Stock Market Reaches Deadly 7 Straight Days of Losses As Catholic Jubilee Year End Day Approaches

Stock-Markets / Stock Markets 2016 Nov 03, 2016 - 02:18 PM GMTBy: Jeff_Berwick

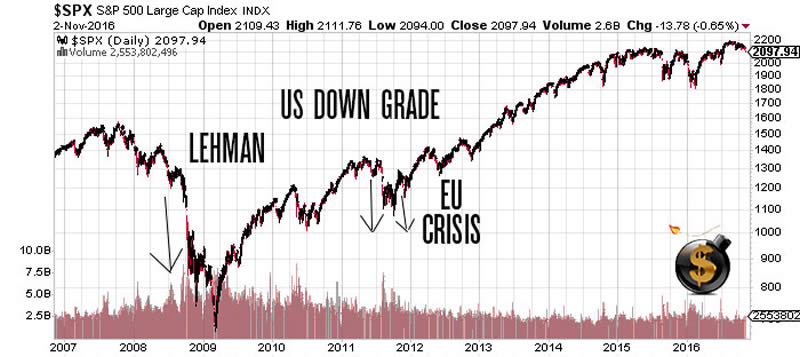

The S&P 500 has only fallen for 7 straight days three times in the last 20 years. And, each time it was during a financial crisis.

The S&P 500 has only fallen for 7 straight days three times in the last 20 years. And, each time it was during a financial crisis.

And, it just happened again today. The S&P 500 fell 0.65% on Wednesday, marking seven days in a row of losses.

Further, the CBOE Volatility Index (VIX) spiked more than 40 percent over the last six days. It was the first time the VIX rose for six straight days since the lead-up to the UK’s Brexit vote.

And, interestingly, the Federal Reserve met again today and surprise, surprise… they didn’t raise rates again – though as usual they keep threatening…

The fact the markets fell after the announcement is very interesting. Over the last few years the market would watch the Fed meeting and rally when they didn’t raise rates. The ruse is getting old now, though, and markets fell even after they announced they would not hike rates.

Imagine what would have happened if they did raise rates? It could have set off a massive market crash.

Ol’ Yellen said, however, that they are pretty sure they will raise rates a massive 0.25% in December… maybe. Yikes. Help!

And as a result, markets have priced in an 80% likelihood of a rate hike – a 10% increase from prior to the FOMC statement.

This plays perfectly into what Donald Trump said they would do. They’d hold the markets together until the election and then engineer the collapse.

What many don’t know (except TDV subscribers) is that the Jubilee Year isn’t officially over. In a bizarre chain of events, the Roman Catholic Church announced a special “Emergency Jubilee of Mercy” that started last year and is set to end on November 20th.

There has been a good deal of speculation over whether or not this will be the last pope. The speculation originates in part from the old Irish Saint Malachy who believed the pope after Benedict would be the final pope.

Of course a lot of people compare great fallen empires including the US to Rome which is interesting considering the last Holy Roman emperor was also named Francis – just like the current pope.

Meanwhile, the upcoming election is the most subversive in US history with leaks coming out daily now that could see Hillary in jail rather than the Oval Orifice. It’s surely meant to cause chaos and it certainly is. Meanwhile, hackers are the new journalists while the mainstream media tries to hide the truth. Welcome to the new Amerika!

These are definitely not boring times! A lot of pieces are in motion and whether there is even a vote next week for president is the topic of alternative media speculation. The idea is that Hillary is indicted and Obama “suspends” the election … just for a little while of course (or maybe longer!).

Gold, silver and bitcoin are soaring while the US stock market broods at critical levels. Nothing’s going on but selling.The longest losing streak for the S&P 500, in history, is 8 days. We’ll see if that is matched on Thursday.

If Trump does win the “selection” we could see the biggest stock market crash in history as early as next Wednesday. Who knows when “they” will pull the plug.

They’ve certainly made preparations by pushing markets to sky-high levels without any real justification. These are massively manipulated markets and Trump will provide a perfect opportunity to dump them – and reduce Trump’s credibility right away.

It need not happen right away. It need not be Trump that causes the crash and subsequent economic unraveling. Perhaps there will be a “mistake” that triggers a shooting war between Russia and the US, or China, Russia and the US.

Perhaps the final termination of the Jubilee Year will be greeted with a crash, a war and a deeper economic depression all at the same time. These are the “trends” Shemitah has left us, and we’re watching them closely on your behalf.

Are you prepared? If not, subscribe to The Dollar Vigilante here. And hold onto your hats for a wild week ahead!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.