Stock Market Top is Expanding

Stock-Markets / Stock Markets 2016 Jul 25, 2016 - 12:07 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: The long-term trend is at an all-time high.

SPX Intermediate trend: The uptrend from 1810 has continued to a new high.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

TOP IS EXPANDING

Market Overview

In last week's letter, I suggested that SPX had come to a minor top. For the past week the index has traded between 2160 and 2175, which is the top of the current projection range. While it could go a couple of points higher, it looks to me as if it is still in the process of building a top, and this should be followed by a correction before we can continue the uptrend from 1810 in earnest. In the meantime, continued distribution at this level can only extend the size of the correction once it starts. 2160 has stopped all attempts at moving lower over the near-term. A conclusive break below would signal the beginning of a corrective decline.

For now, we have to think of this as a temporary high and not a final one since, as mentioned earlier, there are some potential unfilled projections reaching into the mid-2200. These are not chiseled in stone, but it would take strong evidence that these targets will not be met before they can be counted out.

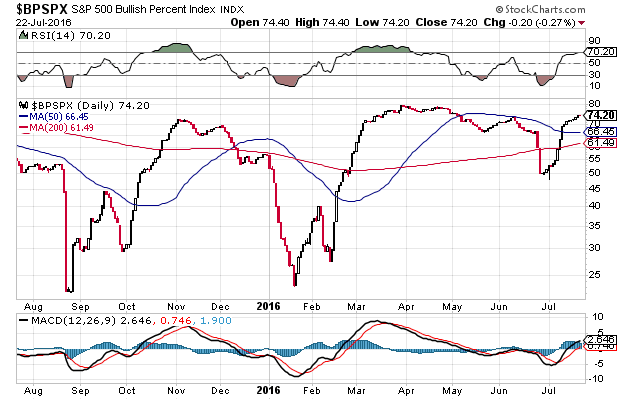

As we have done in the recent past, I want to show you the progress being made by BPSPX. Here is the current chart (courtesy of stockCharts.com): BPSPX has continued to rise but it is losing much of its upside momentum, which mimics what the SPX is doing. Note also that it remains well below its April high while SPX has now risen about 65 points above. Thus, this index continues to show relative weakness to SPX, suggesting that the latter may not be nearly as strong internally as it looks.

SPX Chart Analysis

Daily chart

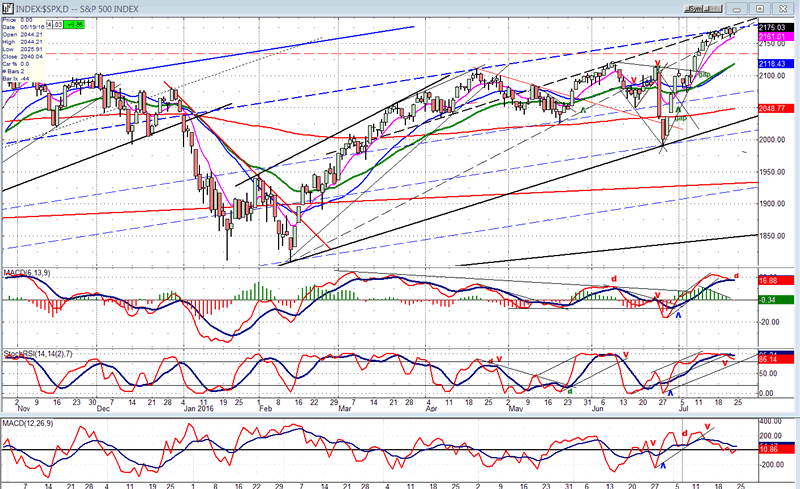

For the sake of variety, I am showing the SPX daily chart in another style. I have drawn a blue dashed parallel to the intermediate lower channel blue line (higher), and a black dashed parallel to the trend line which connects the last two lows (1810 and 1992). As you can see, their conjunction point is creating some resistance for the index and has caused it to round over for the past 7 days. Since that area corresponds to a P&F projection taken across the 2090 level, these two factors may create a temporary high for the SPX followed by a minor correction before it attempts to continue its upward progress.

If a top does form at this level, there is already enough of a distribution pattern in place to take prices back to the former high of 2135, and perhaps even a little lower to the 2116-2120 tops. We should not expect more than that since these former tops should create a powerful support level. However, if we start to retrace more than that, we could start questioning the ability of SPX to reach the mid-2200s.

The loss of momentum in price has caused the three oscillators to roll over. The lowest one (the A/D oscillator) has reached the zero line and is waiting to see if it should go through. The other two are not quite as advanced, and since the MACD rose to its March level on this rally, a pull-back to the zero line may be all we get during the correction.

This chart and others below, are courtesy of QCharts.com.

Hourly Chart

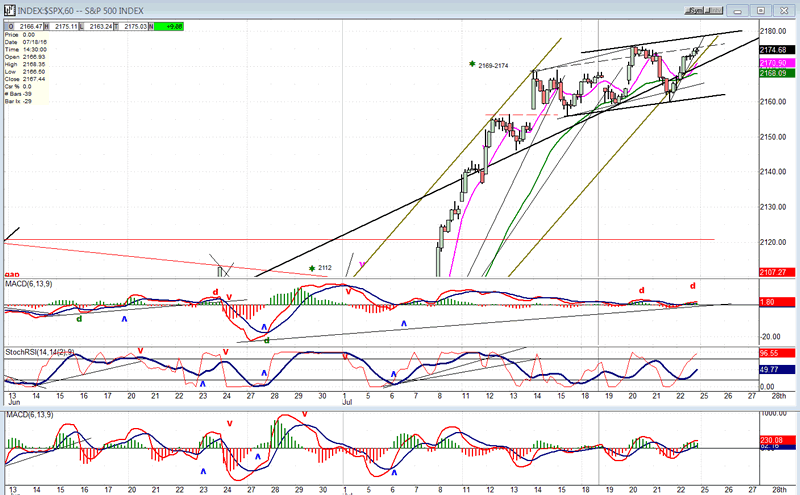

I am focusing the hourly chart on the top formation so we can see more clearly what the index is doing. On the left of the top are the projection numbers 2169-2174 -- which actually should be 2169-2175. That price has already been reached a few times, each time causing the index to pull back. It was reached again on Friday, but the close was near that level and a near-term projection suggests that it could move up to 2179 before peaking.

The oscillators are also not quite in a position to signal a top, so we could push a few more points before finding one. When we have a reversal below 2160, we will be able to estimate the size of the correction.

The price channel from 1992 has already angled over, but it is still fairly steep. The index is crawling along the lower channel line and appears close to breaking it, but we may require one more bounce from 2160 before starting a correction.

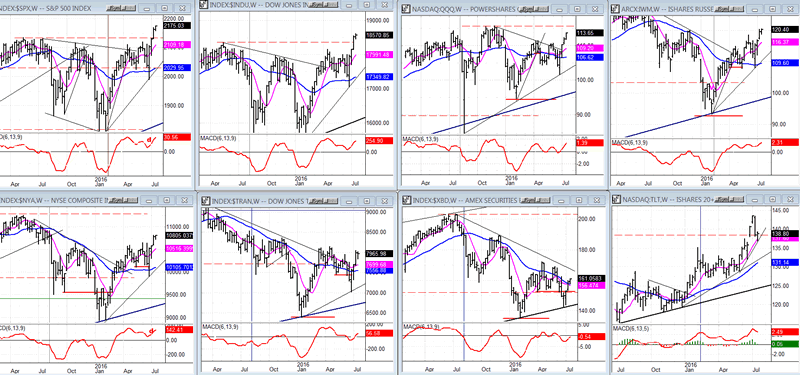

Some leading & confirming indexes (weekly)

SPX and DJIA are still the only indexes to have made new all-time highs except, of course, for TLT which also made an all-time high along with them -- somewhat of a contradiction. If we get a correction in the next week or two, the two main indices are likely to be the only ones to have moved above their 2015 highs. The two weakest indexes remain XBD and TRAN.

Continued strength in all the indices with, at least the QQQ making a new high, will be required if we are the reach the intermediate target.

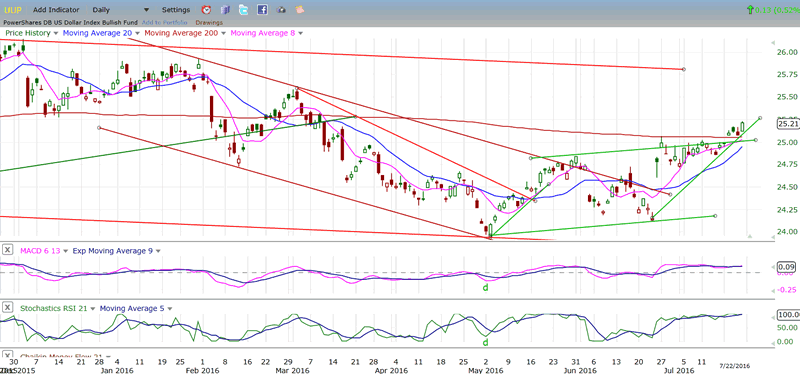

UUP (dollar ETF)

After a short period of consolidation, UUP has broken to a new rally high. Having overcome the 200-DMA, its next challenge will be to stay above the green uptrend line in order to tackle the former March high and the upper intermediate channel line around 25.75. Cycles are favorable for extending the uptrend, and this could be a problem for gold and oil.

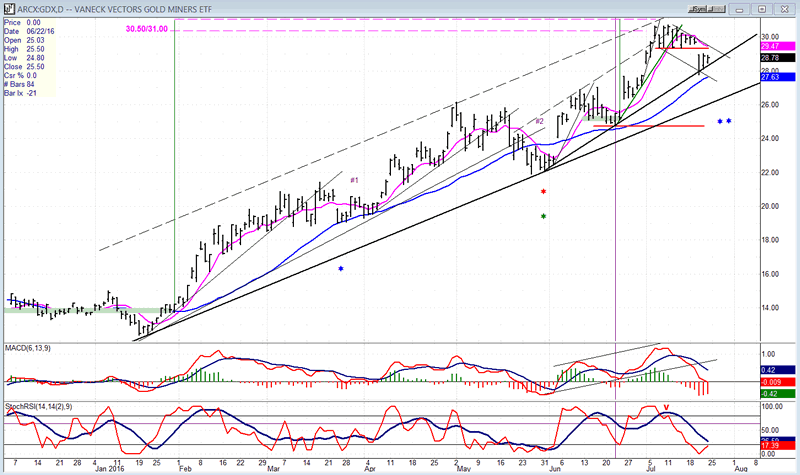

GDX (Gold Miners ETF)

GDX is in a daily uptrend which took it to the top of its channel where it filled the projection marked on the chart. It is also approaching a short-term cycle low which is due in the next few days. This combination ensured a short-term top and the correction that the index is currently undergoing. It is possible that it will continue to correct down to its lower channel line, especially if the dollar continues to rally over the short term, as it is wont to do.

Since there is no intermediate term deceleration in price, the index is very likely to make a new high after it completes its correction. That new high should be followed by a more extensive correction.

Note: GDX is now updated for subscribers throughout the day along with SPX, on Marketurningpoints.com

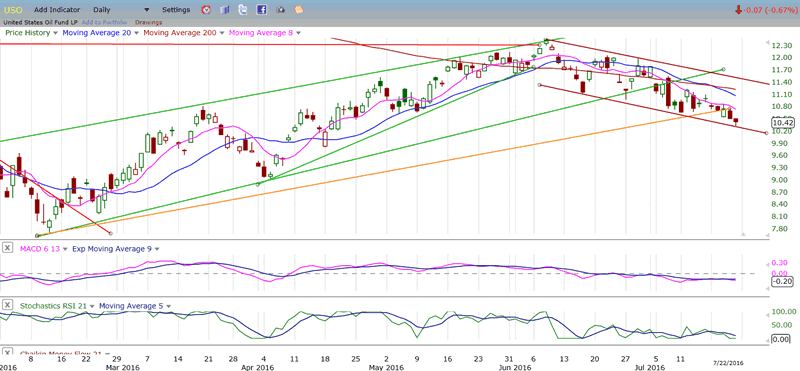

USO (US Oil Trust)

USO continues to correct after reaching its 12.00 projection. If it prints 10, it will signal a potential drop to 8.50-9.00

Summary

SPX has reached its stated short-term projection. This should bring about a reversal and the second correction since the 1992 low.

There is a very slight possibility that the pattern it is currently making will turn out to be a consolidation in an uptrend, immediately followed by a push to its intermediate target in the mid-2200s. Most of the time, however, this is a distribution pattern which resolves to the downside when complete. Next week's action should clarify the index's intention.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.