US Stock Market, Big Picture View

Stock-Markets / Stock Markets 2016 Oct 13, 2016 - 05:34 PM GMTBy: Gary_Tanashian

Because perspective is everything, let’s once again get some big picture perspective…

Because perspective is everything, let’s once again get some big picture perspective…

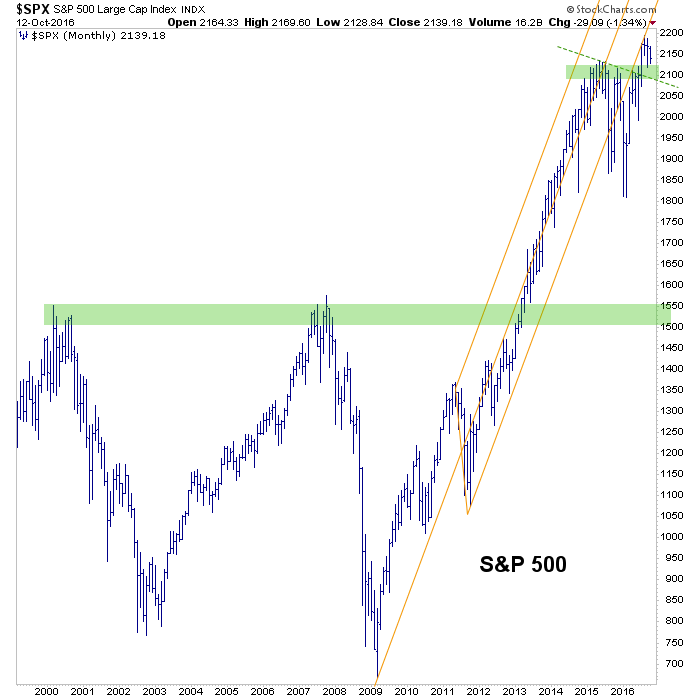

S&P 500 is outside the lower fork line (again the Fork being a novelty, but the line being real) but above critical support. Bears would call this an overthrow to the upside and massive bull trap. We can call it an intact bull market above support and a very bearish market should that support be lost.

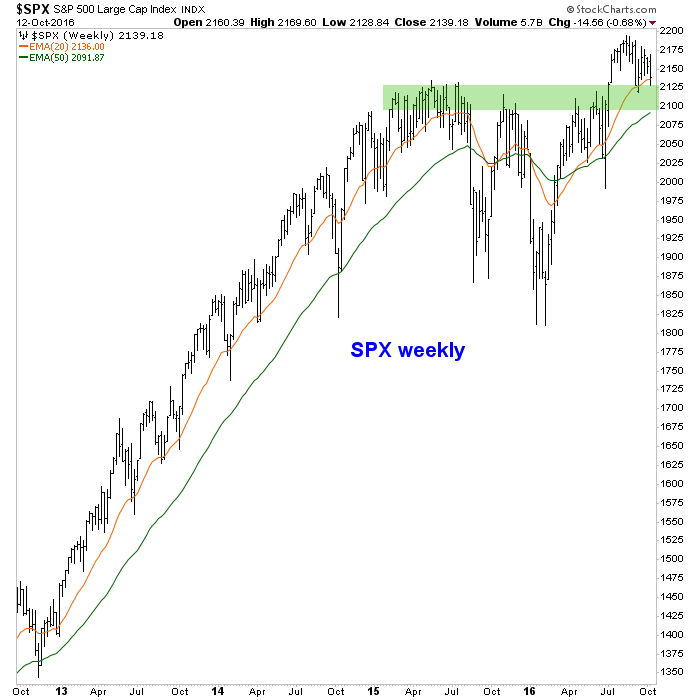

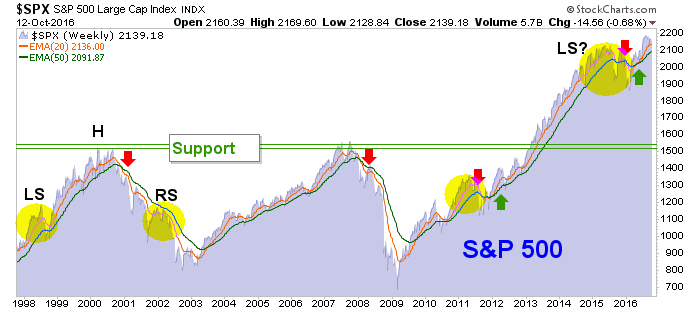

We’ll throw in other time frames on the SPX for reference. When the weekly chart crossed those two moving averages up and then got through resistance (now support), it went bullish. Simple.

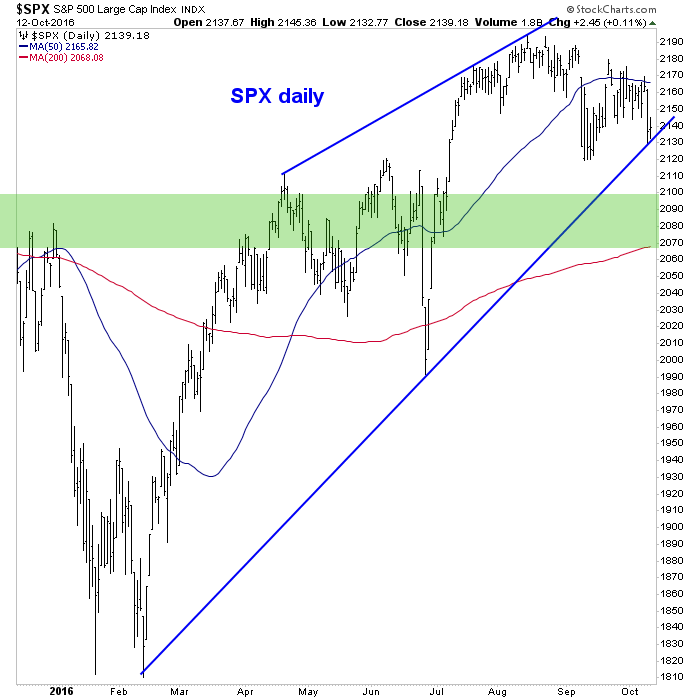

SPX daily chart is at the wedge bottom, but serious support is lower still.

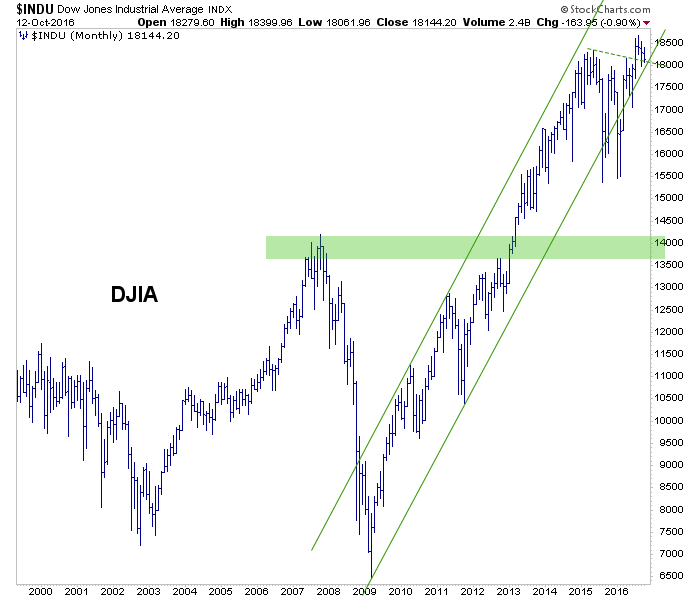

Dow egg is in its little nest, with Mommy Bird Janet Yellen sitting atop of it keeping it warm and comfy incubating it for years on end after Daddy Bird flew the coop. Let’s put aside for a moment that the bond market is making initial signs of disrupting Mommy Bird. Above the solid and dotted green lines… bullish. Below them, scrambled eggs.

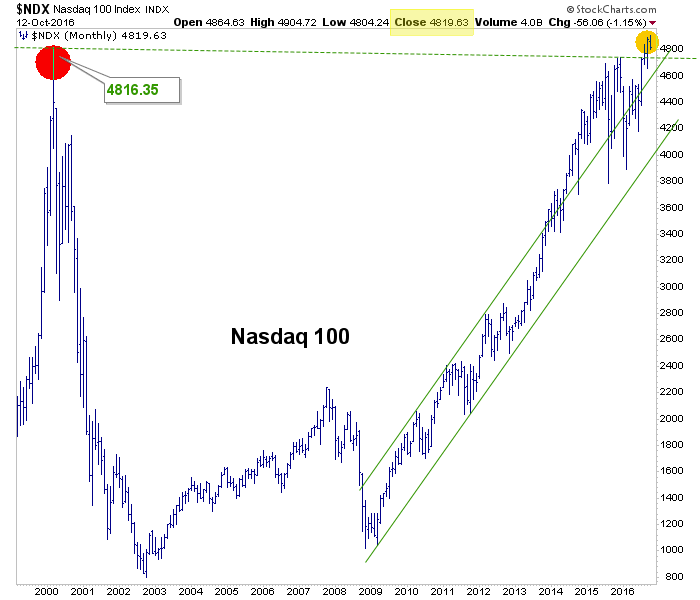

Nasdaq 100 is in blue sky. So if you’re getting good and bearish, let’s just remember that. The first step to a technical bearish situation – a monthly close below 4816.35 – has not even been taken. And that would only be a small step.

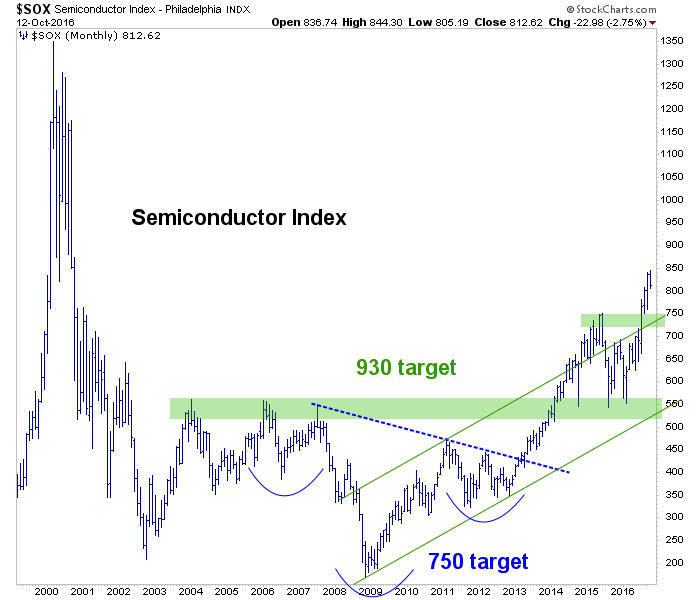

Semiconductor Index continues to target what it targets. I believe the target was 870 based on the short-term pattern, but we have had 930 in view since early 2014 (the year that Semis were supposedly imploding) with the 750 target long ago put in the books. I am cautious about owning this stuff after taking profit all around (except Intel), but if the market only corrects and does not go big picture bearish a pullback here could be another buying opportunity.

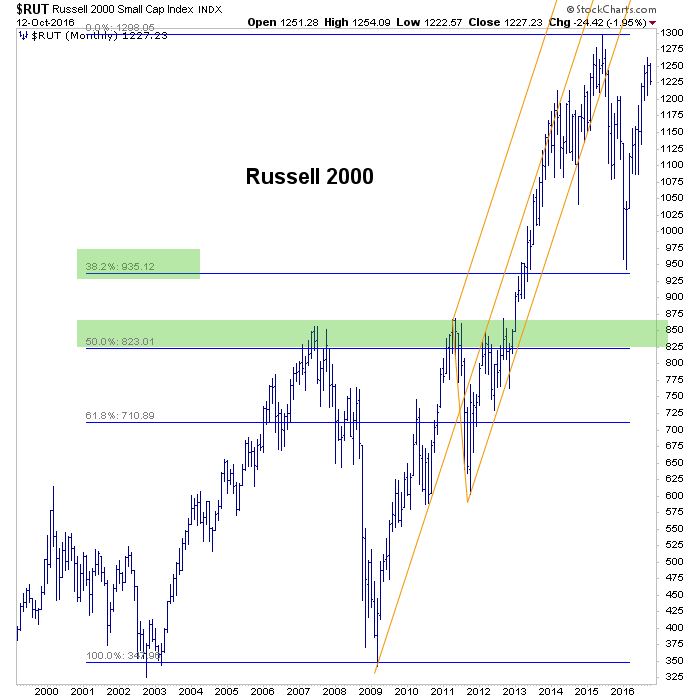

Finally, last and least, is the Russell 2000. The reason I say least is that these stocks have the least in market cap (among the headline indexes), the least reward vs. risk proposition (see the weekly leadership chart below) and the least attractive monthly chart. This wild man has already done a 38% Fib retrace, bounced back hard and retains a pattern that can only be described as gross as long as it is below 1300.

We did measure out a still unregistered target of around 1350 for this years ago, by the way. That was based on the giant ‘Cup’ formed from 2007 to 2011. However, here we can recall the HUI Gold Bugs index, on which I had a similar Cup measuring to near 900. That one proved to be a, ah, bad target. So there’s that caveat.

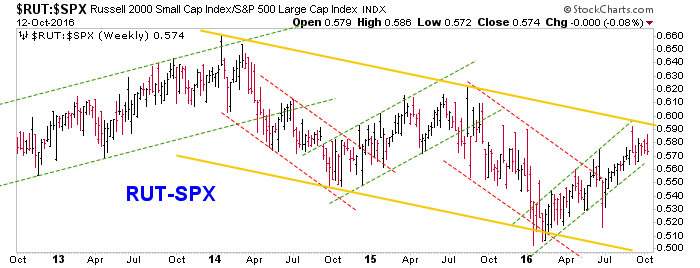

Here’s the weekly ‘leadership’ indicator chart. This has guided us on Small Cap leadership in 2016 (green dotted uptrend channel) but greatly increased risk relative to Large Caps (gold downtrend channel). Again, simple.

As for rolling the above into the current view, it’s a smooth transition. The stock market has been bullish since the signal was made on the S&P 500 (with the weekly EMA 20 crossing above the EMA 50) and the Brexit hysteria failed to be anything other than short-term bullish. Here is another view of the second chart above, adding some long-term perspective with similar signals and would-be signal. This has so far turned out to be more like 1998 and 2011 than 2001 and 2008.

Very simply, the bulls have the ball, period. The bears want that ball and all they have to do is crack the big picture support parameters in order to make things not just bearish, but potentially extremely so, given that the recent breaks upward to blue sky in many indexes would then be painted as an epic final suck in on a bullish overthrow.

So how about a little patience as things play out. The short-term theme has been for a pullback to test major support. Let’s let that play out before making any grand calls.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.