How I Got Mark Cuban to Concede That Central Banks Have Cornered the Bond Markets

Interest-Rates / US Bonds Sep 07, 2016 - 05:26 PM GMTBy: Graham_Summers

Mark Cuban just conceded to me that Central Banks have cornered the bond market.

Cuban is a billionaire investor, owner of the Dallas Mavericks, and reality TV star from Shark Tank.

He’s also begun making a series of strange media appearances in which he claims that if Donald Trump wins the US Presidency in November, “I have no doubt in my mind that the market tanks.”

Professionally speaking, I don’t have a horse in the race regarding the current US election. But regardless of who wins in November, the US and the rest of the world are primed for a massive Crisis (more on this shortly).

The issue is math, not politics.

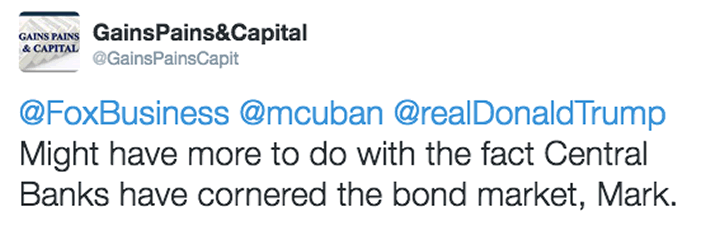

However, I couldn’t pass up a chance to respond to Cuban’s tweet…

Seriously, let’s cut the crap. Politics are irrelevant here.

The Central banks have set the stage for a massive market meltdown. Globally over $13 trillion in bonds have negative yields. Some sovereign yields are negative out as far as 5, 10, even 30 years.

This has NEVER happened before in the history of humanity.

Sovereign bonds are the senior most assets in the financial system. If they are in a bubble, EVERYTHING is in a bubble.

In this context, there is literally no such thing as real price discovery anywhere in the markets anymore. There are simply dozens of smaller bubbles all created by investors reacting to the bond bubble.

Let me give you an example…

In Europe, we’re about to see our first corporate bond issuance with negative yields. Yes, companies in Europe can now CHARGE you for the right to lend to them. As a result, there is now a bubble in European corporate bonds.

The bond bubble is the mother of all bubbles created by Central Banks. And billionaires like Cuban must know it. But getting him to concede it?

He did in his response…

Note that Cuban doesn’t even try to debate my claim that Central Banks have cornered the bond market. He completely concedes the point and moves on to assert that he is worried that if Trump wins, Central Banks “may find other bonds” (which I take to mean that they won’t buy US Treasuries anymore).

Folks, we are witnessing the single biggest financial experiment in history.

Central Bankers have literally bet the financial system that their theories are correct. They believe that by cornering the bond market they can prop up asset prices forever.

Market corners never ever end well And billionaires like Cuban know it. He’s right to worry, but it’s a matter of math, not politics.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.