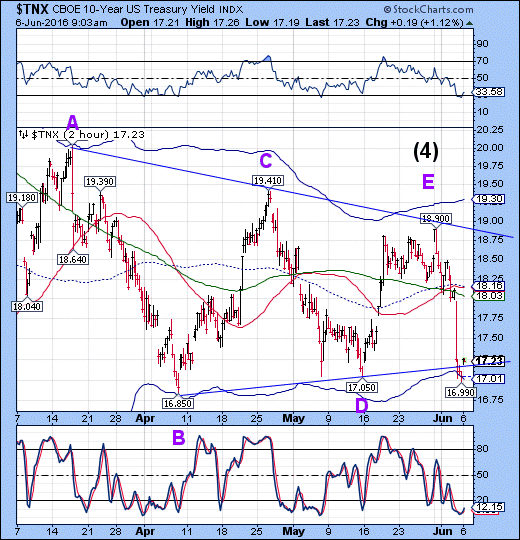

TNX is bouncing this morning. It may have completed Wave A of an Ending Diagonal Wave (5). However, we will let it play out a bit before labelling it. Wave B may go as high as the 50-day Moving Average, but having broken through the lower Triangle trendline, it may not tarry above it very long.

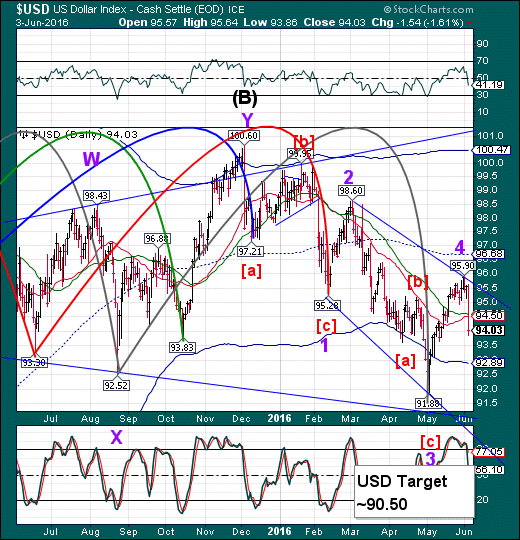

USD bounced to 94.27 in a bit of a retracement this morning. It may go as high at the 50-day Moving Average at 94.55 before resuming its decline.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.