Stock Market Crash Sound More like Stock Market Trash when you listen to Drs of Doom

Stock-Markets / Stock Markets 2016 Oct 07, 2016 - 02:12 PM GMTBy: Sol_Palha

A small mind is obstinate. A great mind can lead and be led. Alexander Cannon

A small mind is obstinate. A great mind can lead and be led. Alexander Cannon

Every few months there is some nonsensical headline that is passed off as news when it should be relegated to the rubbish bin of time. Sometimes it is high oil price that is not good for the market, and then on other occasions, we hear that low oil prices are not good. Then you have the Dance with the Fed and interest rates, which sounds more like a silly girl peeling petals from a flower and murmuring “he loves me, or he loves me not”. If you go back and start from 2006 for example, you will notice that with the passage of each year the headlines are bombastic in nature. However, the outcome is always the same, the masses panic and the smart money comes and laps up all the stocks being sold for next to nothing.

After the 2008 financial crisis, free market forces were killed forever. At this point, this market is the Fed’s market, and so they can push it higher or lower on a whim. As economic conditions are terrible, a healthy market provides the illusion that all is well and so they are not going to allow anything to shatter this illusion anytime soon.

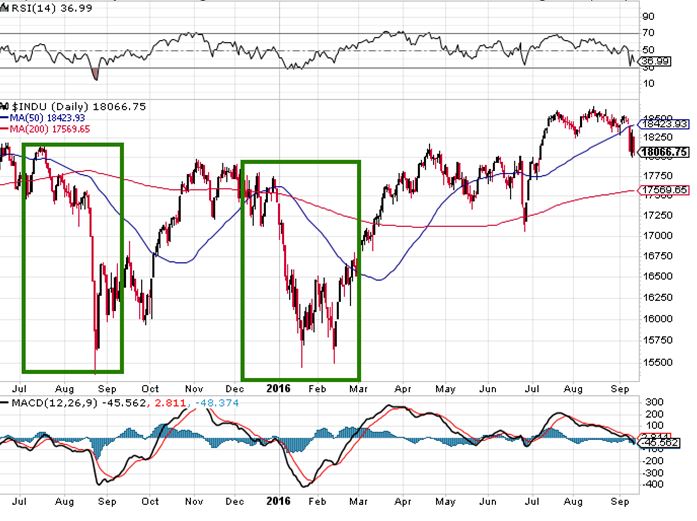

On a separate note, there has been an interesting theme this year; the Fed has gone out of its way to minimise market pullbacks. Additionally, the pattern for the past 24 months has been to allow only one sharp pullback per annum. Take a look at the chart below

2015; the initial wave took place from Aug-Sept; A lower high was put in October, but the pull back from Middle of Sept to Oct was minor.

2016: the main selling wave took place from roughly in Jan 2016. We had a second buying opportunity in Feb, but the overall pullback from early Feb to Middle of Feb was minor in nature. The reaction to Brexit in comparison seems almost a joke; someone intervened to limit the downside action in July of this year. Perhaps the Fed’s are nervous to allow a stronger correction because they assume that the Psyche of the masses would be too weak to deal with one. This could be true as this is the longest period we can remember where the masses have sat on the sidelines. This bull market by any standards should be deemed mature and ready to experience a back breaking correction, but no market has ever collapsed without mass participation. Hey, they have to dump the crap on someone, and the big guys do not want to try to trick each other. Killer whales would rather go after smaller prey than fight amongst themselves.

There is also a marked difference between contrarian investing and investing based on the principles of mass psychology. Contrarian shift position once the masses are on board, but we do not follow that route, we wait for the masses to start frothing before we abandon ship. Mass psychology states that the masses have to be in a state of Euphoria and only after that stage is reached should you abandon the ship. Market Update August 31, 2016

Keep this difference in mind, for many contrarians (probably fashion contrarians), have been predicting the demise of this market for a very long time, and they are still waiting for their day in the sun. Bubbles only pop, when the masses embrace the market and turn Euphoric. Mass Psychology states that these two ingredients are necessary; they need to embrace the market, and they need to be euphoric.

Nothing has changed since the last two sharp pullbacks; the only thing that appears to have changed is that the masses are even more fearful now than before. Bullish sentiment has remained below 50% for more than 12 months; this highly unusual given that the market has continued to trend higher and it suggests that the most we can expect going forward is a correction and not crash.

Conclusion

Negative rates are yet to hit the U.S. some say this will not happen. Well, let’s see if the U.S will buck the trend forever. It seems highly unlikely as the whole world is gravitating towards negative rates. When negative rates hit the US, you can expect the markets to soar.

The U.S will be the last to embrace negative interest rates as they need to foster a sense that our economy is healthy and vibrant. After all, we are still the largest economy on this planet; if the largest economy is sick, then it makes the illusion harder to sell. Corporations will go on debt binge when rates turn negative; their current foray into the debt markets will look like child’s play in the years to come. This bubble could rival that of the tulip mania; at this point, we are not even at the beginning stages of a bubble. The masses will embrace this market and the longer they resist, the higher this market will surge; think of their resistance along the same lines you examine a channel formation. The more extended the channel formation, the stronger the move. In this case, this is a channel formation based on fear; hence the move will be up, and the move will be damn powerful.

Experiments have shown that fear shuts down one’s ability to view things rationally. Don’t embrace any perspective; understand that it is a perspective and that there always at least three sides to a story; the I like it side, the I hate it side and the I do not care side. The focus should be on the trend, and market sentiment and both of them indicate that a crash is not in the works.

Obstinacy is the sister of constancy, at least in vigor and stability.

Michel Eyquem De Montaigne

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.