Stocks Just Triggered a Major “Topping” Signal… Next Up is the Bloodbath

Stock-Markets / Stock Market Crash Dec 17, 2016 - 04:19 PM GMTBy: Graham_Summers

The markets are priming for a major inflection point.

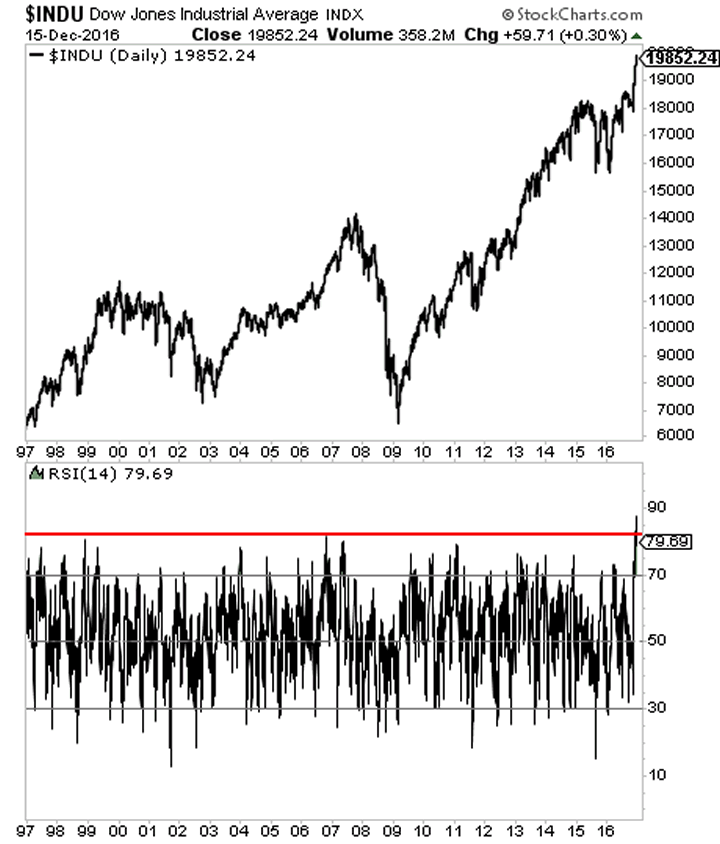

I cannot remember a time when investors were more bullish. The Dow is currently more overbought (based on the 14 day relative strength index) than at any point in the last 20 years.

The peak of the Housing Bubble?

The Dow is more overbought today.

The peak of the Tech Bubble?

Again, the Dow is more overbought today.

The market is primed for a sharp reversal and correction. Everyone and I mean EVERYONE is “all in” on stocks. Hedge funds, commercial traders, even individual investors have piled into the market.

This will end badly as all manias do. We believe the market is primed for a 10% drop… possibly more.

THIS WILL HIT BEFORE THE END OF JANUARY.

Another Crisis is brewing… the time to prepare is now.

Based on this situation… we’ve decided to extend our offer to explore Private Wealth Advisory for 30 days for just $0.98.

We don’t want investors to miss out on the potential to turn this market volatility into profits. Private Wealth Advisory have a success rate of 89% with our trades (meaning we make money on nearly 9 out of 10 positions).

But we cannot maintain this track record with thousands of traders following these picks.

Tonight at midnight we’re closing the doors on our offer to explore Private Wealth Advisory for 30 days for just $0.98.

But this is IT. No more extensions.

If you want to lock in one of the remaining slots, you better move quickly.

To lock in one of the last $0.98 30 day trials to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.