Stock Market Headed for 10% Decline

Stock-Markets / Stock Markets 2016 Aug 08, 2016 - 06:47 AM GMTBy: Brad_Gudgeon

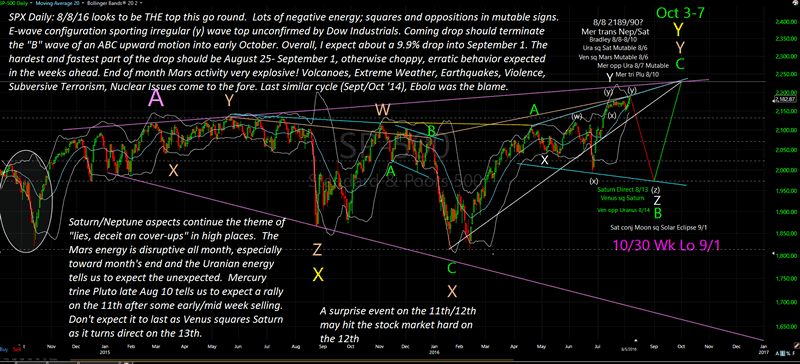

All the cycles that I follow are topping for the stock market. In fact, ideally, the SPX should top on Monday 8/8 near 2189. I believe we see 1972 by September 1.

The week ahead should see weakness after initial strength. A rally on Thursday should be the “b” wave of an a-b-c type drop into Friday. The expected large drop on Friday could be a monetary issue as Venus squares Saturn on the 13th as Saturn turns stationary/direct. Venus rules money. Saturn also conjuncts the moon Friday (the moon in Sagittarius is often times the low of the cycle); is also an 8 TD low from the 5 week low last week on August 2.

I believe the gold sector topped on the 2nd of August as Mars entered the sign of Sagittarius. It looks now like we are headed for a month end low near the August 30th Mercury Stationary/Retrograde date. The dates August 17-19 should see a large drop for GDX as well as the stock market. August 18th is a full moon and lunar eclipse, as well as Bradley Turn. The 19th is a 2.5 week low for the SPX.

Mars looks war-like as we get closer to the 24th, 26th and 29th of August. August 25-September 1 should see a large drop in the stock market.

The chart below explains the stock market forecast in detail:

SPX Daily Chart

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.