SPX Easing Lower

Stock-Markets / Stock Markets 2016 Aug 18, 2016 - 03:30 PM GMT The SPX Premarket has gone from flat to lower this morning. Should the decline continue, the key level is the combination trendline/Short-term support at 2175.24.

The SPX Premarket has gone from flat to lower this morning. Should the decline continue, the key level is the combination trendline/Short-term support at 2175.24.

ZeroHedge comments, “n the latest quiet trading session, European shares rose while Asian stocks fell and S&P futures were little changed. Minutes of the Fed’s last meeting damped prospects for a U.S. interest-rate hike, sending the Bloomberg Dollar Spot Index doen 0.3%, approaching a three-month low. Dollar weakness continues to buoy commodities, with the Bloomberg Commodity Index set for the most enduring rally in more than two months, as WTI flirted with $47 and Brent briefly rising above $50.”

VX futures are higher this morning, suggesting an elevated tension concerning the direction of the market.

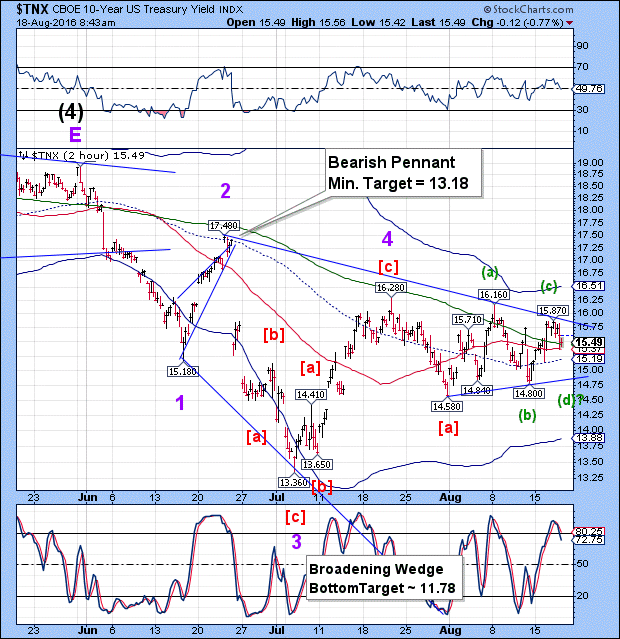

TNX is lower this morning, also suggesting money flows from equities to Treasuries. There may be a few “bumps” on the way to its next Master Cycle low, due August 25.

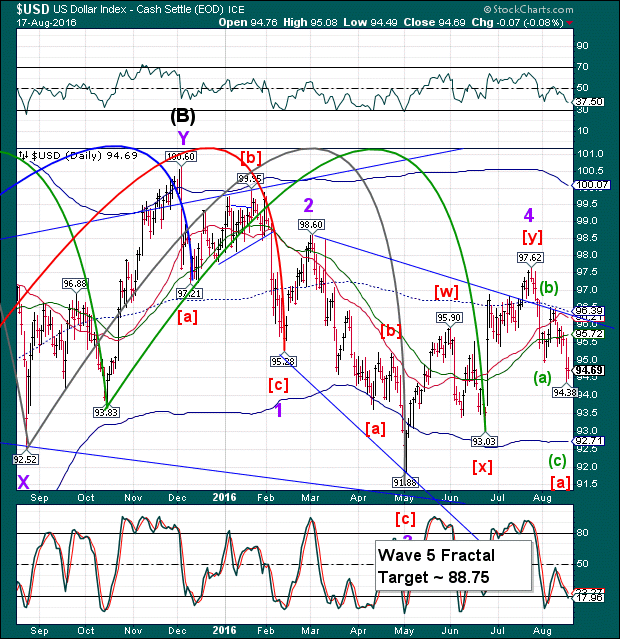

USD made a new low this morning at 94.31. Its expected Master Cycle low is due on August 24, its Pi date.

This decline may propel the decline in equities, which are due for a low on August 25, just 8.6 market days from its August 15 high.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.