SPX Premarket is Flat

Stock-Markets / Stock Markets 2016 Jul 28, 2016 - 02:38 PM GMT SPX Futures are still on a rollercoaster as the earlier rise in the Premarket is given up to a flat scenario.

SPX Futures are still on a rollercoaster as the earlier rise in the Premarket is given up to a flat scenario.

ZeroHedge reports, “Following yesterday's Fed decision and ahead of tonight's far more important BOJ announcement, European stocks have posted modest declines, Asian shares rise toward 9-month highs, while U.S. equity index futures are fractionally in the green in the aftermath of Facebook's blowout earnings. The dollar has extended on losses after Yellen reiterated a gradual approach to raising interest rates, with the BBDXY down 0.5% in early trading after slipping 0.4% over the previous two sessions.”

VIX has been flat this week. There is a probable impulse from the July 20 low. If so, a retracement may be underway. There will be more commentary as the pattern becomes clearer.

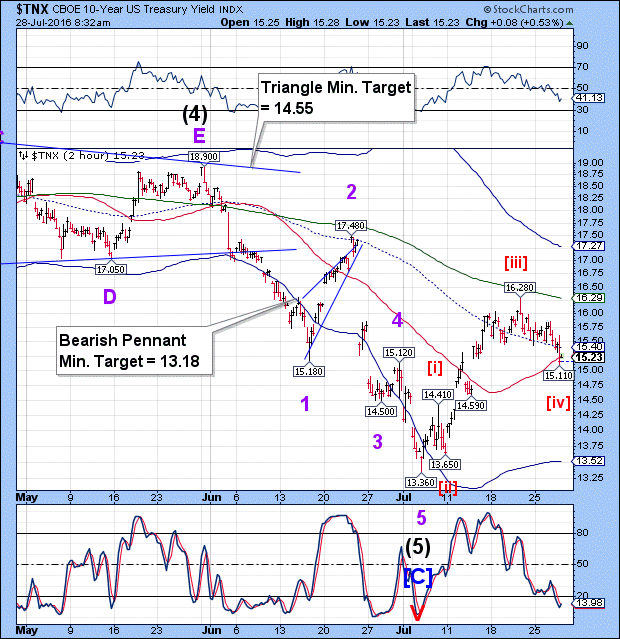

TNX appears to be in the final stages of its correction. If so, we may see TNX rise to its 2-hour Cycle Top at 17.27 or possibly higher before a correction. This may also verify whether the trend has changes, as TNX must have an impulse off the low to confirm the change in trend.

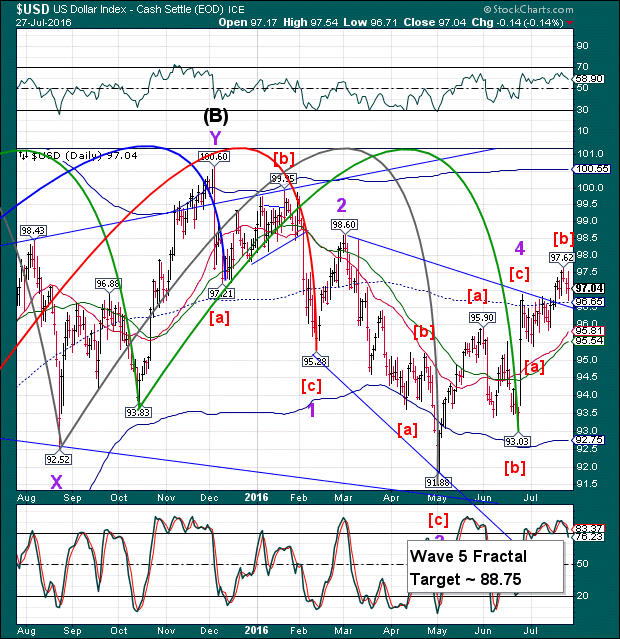

The more important news this morning is that the USD has declined beneath mid-Cycle support and the declining Wedge trendline to a low of 96.20. This confirms the structure on the chart and suggests a much lower USD in store.

Failure by the Fed to raise interest rates may not bode well for either stocks or bonds. It may also lead to a disconnect in the current relationship between stocks and bonds.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.