Energy Resources Bull Market Remains Intact

Commodities / Energy Resources Jul 24, 2008 - 05:23 PM GMTBy: Joseph_Dancy

Flooding last month interrupted rail traffic in the Midwest , disrupting ethanol production and shipments. Shipments of low-sulfur Power River Basin coal needed for many power plants has also been impacted. Coal inventories are already lean at many generating plants. Barge traffic has come to a standstill in many areas on the Mississippi River .

Flooding last month interrupted rail traffic in the Midwest , disrupting ethanol production and shipments. Shipments of low-sulfur Power River Basin coal needed for many power plants has also been impacted. Coal inventories are already lean at many generating plants. Barge traffic has come to a standstill in many areas on the Mississippi River .

The impact of the floods on the global agricultural and energy markets in our opinion will be much larger than expected. We think the extent of these impacts will become evident quite soon, and will be reflected in the markets.

The U.S.D.A. estimate of the crop damage caused by the Midwest flooding in our opinion underestimates the extent of crop loss, and the yield – productivity per acre, could be significantly impacted by the ongoing weather conditions. In addition to the flood many grain growing areas in North America have been abnormally cool this spring which should reduce field productivity.

Meanwhile the hurricane season for the Atlantic basin started in earnest July 1 st . Forecasters have laid one-in-three odds a hurricane will impact oil and gas facilities in the Gulf of Mexico (chart from Accuweather.com).

Keep in mind that 25% of the crude oil and 18% of natural gas produced in the U.S. comes from Gulf waters. Roughly one-third of the nation's refining capacity is also located on the Gulf coast.

To say nothing of crude oil production and exports from Mexican waters – which continues to plummet in a manner that is truly alarming to most observers – even without hurricane.

Mexican crude oil exports – which have historically gone mainly to the U.S. – in the first four months of the year decreased 14.8% from year earlier levels. Much of this decline is due to production issues at the massive Cantarell field located in the Gulf of Mexico . Target production for this field has fallen well below expectations.

Figures released by the Russian government last month also surprised analysts. That country's crude oil production fell for a fourth straight month in April. Experts had expected production to continue to increase in 2008. Russia has become the world's largest producer with enormous gains in production over the last decade, however those production gains are now history.

Meanwhile more Nigerian crude oil production was shut in last month due to violence and political instability – and production has fallen to 25 year lows.

Summer weather . The interruption of coal shipments by rail from the Power River Basin due to the flood, if extended for any length of time, could provide a boost for natural gas fired generating facilities during the summer months.

Natural gas use for electrical generation purposes has increased 5.6% per year for the last decade as most new capacity added to the electrical grid is natural gas fired. Issues with coal supplies, if they occur this summer, should only increase that rate of growth.

Year-over-year power generation in the U.S. increased slightly more than 1% over year earlier levels according to data from the Edison Electric Institute – which means fuel demand for power generation continues to expand.

The strain on the grid will come, if at all, in the hot weather months of July and August – and natural gas injections into storage could be impacted as they have been historically. It would be rare – but not unheard of – to even see a draw of natural gas from storage to meet electrical demands in the next two months.

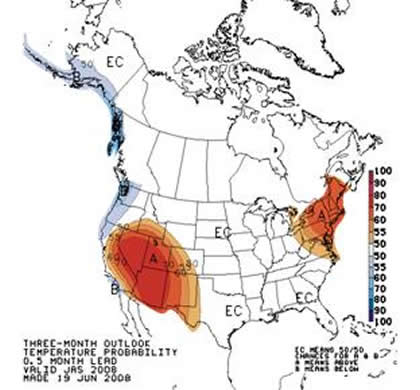

Long term forecasting models at the National Oceanic and Atmospheric Administration for the three month period of July, August and September point to an above average chance of higher temperatures in the Northeast - a heavily populated area and large electrical consumer, as well as in the Southwest and California (see NOAA chart at right).

Natural gas . Natural gas in storage for this week of the injection season remains at depressed levels, levels that we have not seen in four years. Total demand for the fuel has grown significantly over this time.

Liquefied natural gas (LNG) imports to the U.S. remain well below forecast levels as shipments are bid away to other international markets. Canadian imports continue to disappoint. Canadian natural gas storage levels are also well below what we have seen for this week in the past few years.

Domestic production of natural gas – much of it from unconventional shale formations – continues to increase at an impressive rate. But these gains, in the face of lagging LNG and Canadian imports, increasing demand, and the state of the natural gas storage inventories, should only moderate any price increases we see going forward.

Unconventional natural gas wells in general have oversized decline rates and have been called ‘high maintenance' wells, requiring a lot of subsequent workover, fracturing, and compression services. Many of these unconventional resources are just now being developed using technology we did not have a decade ago. Which should bode well for the oil and gas services sector.

Ethanol . With the recent flooding the percent of the U.S. corn crop that is expected to be used for ethanol production is estimated by some analysts to increase from 25-30% of the crop to nearly 50% due to the contractual commitments of the ethanol producers - a situation that would be untenable politically and economically.

The actual percent utilized by the biofuel sector will depend on the U.S.D.A. damage assessment which should be issued in late July. Keep in mind a healthy corn crop would be at least knee high by now, but many fields remain flooded and corn growth remains stunted.

We were interviewed on CNN radio last month on the state of the agricultural and biofuels markets after the flooding. We remain convinced that corn production will decrease substantially this year in the U.S. due to the reduced acreage planted for that crop, the flooding, and the reduced yields expected due to sub-optimal growing conditions.

Sunspot activity, discussed last month, has not increased as we proceed further into the new solar cycle. Only one sunspot was visible earlier this week. Historically we should be seeing dozens. Some commentators such as Donald Coxe point out that such a low level of solar activity may point to climate change issues – and he claims this most likely would be a cooling not a global warming event.

We remain fully invested in the energy and agricultural sector, and would add to our positions on any price weakness.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.