USDU - An Important Perspective on the US Dollar

Currencies / US Dollar Aug 17, 2016 - 07:29 AM GMT We started following this US dollar index about a year or so ago which has a more equal weighting of different currencies than the $USD. Even though I don’t post it much this Alternative US dollar index has some very interesting Chartology on it which may be giving us an important clue as to the intentions of the Dollar .

We started following this US dollar index about a year or so ago which has a more equal weighting of different currencies than the $USD. Even though I don’t post it much this Alternative US dollar index has some very interesting Chartology on it which may be giving us an important clue as to the intentions of the Dollar .

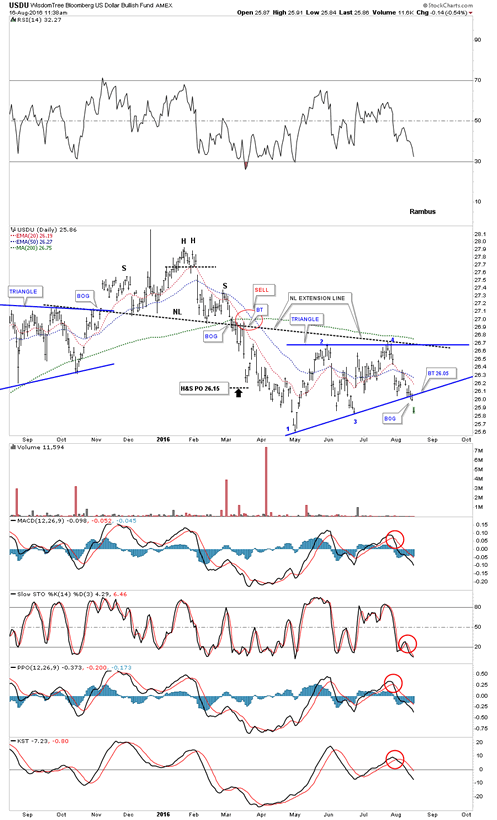

If you recall the Standard US dollar index ($USD) was testing a major inflection point in May around the 92 area earlier this year. It did finally bottom but left some unfinished business behind. This is the daily chart I was following at the time for the USDU which shows the H&S top in place and the decline that took the price action down to the low at the 25.50 area. From that low the USDU began a decent rally but couldn’t trade above the neckline extension line at reversal point #2 before the bears took charge again. The bulls were able to stop the decline at reversal point #3 and a laborious rally took the USDU back up to the top of the trading range where the neckline extension line came into play again along with the 200 day moving average.

Reversal point #4 started the next decline back down to the bottom rail of what we can now call a triangle that has four completed reversal points when the price action hit the bottom rail recently. The bulls were able to only put in a modest rally over next four days when the bears took charge again. As you can see, yesterday the bears were able to break the bottom rail of the blue triangle and today that was followed by a large gap down. When you’re following a well defined chart pattern and you see a gap over an important trendline that generally signals the pattern is finished building. It’s never 100% but generally that is a good sign.

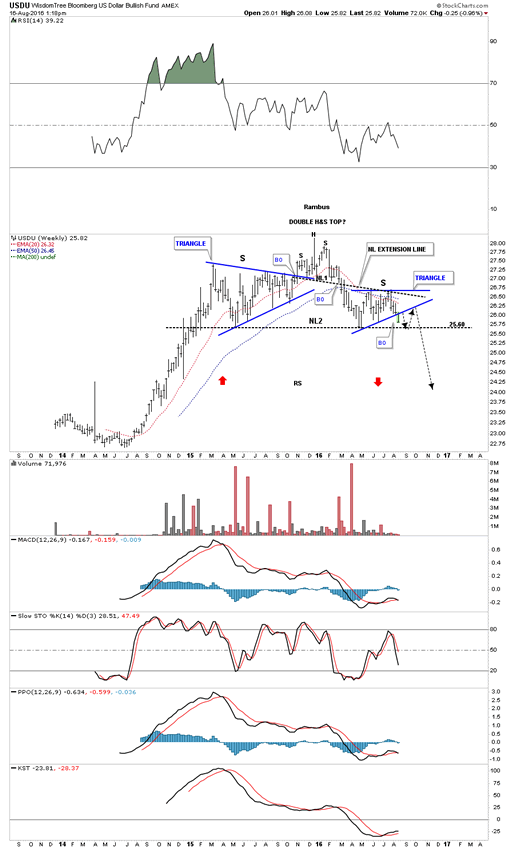

As always it’s important to put the consolidation pattern in perspective to see how it fits into the bigger picture. The weekly chart below shows the potential of what might be happening. As you can see the blue triangle is breaking down this week which may very well be the right shoulder of a much bigger H&S reversal pattern with the big neckline #2 being part of a double H&S top.

The next thing we’ll be watching very closely is how the price action interacts with big neckline #2. There is a good possibility that we could see a ping pong move between NL# 2 and the bottom rail of the blue triangle consolidation pattern as shown by the black arrows. That’s what I would expect to happen but there is no way to know ahead of time. So now we can watch the price action and let it tell us what it wants to do by the way it trades between the neckline and the bottom rail of the blue triangle. If the bears are really in charge and the bulls are extremely weak then we could see a breakout gap below neckline #2. At least we have something concrete to work with now.

One last note on the weekly chart below. I’ve added two red arrows that shows how this index could reverse symmetry back down if this big H&S top plays out. How the price action went up is often how it comes back down over the same area when there was a strong move with small or no consolidation patterns that formed. Stay tuned. If this pattern plays out we could be witnessing a large trend reversal in the most important chart on the planet .

All the best

Gary (for Rambus Chartology)

FREE TRIAL - http://rambus1.com/?page_id=10

© 2016 Copyright Rambus- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.