SPX, TNX May Finish their Rallies. BKX May lead the Decline

Stock-Markets / Financial Markets 2016 Jul 27, 2016 - 03:00 PM GMT Good Morning!

Good Morning!

At last there may be some resolution to this rally. The Triangle formation is an introduction to the terminal thrust for this rally. A Triangle formation also suggests this may be the last of the rallies. I drew the upper channel trendline in the same manner as the 2-hour chart. It shows a probable terminus of the last thrust closer to 2185.00. Given the rise in volatility that the Fed meeting may engender, it may be a more likely top than the minimum 2180.00 that I mentioned yesterday.

This morning ZeroHedge reports, “Following a rollercoaster night for the Japanese Yen, when following several media headlines Abe was said to have announced a stimulus package that would be more than JPY28 trillion, which however upon more careful reflection appeared less then met the eye (more in a subsequent post), Japanese stocks surged 1.7% while the USDJPY spiked but well off overnight highs, pushing risk assets higher.”

Apparently the Yen gave traders a rollercoaster ride last night.

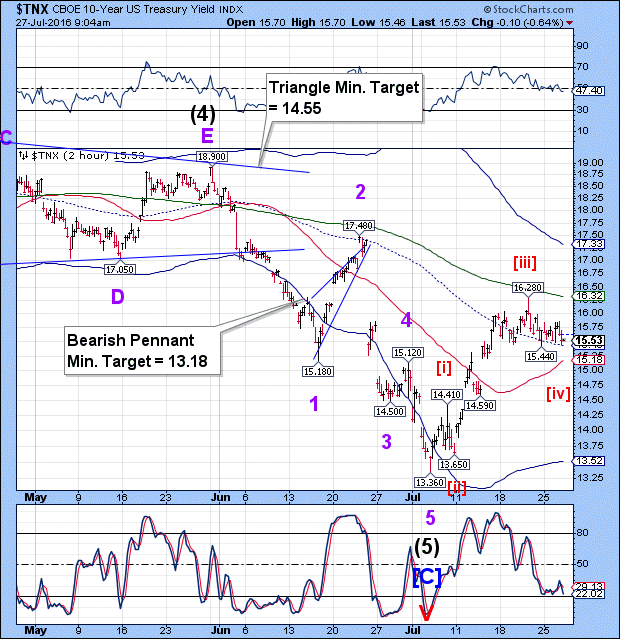

TNX appears to be nearly done with its retracement. There may be one final thrust lower, then a probable rally to the 2-hour Cycle Top at 17.33. This supports the observation that the SPX has a final move to the upside in tandem with TNX.

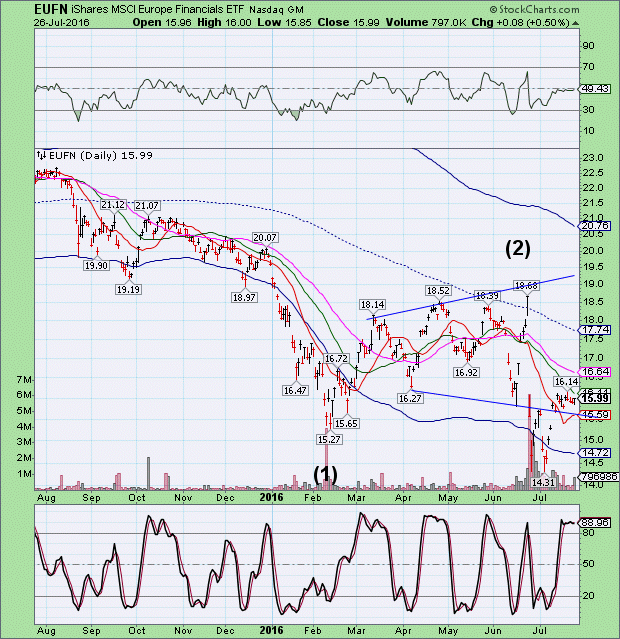

European financials are about to take a hit this morning as Deutsche Bank profit plunged 98%. Unfortunately, the future looks even worse.

Not surprisingly, BKX appears to be in similar straits. We may see BKX start its decline today as SPX finishes its speculative rally. BKX is still a leading indicator due to the large presence of financial stocks in the SPX.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.