Stock Market Exuberant New All Time Highs

Stock-Markets / Stock Markets 2016 Jul 14, 2016 - 03:02 PM GMTBy: James_Quinn

The stock market has reached new all-time highs this week, just two weeks after plunging over the BREXIT result. The bulls are exuberant as they dance on the graves of short-sellers and the purveyors of doom. This is surely proof all is well in the country and the complaints of the lowly peasants are just background noise. Record highs for the stock market must mean the economy is strong, consumers are confident, and the future is bright.

The stock market has reached new all-time highs this week, just two weeks after plunging over the BREXIT result. The bulls are exuberant as they dance on the graves of short-sellers and the purveyors of doom. This is surely proof all is well in the country and the complaints of the lowly peasants are just background noise. Record highs for the stock market must mean the economy is strong, consumers are confident, and the future is bright.

All the troubles documented by myself and all the other so called “doomers” must have dissipated under the avalanche of central banker liquidity. Printing fiat and layering more unpayable debt on top of old unpayable debt really was the solution to all our problems. I’m so relieved. I think I’ll put my life savings into Amazon and Twitter stock now that the all clear signal has been given.

Technical analysts are giving the buy signal now that we’ve broken out of a 19 month consolidation period. Since the entire stock market is driven by HFT supercomputers and Ivy League MBA geniuses who all use the same algorithm in their proprietary trading software, the lemming like behavior will likely lead to even higher prices. Lance Roberts, someone whose opinion I respect, reluctantly agrees we could see a market melt up:

“Wave 5, “market melt-ups” are the last bastion of hope for the “always bullish.” Unlike, the previous advances that were backed by improving earnings and economic growth, the final wave is pure emotion and speculation based on “hopes” of a quick fundamental recovery to justify market overvaluations. Such environments have always had rather disastrous endings and this time, will likely be no different.”

As Benjamin Graham, a wise man who would be scorned and ridiculed by today’s Ivy League educated Wall Street HFT scum, sagely noted many decades ago:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Short-term traders can make immediate profits using momentum techniques, following the herd, and picking up pennies in front of a steamroller. Remember your brother-in-law who was getting rich day trading stocks in 1999? Remember your cousin who was getting rich flipping houses in 2005? Remember The Big Short, where the Too Big To Trust Wall Street banks were getting rich creating fraudulent mortgage derivatives and selling them to suckers? There are always profits to be made for awhile. Then the bottom drops out, because fundamentals, cash flow, valuations, and reality matter in the long run.

Lance Roberts points out some inconvenient facts, and I’ll point out a few more.

“It is worth reminding you, that while the markets are moving higher and pushing new highs currently, it is doing so against a backdrop of weak fundamentals, high valuations, and deteriorating earnings.”

History might not repeat itself, but it certainly rhymes. Late in 2007, as the housing collapse was well under way, the stock market hit all-time highs of 1,575 in October. The bulls were exuberant, even as the greatest housing crash in history was evident to everyone except Bernanke and Paulson. Corporate earnings were falling. Valuations were at levels only seen in 1929 and 2000. The so called “doomers” like Hussman, Shiller and Schiff were warning of an impending crash. Very few heeded their warning. In retrospect, the economy was already in recession by December 2007 despite economic reports saying otherwise. GDP and other falsified economic indicators were revised negative years after initially being reported as positive. Familiar?

The stock market dropped 20% from the October high by March of 2008, as Bear Stearns collapsed and struck fear into the hearts of the Wall Street sociopaths. But the Fed and their Wall Street puppeteers needed to keep the game going a little longer so they could short their own fraudulent derivative creations and screw over their clients once more. JP Morgan, which was just as insolvent as Bear Stearns, bought them and restored confidence in the ponzi scheme. The market proceeded to soar by 12% over the next two months. All was well!!! Until the bottom fell out in September. By March 2009, the market had fallen 58% from its October 2007 high.

The market topped out in May of 2015 at 2,126. Since then, corporate profits have been in freefall, consumer spending has been in the toilet, GDP has been barely positive, and virtually every economic indicator has been falling. Valuations are now higher than at the 1929, 2000, and 2007 peaks. The median existing home price of $239,700 is 55% higher than the median price in 2012. At the peak of the housing bubble in 2005/2006 the median price to median wage ratio reached 9.5. In 2012 it had fallen to a reasonable level of 5.6. It currently stands at a bubble like level of 8.3.

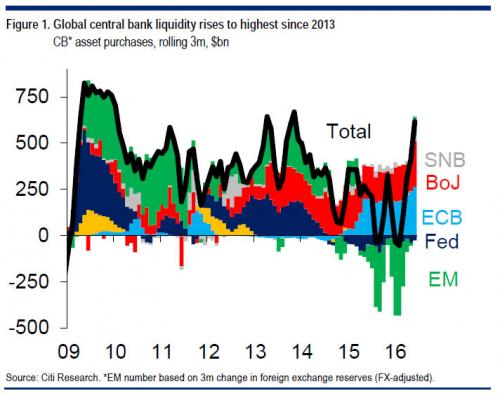

The market meandered about for the next seven months going nowhere. It then suddenly dropped in January and February, falling 13% from its May 2015 high. This was unacceptable to central bankers around the globe who believe stock market gains are the only factor reflecting the health of our economic system. Maybe it’s because they are only beholden to bankers, oligarchs, corporate chieftains, corrupt politicians, and unaccountable bureaucrats. Central bankers from around the world have come to the rescue by buying stocks and providing unlimited liquidity to banks and corporations so they can buyback their own stocks. The result, is new record highs.

It has the feel of JP Morgan “rescuing” Bear Stearns and saving the world in early 2008. Smoke, mirrors, negative interest rates, debt creation, money printing and the artificial elevation of stock valuations by central bankers and their politician co-conspirators is not creating wealth. It is creating epic bubbles in stock markets, bond markets, home real estate markets, commercial real estate markets, and automobile markets. John Hussman chimes in with a reality based assessment of their reckless actions:

“Instead, central bankers seem to view elevated security valuations as “wealth.” The longer this fallacy persists, the worse the subsequent fallout will be. I have little doubt that future generations will look at the reckless arrogance of today’s central bankers no differently than we view speculators in the South Sea Bubble and the Dutch Tulip-mania. Unfortunately, there is no mechanism by which historically-informed pleas of “no, stop, don’t!” will penetrate their dogmatic conceit. Nor can we change the psychology of investors.”

Today is just a continuation of the bubble blowing policies of the Fed and their central banker cohorts at the ECB and BOJ. These policies are deranged, illogical, and always result in the destruction of real wealth. Promoting financial engineering, while destroying the incentive to save and invest in the real economy has gutted true investment in our country. This is why good paying jobs have disappeared and we are left with the gutted remains of decades of financialization and globalization. As Hussman points out, our real economy has died a long slow death, drowning in debt.

“One of the hallmarks of the bubble period since the late-1990’s is that the growth rate of real U.S. gross domestic investment has slowed to less than one-quarter of the rate it enjoyed in the preceding half-century. Yet because central banks have stomped on the accelerator at every turn, the quantity of outstanding debt has never been higher, and the combined value of corporate equities and debt (“enterprise value”) is now at the highest multiple of corporate gross value-added since the 2000 bubble extreme.”

Artificially boosting stock prices through convoluted liquidity schemes, devious machinations, backroom central banker deals, sending Bernanke to Japan, and helicopter money dropped on Wall Street only, has just exacerbated the wealth inequality permeating the world. The anger over this blatant pillaging by the .1% who rule the world is reflected in the chaos across Europe and the brewing civil war here in the U.S.

As Hussman notes, no wealth is being created because no productive investments are being made. Mega-corporations buying back hundreds of billions of their own stock to enrich their executives is not a productive wealth creating venture. We are in the midst of a sickening crisis created by appalling incentives, driven by sociopathic corporate and political leadership captured by their greedy desire for power wealth and control. The sickness is pervasive and terminal.

“In a healthy economy, savings are channeled to productive investment, and the new securities that are issued in the process are evidence of that transfer. In an unhealthy economy, and particularly one with very large wealth disparities, a large volume of securities may be created, but they are often simply a way of supporting debt-financed consumption. As a result, no productive investment occurs, and no national “wealth” is created. All that occurs is a wealth transfer from savers to dis-savers. Over the past 16 years, U.S. real gross domestic investment has crawled at a growth rate of just 1.0% annually, compared with a growth rate of 4.6% annually over the preceding half-century. There’s your trouble.”

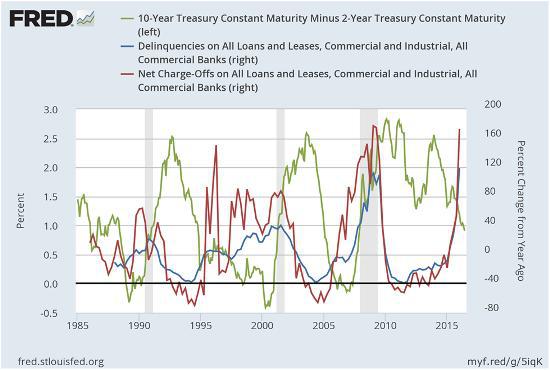

A chart that caught my eye this week, along with dozens of other data points from the real world, reveals the phoniness of the stock market rally and the underlying weakness of this tottering edifice of debt. We are supposedly in the seventh year of an economic recovery. Corporate profits have been at record highs. Interest rates are at record low levels.

The Fed and the FASB have colluded to allow banks and commercial real estate companies to fake their financial statements and pretend their assets are worth more than they are and to pretend rental income from non-existent tenants in their malls and office buildings can cover their debt payments. And somehow delinquencies and charge-offs are soaring by levels seen during the height of the 2008/2009 financial crisis. It seems all those vacant mall storefronts and all those FOR LEASE signs in front of every other commercial building across America are finally coming home to roost.

This faux economic recovery has been driven by debt, with much of it subprime. The shale oil scam was built on high yield debt and false promises. The Wall Street banks reported fake profits for years by relieving their loan loss reserves created in 2009. Now the table has turned.

The three largest banks in the US—Bank of America, JPMorgan Chase, and Wells Fargo—disclosed that the number of delinquent corporate loans increased by 67% in Q1.

- JPMorgan’s delinquent corporate loans increased by 50% to $2.21 billion

- Bank of America’s delinquent loans increased 32% to $1.6 billion

- Wells Fargo’s delinquent loans increased by 64%, to $3.97 billion

The banking industry added $1.43 billion to the total money it has set aside to cover bad loans in Q4 2015, according to the FDIC. Making bad loans to deadbeats can make profits look spectacular in the short-term, but interest and principal can’t be paid with a cool business plan and a narrative. Cash flow is a necessary ingredient to servicing debt in the real world. The fun has just begun. Fitch Ratings just reported that the default rates for junk bonds rose to 3.9% this month, up from 2.1% in April 2015.

The “tremendous” auto recovery which drove sales (I use the term loosely since 31% of sales are actually leases and the rest are financed over an average of 67 months) from 10 million in 2010 to 18 million in 2015 has been completely driven by easy money provided to Wall Street. It’s amazing how many vehicles you can sell by doling out $350 billion in 0% loans and allowing “buyers” to finance 100% of the purchase.

When they started to run out of legitimate suckers who liked being perpetual debt slaves, they used the tried and true method that worked so well with housing in the mid-2000s – loaning money to losers who weren’t capable of repaying them. This Wall Street mindset is driven by the free money provided them by the Fed. You borrow from the Fed at 0%, lend it to deadbeats at 12% for 72 months so they can “buy” that $40,000 Cadillac Escalade and boost the economy. Over 20% of all auto loans are now being made to subprime (aka deadbeat) borrowers. Now the shit is hitting the fan belt.

Serious Delinquency Rates for Auto Loans by Term

| Risk Tier | |||

| Loan Term | Subprime | Prime | Super prime |

| 49-60 months | 22.4% | 3.4% | 0.4% |

| 61-72 months | 22.8% | 5.0% | 0.9% |

| 73-84 months | 30.7% | 7.1% | 1.8% |

Financing 100% of overpriced automobiles, extending terms, pretending you will get repaid, and recording it as a sale is the corporate/banker method of creating wealth. Auto loan terms between 73 and 84 months more than doubled between 2010 and 2015. One quarter of all loans originated in Q3 2015 were between 73 and 84 month terms, compared to just 10% in Q3 2010. The average new-car loan rose to $29,551 during the fourth quarter of 2015, up more than 4% over the past year, according to Experian, one of the three major credit-reporting agencies.

The chickens are coming home to roost for subprime auto lenders and investors, with Fitch Ratings warning delinquencies in subprime car loans had reached a high not seen since October 1996. The number of borrowers who were more than 60 days late on their car bills in February rose 11.6% from the same period a year ago, bringing the delinquency rate to a total 5.16%. Subprime lending always ends in tears. Wall Street is probably betting against these packages of subprime slime while simultaneously selling them to their muppet clients. History rhymes.

These subprime auto loans look positively AAA compared to the hundreds of billions in subprime student loans distributed like candy by Obama and his government minions to artificially lower the unemployment rate and again boost the economy. Student loan delinquencies are already skyrocketing before the $400 billion doled out in the last four years has come due. The official delinquency rate reported by the government of 11% is another falsehood. The delinquency rate is really 17% when loans in deferment and forbearance — for which payments are postponed due to any reason — are included. The taxpayer will eventually foot the bill for at least $400 billion in losses.

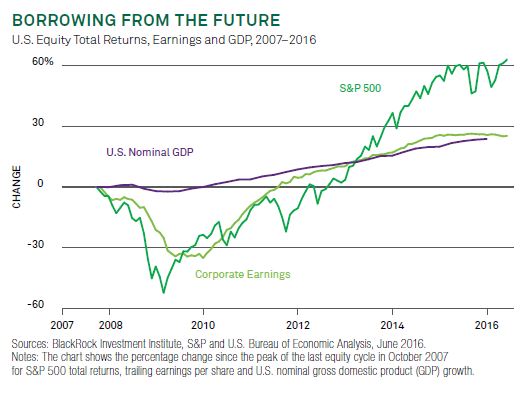

We’ve been borrowing from the future for the last 16 years because real economic growth was killed by Greenspan, Bernanke, Yellen and the rest of the Fed yahoos. The stock market has returned 60% since the 2007 peak, three times the growth in corporate profits and GDP. The all-time highs in the stock market have been driven by the $3.4 trillion increase in the Fed’s balance sheet, hundreds of billions in stock buybacks, PE expansion, and ZIRP. The valuation of the median stock is now the highest in history.

For all I know the stock market could continue to rip higher. Madness knows no bounds. The general public is not involved in this madness. They were wiped out twice in the space of eight years. Wall Street and their media mouthpieces have been unable to lure the average Joe back into the casino because the average Joe has been impoverished by Fed policies designed to benefit the .1%. The Wall Street lemming herd has gone mad, but I’m not sure they will recover their senses before they burn the entire demented financial system to the ground. But enjoy the all-time highs while they last.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2016 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.