Stocks and Bonds All Time Highs and Lows … and the Great Collapse

Stock-Markets / Financial Markets 2016 Sep 06, 2016 - 03:13 PM GMTBy: DeviantInvestor

Stocks and Bonds:

Stocks and Bonds:

Dow Jones Industrial Index – high 18,636 on August 15, 2016

S&P 500 Index – high 2,190 on August 15, 2016

NASDAQ Index – high 5,262 on August 15, 2016

T-Bonds – the 30 year bond high was 176.94 on July 8, 2016

Dow Transportation Average – high on December 29, 2014 – Oops! Dow Theory says we should be worried about an unconfirmed market top.

Financial:

- National Debt (US – official only) exceeds $19.4 trillion in August 2016. Unfunded liabilities are much larger.

- Student loan debt is over $1.4 trillion in August 2016.

- Debt to GDP ratio – all time high in August 2016.

- Central bank balance sheets – globally around $25 trillion in August 2016, and rising rapidly.

- Sub-prime auto loans – about $1 trillion (US) in August 2016.

How many times in the past 1,000 years has “too much debt” been a precursor of future prosperity and social stability?

Other Highs

- Total tons of gold hoarded by China, India, and Russia continue to rise. Why would Asian countries hoard gold while western nations actively suppress gold prices and awareness of gold’s importance?

- The cost of buying a Presidential election, including media advertising, payoffs, focused disinformation, “dirty tricks,” programming voting machines, and so much more.

- Central bank intrusions into markets. The Fed has helped the 1% but hurt most others. The Bank of Japan, Swiss Central Bank, and the EU are buying equities. Interest rates have been forced to the lowest levels in history. Economies are struggling even though central banks have aggressively “stimulated.” Perhaps the purpose of the stimulation was to boost the wealth of the 1%…

- “Trillionaire Rothschild Warns …”

- Negative interest yielding sovereign debt – about $13 trillion – in August 2016. BUBBLES ALWAYS CRASH!

- Political corruption – One need look no further than the DNC and their candidate. However there are many other blatant examples of corruption – top to bottom, far and wide.

- NSA spying on US citizens via cell phones, internet, and phone calls. We are not all terrorists … so the reason is what?

- Welfare, unemployment, and food stamp costs in the US. Why are over 45 million people receiving SNAP (food stamps) benefits if the economy is “fine?” Why is the supposed unemployment rate so low when so many Americans are out of work?

Other Highs:

- Use of painkillers by US citizens. The US has 5% of the global population but uses 80% of the prescription painkillers.

- Heroin use by individuals.

- Drug deaths from legal painkillers.

- Cost of cancer “treatment” via chemotherapy, radiation, and other such “cures.” It is a $100 billion annual business in the US.

- Total medical, sick care, prescription drugs, and health care costs in the US and western countries. Are the benefits worth the cost?

Approximate Lows:

- US 10 and 30 year bond yields – lowest in centuries.

- Other US debt instrument yields

- Interest payments on “High Yield Checking Accounts”

- Yields on UK, Japanese, EU, and Swiss sovereign debt

- Underfunded pension plans . (Low percentage of assets to support projected liabilities)

- Central bank successes: Only one – “kicking the can.”

- Voter approval ratings for US congress.

SUSPECTED LOWS:

- US Army financial accountability – $6.5 trillion missing, along with 16,000 documents and invoices.

- Gold actually stored in US depositories and in Fort Knox. (In which country is the gold stored now?)

- Gold and silver prices as ratio to total US currency in circulation.

CONCLUSIONS:

- Stock markets and bond markets have reached all-time highs and sovereign debt yields are at all-time lows. Yes, global central banks have pushed stocks up and yields down. This is dangerous and will eventually become catastrophic – unless you believe that markets can be PERMANENTLY manipulated higher.

- Paul Singer: “Sudden, Intense Market Breakdown”

- Central banks and governments must maintain the illusion that economies are “fine,” (especially in an election year) but are worried an interest rate increase of one-quarter of one percent in the US will crash markets. Clearly everything is not “fine.”

QUESTION:

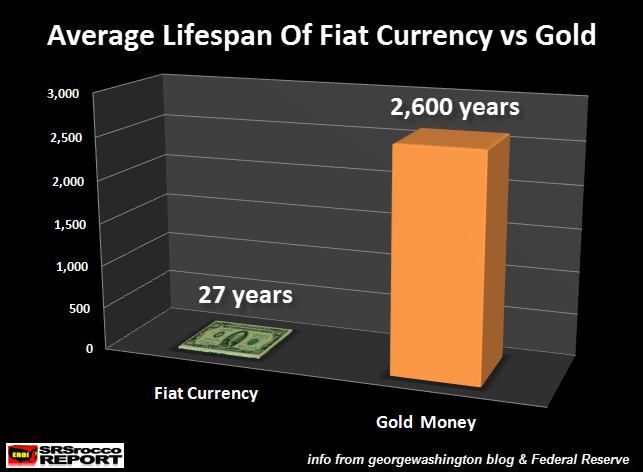

Since gold and silver are real money while currencies are debt backed by corrupt and insolvent governments and central banks, should reasonable individuals switch from risky and debt based digital assets to real gold and silver?

ANSWERS:

- Switch to gold and silver if you think fiscal and monetary insanity cannot last forever. The crash will be ugly.

- Switch to gold and silver if you doubt the integrity of central bankers, politicians, and insolvent governments.

- Switch to gold and silver if you worry that either, or both, US Presidential candidates will escalate wars and possibly create a nuclear war. Armageddon and Balls of Flame.

- Switch to gold and silver if you think that solving an excessive debt crisis by creating more debt is an unworkable plan.

- Switch to gold and silver if you believe, as per Jim Sinclair and Bill Holter, that we must “GOTS” – Get Out of The System – now – as in soon. Bill Holter interview.

- Switch to gold and silver if you are intellectually honest about the impossibility of repayment of global sovereign debt without hyperinflation, while realizing that central banks and governments believe it is necessary to further increase sovereign debt to even more insane levels.

- Switch to gold and silver for your own sanity and to sleep better at night.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.