Why Most Unloved Stock Market Bull Will Continue to trend higher whether you like it or not

Stock-Markets / Stock Markets 2016 Aug 05, 2016 - 07:41 PM GMTBy: Sol_Palha

Do not anticipate trouble, or worry about what may never happen. Keep in the sunlight.-

Benjamin Franklin

Do not anticipate trouble, or worry about what may never happen. Keep in the sunlight.-

Benjamin Franklin

The masses do not believe this market can trend higher; sentiment is decidedly negative, and this has been confirmed time and time again. For months on end investors in the neutral or bearish camp have ranked higher than those in the bullish camp. What is surprising is that the higher this market trends, the more anxious the masses become. In a nutshell, that is precisely why this market will continue to run higher and higher.

We agree that the driving forces behind this economy are illusory in nature and that this economic miracle has and is being supported by hot money. Nothing else is driving this economic recovery. Any piece of data that can be manipulated has been manipulated to suit whatever picture the Fed wants to paint; all this is true but fighting the Fed is going to lead you nowhere but to an early grave. Central bankers have embraced the era of negative rates, and this experiment will not end until we have another currency crisis. Who knows when this will occur? What we do know is that many of those who were dead certain this would transpire in their lifetime are no longer here. One clue that something is amiss will be when the masses move into the euphoric camp, and they are a long way from that zone.

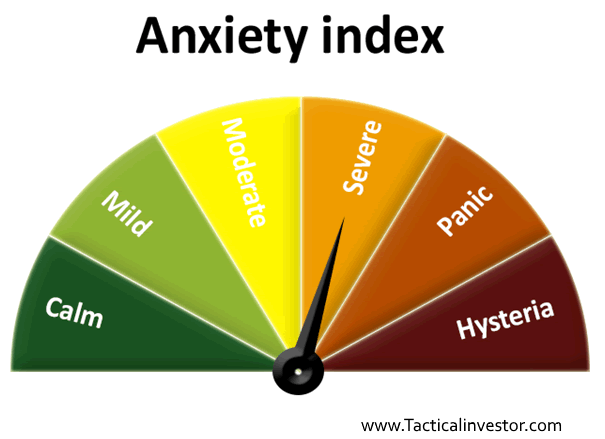

One would think after the market surged to new highs, the number of individuals in the bullish camp would soar, but no such luck. In fact, our proprietary “anxiety index” reveals that the crowd has remained in the circle of “fear zone “and has not moved into the calm zone once in the past six months. Data from AAII Investment sentiment survey’s also reveals that the crowd has been unusually pessimistic for an extended period.

Hot money the main driving force behind this economic recovery

The Fed and the corporate world understand that there is no economic recovery and that the moment the hot money stops, this bull will drop dead in its tracks. Moreover, that is precisely why the Fed will not stop supporting this market. The Fed and the corporate world will do whatever it takes to maintain the illusion that all is well. That includes creating and throwing as much money into the markets as is necessary to propel them higher and those that stand by and try to fight the Fed are going to be run down mercilessly.

The mass mindset is now at the stage where they accept this as the new norm. They want the illusion; they do not want to deal with reality because they were raised in an illusory world and for them, the illusory is far easier to deal with than reality. Hence, the saying “tell me sweet lies”. Individuals should expect the markets to be manipulated in ways that will shock anyone that is 40 or older.

The era of hot money is not over; it has just begun as Central bankers have embraced the concept we have termed “inflate to infinity”. Moreover, when the Fed adopts negative rates, it will be like pouring Jet fuel onto a raging inferno. One day this bull market will run into a brick wall, but that day is not upon us yet. Until then you should view all sharp pullbacks as buying opportunities; the more substantial the pull back, the better the opportunity.

Conclusion

The markets will most likely trade a lot higher than any of today’s naysayers could ever envision. The Fed is far stronger than few hundred loud mouths that claim to be experts but, in reality, know next to nothing. Lastly, in such an environment it makes sense to put some money into precious Metals.

Anger, if not restrained, is frequently more hurtful to us than the injury that provokes it.

Seneca

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.