3 Clear Signs the US Stock Market Is Doomed

Stock-Markets / Stock Markets 2016 Sep 15, 2016 - 02:55 PM GMTBy: John_Mauldin

BY TONY SAGAMI : The Dow Jones Industrial Average has been going sideways ever since the Commerce Department reported that retail sales in July came to a grinding halt (0.0%).

BY TONY SAGAMI : The Dow Jones Industrial Average has been going sideways ever since the Commerce Department reported that retail sales in July came to a grinding halt (0.0%).

At the same time, companies including Starbucks, McDonald’s, Ford, Burberry, and Gap are reporting disappointing sales. That means trouble in shopping paradise.

Target just reported a Q2 drop of 1.1% in same-store sales. It expects a “challenging environment in the back half of the year.”

There are many reasons why Americans have become reluctant shoppers. I talked about this in my recent article “The Stressed-Out, Tapped-Out American Consumer.” Stagnant incomes and rising debt loads are part of the problem.

But another big factor is a change in spending psychology.

The save vs. spend mindset has shifted

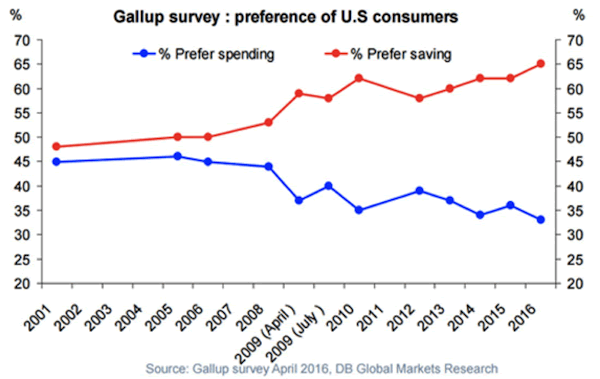

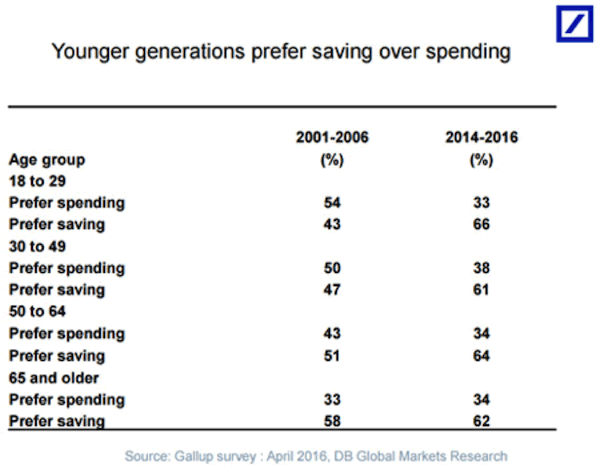

Americans are becoming big savers, according to Deutsche Bank,.

The save vs. spend mindset has shifted for all adults. But this change is most dramatic for Millennials.

Transport of goods is slowing

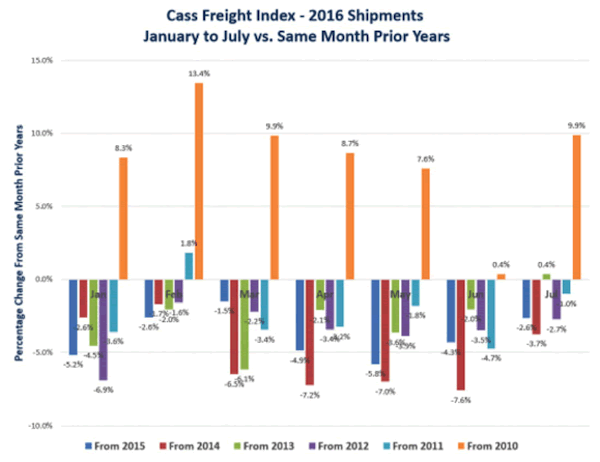

Evidence of shopping fatigue is also showing up in the transportation food chain.

Truck shipments continue to decline. July shipments were down versus 2015, 2014, 2012, and 2011.

Shipping is slowing, too. Maersk Line is the largest container shipping company in the world, so it deserves close attention. Times have been tough for shippers. And Maersk expects the business to get worse.

“Currently we are challenged by market headwinds,” said CEO Soren Skou during the latest earnings call, “…in the form of low growth and excess capacity in both our industries, and that has led to declining prices and declining revenue.”

Jakob Stausholm, part of Maersk Line's management board, told Reuters, “It’s really tough, and everybody in the industry is really suffering, and so have we.”

Maersk isn't the only shipper in trouble. Evangelos Chatzis of rival shipper Danaos said, “World GDP growth is struggling… Combined with trade growth slowing down, this is a recipe for a very bad market.”

Ports confirm the shipping slowdown. The Port of Long Beach just reported a 7.7% year-over-year decline in the number of shipping containers that pass through:

“Due to continued market uncertainty and high inventory levels, the traditional holiday peak season is off to a slow start, and several national forecasts have been revised downward to reflect this softness in cargo movement.”

Businesses have too much inventory

The inventory-to-sales ratio is climbing. This tells me that demand is weakening and businesses aren’t moving their goods.

The ratio tends to increase during the late stages of an economic expansion. This often represents the turning point in a business cycle.

Companies stockpile inventory for one of two reasons: (1) voluntary accumulation in anticipation of booming sales, or (2) involuntary accumulation as unsold goods pile up.

The US’ consumer-driven economy has hit a brick wall

You’ve heard it before—the US is a consumer-driven economy. And 70% of GDP is tied to consumer spending. That’s why you need to connect the dots between the retailers’ warnings, the shift from spending to saving, and the woes of the transportation food chain.

If you do, you won’t find anything to be bullish about with this stock market.

Keep in mind… buy, hold, and pray is NOT an investment strategy.

Join Hundreds of Thousands of Readers of John Mauldin’s Free Weekly Newsletter

Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news and analyzes challenges and opportunities on the horizon.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.