Stock Buybacks Fueling the Stock Market? By How Much?

Stock-Markets / Stock Markets 2016 Oct 07, 2016 - 10:43 AM GMTBy: Mike_Shedlock

Here's the question of the day: are corporate stock buybacks fueling the stock market?

Here's the question of the day: are corporate stock buybacks fueling the stock market?

Let's look at a couple of charts and a news report to help determine the answer.

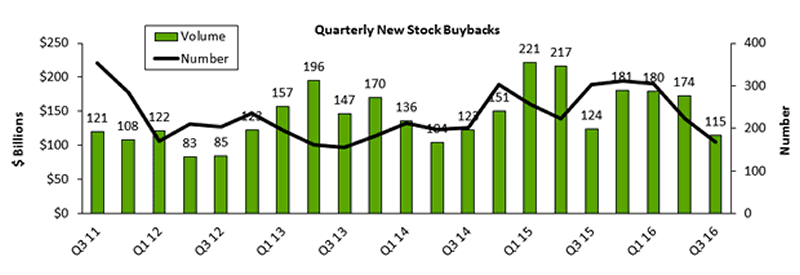

Quarterly Stock Buybacks

Stock buybacks are at a nine-quarter low according to an Email TrimTabs press announcement.

"Buybacks have been trending lower for the past two years, which is a cautionary longer-term signal for U.S. equities," said Winston Chua, analyst at TrimTabs. "Along with central bank asset purchases, buybacks have been a key pillar of support for the bull market."

"The U.S. stock market isn't likely to get as much of a boost from buybacks as it did in recent years," noted Chua. "Apart from big tech firms and the too-big-to-fails, fewer companies seem willing to use lots of cash to support share prices."

There are numerous references to that announcement, but until now, nobody checked to see if the relationship was in fact true.

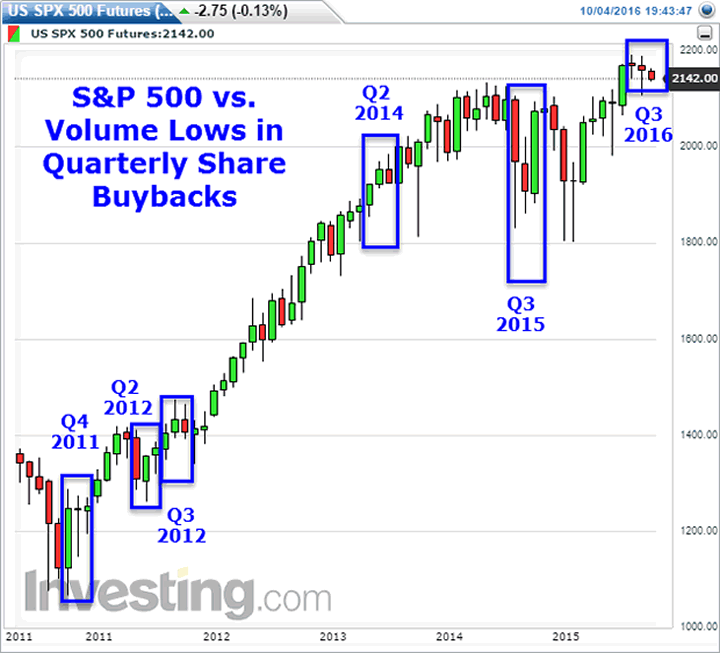

S&P 500 vs. Volume Lows in Share Buybacks

If there is a relationship, I fail to see what it is, at least by looking at the chart.

That does not mean there is no relationship. Rather, it does not show up.

Logic would dictate that share buybacks lower P/E ratios thereby boosting earnings, making stocks look more reasonably priced.

But if reasonable P/E logic was in play, P/E's would not be as ridiculous as they are. Then again, Wall Street charlatans point buybacks and forward P/Es as evidence the stock market is cheap.

Competing Theories

- Stock buybacks are still sufficient to fuel the stock market

- Something else is happening, such as another Fed-sponsored mania

#2 is a given. #1 certainly doesn't hurt. But market sentiment is so strong now, stock buybacks just may not matter much at all.

When stock market sentiment turns, I strongly suspect buyback announcements will be meaningless.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.