Trump's Presidency - Stock Market Crash or Start of New Mega-Trends

Stock-Markets / Stock Markets 2016 Nov 29, 2016 - 03:14 PM GMTBy: Sol_Palha

"A little and a little, collected together, becomes a great deal; the heap in the barn consists of single grains, and drop and drop make the inundation." ~ Saadi

Trump's win proves that mainstream Media is in trouble; it is going to be all downhill from here except for the ones that parted ways and tried to provide accurate coverage of what was going on. The crowd will turn increasingly to social media and outlets that focus on facts as opposed to fiction. Mainstream media is in for a painful ride as the crowd is not going to forgive them so easily for their transgressions; the only exceptions being the ones that portrayed an accurate image of what was taking place. Many pollsters might have to look for new jobs, and as we just stated, we feel that social media is going to be the biggest winner. Perhaps this is why Google has its eye on Twitter and has decided to donate its search engine business and in doing so take a $1 trillion business write off.

Google is working with a financial adviser to consider a potential bid for Twitter Inc., as the social-media company continues to explore a sale, according to a person familiar with the arrangement. In tapping Lazard Ltd., Google hasn't indicated it will definitely make an offer for Twitter. However, the move suggests that Google is evaluating the option, pitting the search giant against other potential bidders including Walt Disney Co. and Salesforce.com Inc. ~ Bloomberg

No matter how mainstream media tries to spin it, they blew it; it was Brexit on steroids. Trumps win highlights the power of social media and how terribly controlled traditional media outlets are. They misfired on Brexit and grossly over exaggerated Clinton's lead. It was a stunning defeat and the fact that mainstream media was so far off the mark will now serve as the bedrock to propel social media to levels never seen before. Expect a whole new range of social media apps and sites to emerge that are going to put many newspapers out of business. As the masses grow increasingly suspicious of mainstream media, we believe that social media will be able to provide valuable insights into the mass mindset.

Being politically correct is now a dead concept

All over the world, the politician that speaks his mind is the one that will resonate well with the public. Those that focus on their P's, and Q's will be toast. The crowd seems to agree:

Most Americans (59%) say "too many people are easily offended these days over the language that others use." Fewer (39%) think "people need to be more careful about the language they use to avoid offending people with different backgrounds." About eight-in-ten (78%) Republicans say too many people are easily offended, while just 21% say people should be more careful to avoid offending others. Among Democrats, 61% think people should be more careful not to offend others, compared with 37% who say people these days are too easily offended. ~ Pew Research

Regulations in the US are going to be torn apart

The Hill, for example, compiled a solid list of "14 Obama Regs Trump Could Undo" that are surely being reviewed by transition operatives. For present purposes, there are a couple categories of rules potentially subject to elimination by the Trump administration. The first consists of already finalised (and often legally challenged) rules, like the Environmental Protection Agency's Clean Power Plan and the Waters of the United States rule; the Department of Labor's "overtime rule" and its "fiduciary rule." Then there is the big one, Obamacare. These are long-discussed items like those in the Hill article noted earlier. ~ Forbes

Obama care will be gutted as in general it is a disaster; "You can keep your doctor" slogan and the steep rise in premiums clearly demonstrate the detrimental nature of this program. Many small businesses were forced to fire workers as they could not afford to pay these premiums. It remains to be seen what will replace it, but for now, the news is being greeted with enthusiasm. Trump's decision to knock off two rules on the book for every rule created should contribute to creating a more friendly business environment.

The energy, transportations and Banks are just a few of the sectors that will do well. Banks have rallied strongly as there is a wide held belief that Trump's administration will gut the Dodd-Frank Act. This will pave the way for banks to speculate and that should provide more fuel for one of the most hated bull markets in history.

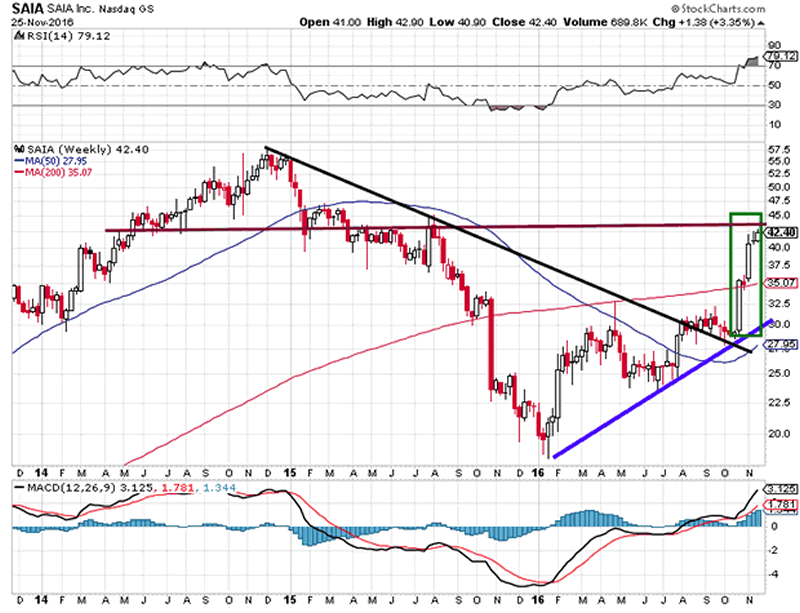

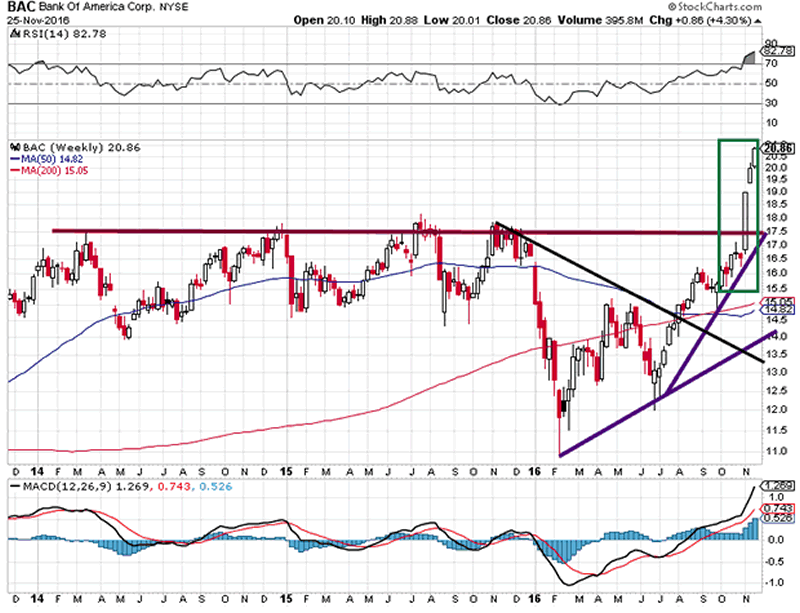

The trucking sector has rallied sharply, possibly on the expectation that tougher trade deals will be negotiated and the hope is that this will lead to a rise in manufacturing activity. Whether this belief is true or not hardly matter; the rally has gathered momentum after Trump was declared the winner. Markets are forward looking beasts and the long term trend for the transportation sector and banking sectors have turned positive. BAC and SAIA are two random stocks we picked from the banking and transportation industry to illustrate the strength behind the current rally.

SAIA Inc is just one of the many stocks in the trucking sector, but you can see how strongly it has rallied over the past few weeks. It has tacked on more than 30% in less than eight weeks and is now clearly trending upwards. There is a strong wall of resistance in the 42.50-44.00 ranges, but once it overcomes this zone, it should soar in to put in a series of new highs.

The pattern in the banking sector is pretty similar to that of the Transportation sector; Bank of America has rallied very sharply over the past few weeks, surging from the 15.00 ranges to almost 21.00 for a gain of over 30%. The stock has broken out and is now trading at new three-year highs; as the trend is up, it is likely to continue trading higher for several years to come. A Strong pullback should be viewed through a bullish lens.

Conclusion

Many sectors are breaking out, but the transportation and the financial sectors are two important segments that have the potential to drive the markets significantly higher. The financial sector has been a laggard for a long time, and as the trend change is relatively new, this trend should remain in force for a significant period. The markets have responded well to a Trump win and what we stated in an article that was penned before the election results came in has come to pass; once again proving that as long as the trend is up, every substantial pullback should be viewed through a bullish lens.

From a contrarian angle (and not a political point of view) a Trump win could be construed as a positive development; non-contrarians will demand to know why? Mass Psychology clearly states that the masses are always on the wrong side of the equation. A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking. ~ Tactical Investor

In general, we have stated for the past few years that as long as the trend is up, all substantial pullbacks should be viewed as buying opportunities. Some of our readers (claiming to be expert floor traders, etc.) have erroneously assumed that we are advocating a buy on the dip strategy. The keyword they forget to pay attention to is the trend. Individuals like this are famous for flip-flopping, saying one thing today and changing their stance tomorrow. Be wary of such people and take their ramblings with a barrel of salt. If this was our strategy we should have taken the same position with Gold, but since we bailed out in 2011, we have not viewed pullbacks through a bullish lens because the trend is not positive. However, we have seen the dollar through a bullish lens since 2011 as the trend is positive. Our strategy is based on the trend and market sentiment and as long as the trend is up, the greater the deviation; the bigger the buying opportunity.

"If the only tool you have is a hammer, you tend to see every problem as a nail." ~ Abraham H. Maslow

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.