Three Ways Traders Can Spot a Stocks Bear Market Before it Bites

Stock-Markets / Stocks Bear Market Nov 23, 2016 - 12:38 PM GMTBy: Nicholas_Kitonyi

A bear market is a disheartening market scenario for most traders and investors because it connotes a season of losses. A bear market is technically defined as a market condition in which securities decline 20% or more from their previous highs. A bear market is more troubling than a market correction because a correction refers to a 10% decline from previous highs. In fact, a correction is more like peeping into bear territory while a bear market can be likened to living inside a bear territory.

A bear market is a disheartening market scenario for most traders and investors because it connotes a season of losses. A bear market is technically defined as a market condition in which securities decline 20% or more from their previous highs. A bear market is more troubling than a market correction because a correction refers to a 10% decline from previous highs. In fact, a correction is more like peeping into bear territory while a bear market can be likened to living inside a bear territory.

The worst reality about bear markets is that most traders and investors only know how to make money when the market is in an uptrend. You buy a security at a price X and you sell when it gains to a price Y, which is higher than the original price X – you pocket the difference as your gains. Binary options traders however can profit from both bull and bear markets because you are 'betting' on the direction of the market. This article provides three insights for spotting a bear market before it bites so that you can trade accordingly.

A pervasive sense of failed rallies or low-volume rallies

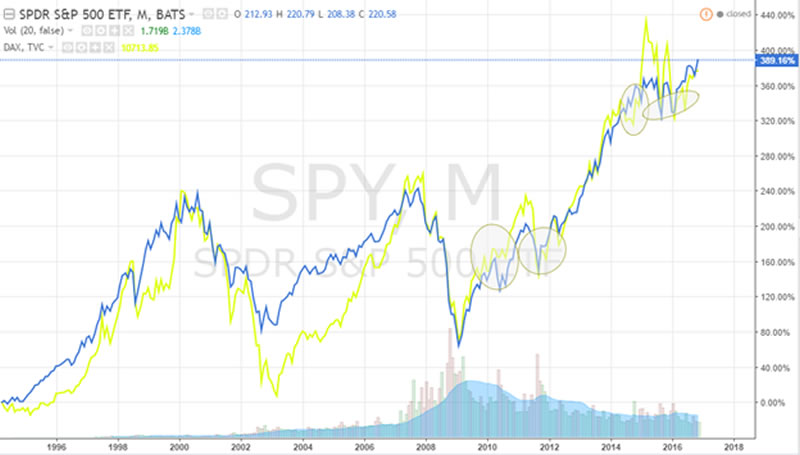

The first signal that could indicate that a bear market is in the offing is that the market won't have enough momentum to sustain a rally. Binary options traders can apply this thesis toward a wide range of assets and securities. If you see a market with a series of lower lows with a marked inability to break out, you can be reasonably sure that a bear market is in the offing. Notice the momentum indictor as illustrated on the histogram below versus price movement.

Once the rallies can’t seem to build enough momentum for sustenance, you'll start to notice that the securities will start exhibiting signs of low market volume. Major institutions will start cutting back on the volume of buys and the frequency of such buys.

The worst part is that institutional investors tend to follow a herd mentality; hence, once a couple of institution buyers withdraw from the market, you can expect other institutions to slow down on their purchases. A low volume market environment is a sign that institution buyers are withdrawing from the market and it suggests that a bear is around the corner.

Technical charts devoid of a decent bounce

The second signal that could indicate the possibility of a bear market is that the charts won't show a decent bounce. All securities experience seasons of highs and lows but a healthy market should be able to bounce back after a 3% decline. In fact, a healthy market should be able to retrace its steps to regain half of lost points after a 3% loss. However, the technical charts don't show a decent bounce after a 3% decline, you might want to change your strategy to accommodate a budding bear. The chart below demonstrates situations of a healthy market bouncing after a short pullback.

Of course, smart traders will brush up their binary options strategy education to confirm if they should be greedy or fearful. If your binary options strategy suggests that the bear will be short-lived, you may want to "buy the dip" or "buy on weakness" using dollar-cost averaging strategies. However, you need to be doubly sure that you read your charts correctly before you go contrarian in a budding bear market.

A race to the bottom

The third important sign that might signal the birth of a bear market is that securities will be on a race to the bottom. Once an asset is bedeviled by low-volume rallies devoid of a decent bounce, the natural progression will lead to double-digit corrections in a race to the bottom. You can start seeing 20 to 50 points losses, which will alternate with single digit gains in the market every few days. The declines will be sharp, quick, and significant but the alternating rallies will be slow and inconsequential.

Once the race to be bottom gets underway, you can expect institution investors to start selling in order to reduce their risk burdens. The massive sales by institution investors will trigger another round of panic-induced selloff and by then the market will have officially entered a bear market. The worst part is that economic news will tend towards bad news and the instances of good news will be met with skepticism from the markets.

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.